Coinbase: ‘Ethereum killers’ proved ineffective

The emergence of new DeFi-focused networks with faster and cheaper transactions could not undermine Ethereum’s position as the pioneer, according to a report by the American cryptocurrency firm Coinbase.

In this latest edition of Around the Block, we explore the landscape of smart contract platforms and the idea of «ETH killers» vying to challenge Ethereum’s dominance in the space: https://t.co/xNFH3p4DHi

— Coinbase (@coinbase) December 11, 2020

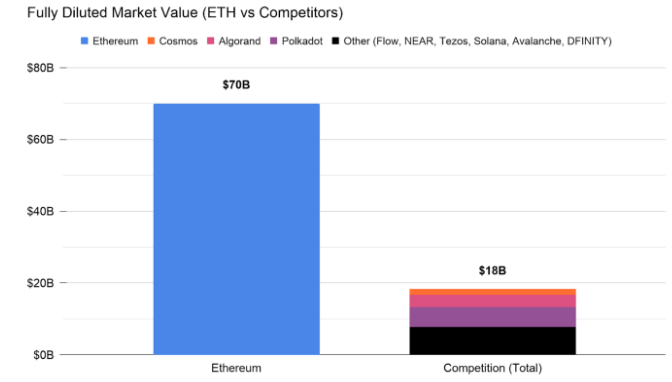

Coinbase analysts noted that rivals’ efforts to establish themselves as the standard in the rapidly expanding DeFi sector did not pay off. On the Fully Diluted Market Value metric, which accounts for announced but not yet issued tokens, Ethereum exceeds the combined value of Cosmos, Algorand, Polkadot, NEAR, Tezos, Solana, Avalanche and DFINITY by a factor of 3,89 — $66 billion to $18 billion.

Coinbase analysts did not regard projects such as Cardano, EOS, TRON, NEO and Binance Smart Chain as “Ethereum killers”.

Data: Coinbase.

Analysts also highlighted the advantages Ethereum has over competitors in the following areas:

- Developer activity.

Most applications are deployed on the Ethereum network. ERC-20 remains the most common standard for newly issued crypto assets. - Adoption/integration.

Third-party services rely on ETH support, including developer tools, wallets, cloud infrastructure, and exchange integration. As an example, analysts cited the launch of the largest stablecoins USDT and USDC on Ethereum. - Number of users.

The number of active addresses continues to grow significantly. - Network value/security.

Because of leading positions in the above criteria, the costs of manipulating data on the Ethereum network are higher than those of competitors. Analysts mentioned Ethereum Classic, which in August three times subjected to a 51% attack.

Researchers believe that any “killer” must compete on several levels, not just offer faster and cheaper transactions. Developer perception, tooling, and programmability must be considered when writing dapp code and smart contracts.

Analysts stressed that scalability and user experience are key factors, in which many competing platforms have indeed gained an advantage. But in their view, it’s not enough given Ethereum’s clear lead in components such as infrastructure, node support, staking services and security.

Coinbase believes that the future balance of power will largely depend on Ethereum’s ability to meet developers’ demands and the challenges that may arise if they switch to a new ecosystem.

«If Ethereum can increase throughput and continue to improve the developer experience, it will be hard for any competitor to reach the leading position», — they concluded.

Earlier Messari analysts also expressed confidence that the Ethereum network will remain out of reach for competitors thanks to the deployment of a Layer-2 solution based on Rollups.

Subscribe to ForkLog’s news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!