Coinbase Observes Cryptocurrency Market Reaching ‘Maturity’

In 2024, the digital asset market has reached ‘significant maturity’ due to increased trading volumes and on-chain activity, alongside billions of dollars flowing into crypto ETFs. This is highlighted in a report by Coinbase and Glassnode.

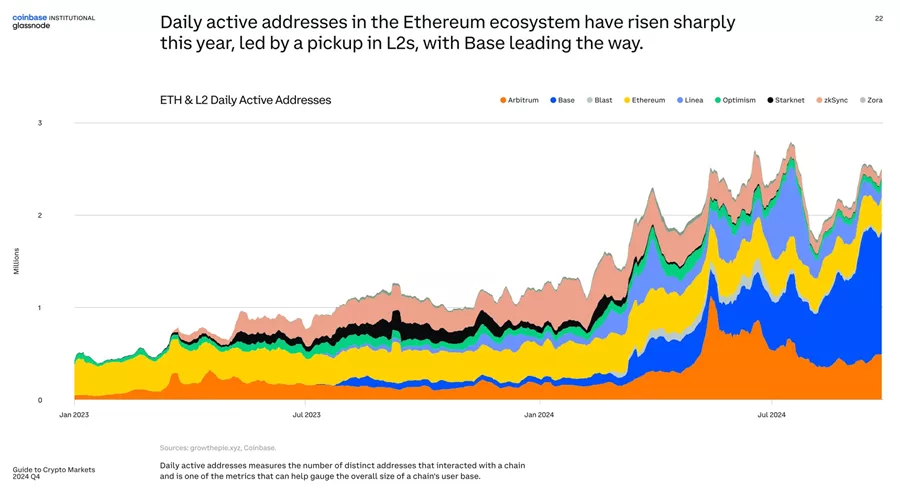

Experts noted the accelerated popularization of stablecoins and Layer 2 solutions for the second-largest cryptocurrency by market capitalization.

In 2024, the number of daily active Ethereum addresses surged, with transactions increasing fivefold compared to early 2023.

The second-largest cryptocurrency regained a significant share of fees among Layer 1s, rising from a low of 9% at the end of August to 40% by the end of September.

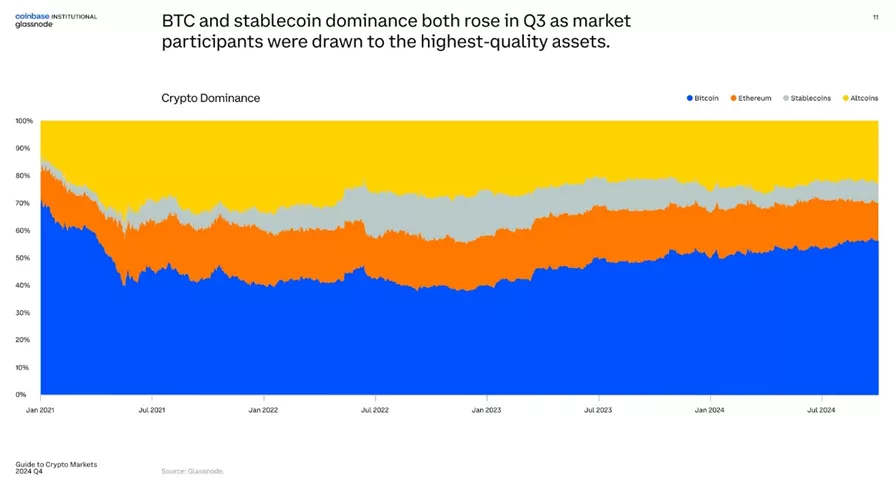

Interest in stablecoins, whose capitalization reached $160 billion, is driven by investors shifting focus towards more ‘quality’ assets and the emergence of new use cases.

Bitcoin also benefited from the trend of reduced risk appetite.

The volatility of digital gold over a three-month horizon fell below 60%, compared to a peak of ~130% in 2021.

During the third quarter, spot ETFs based on the first cryptocurrency attracted $5 billion.

“Markets have become deeper, more liquid, more complex, and more accessible,” experts stated.

Congress Struggles to Keep Up with the Market

Coinbase’s Head of Security, Phillip Martin, lamented in an interview with Cointelegraph about the low level of cryptocurrency education in the US Congress, which could lead to the adoption of ‘bad laws.’

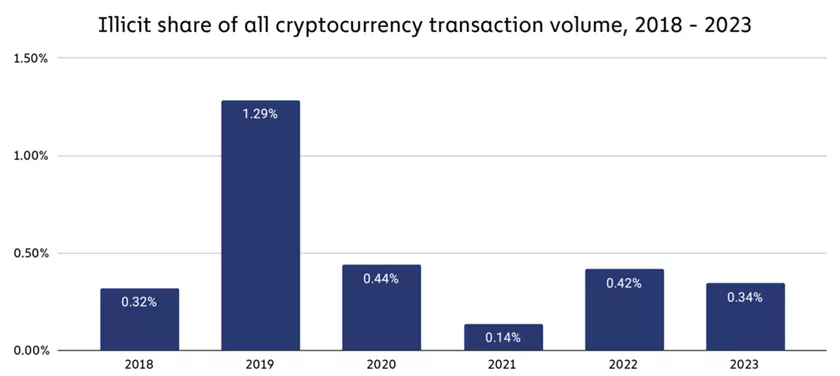

The platform educates lawmakers on consumer protection, security, and combating illegal activities.

The expert noted that transactions deemed unacceptable from a regulatory perspective account for 0.34% of digital asset volume.

The expert added that such a level of transparency is “completely impossible in TradFi.”

Earlier, Tether reported blocking funds on ~1850 addresses, recovering more than $113.8 million, including $5 million linked to the Lazarus Group. The USDT issuer also assisted in freezing $1.86 billion stolen in various fraudulent schemes.

As reported by Chainalysis, the volume of laundered cryptocurrency since 2019 was estimated at $100 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!