Coinbase to Introduce Trading of Tokenized Stocks and Prediction Platform

The American cryptocurrency exchange Coinbase is set to expand its platform’s functionality for users in the United States. Soon, clients will gain access to tokenized stocks, prediction markets, derivatives, and token presales.

We’re building the everything exchange.

→ Millions of assets

→ Derivatives

→ Tokenized equitiesAnd a lot more, all in one place. pic.twitter.com/OfSVeUg6mc

— Coinbase 🛡️ (@coinbase) July 31, 2025

“We’re building the everything exchange,” the platform stated.

Coinbase’s Vice President of Product, Max Branzburg, told CNBC in an interview that the platform is “laying the foundation for a faster, more accessible, and global economy.”

Financial Performance

Coinbase released its financial report for the second quarter of 2025. The company’s net profit was $1.43 billion, compared to $36 million for the same period last year. Total revenue increased by 23.8% to $2.03 billion, up from $1.64 billion a year earlier. However, the result fell short of investors’ expectations, who had forecast $2.12 billion.

Our Q2 2025 financial results are now live. pic.twitter.com/PMx4cOz9fM

— Coinbase 🛡️ (@coinbase) July 31, 2025

Operational revenues reached $1.26 billion, while subscription and service revenues were $698.1 million. Meanwhile, net profit amounted to $65.6 million, with adjusted profit at $527 million.

Spot trading volumes decreased by 30% compared to the first quarter, from $237 billion to $226 billion. Retail trading activity fell by 17% to $78.1 billion, while institutional trading dropped by 9% to $315 billion.

In April, operations generated $240 million. Coinbase anticipates that next quarter’s subscription and service revenues will reach $600–680 million. The company expects that growth in stablecoin revenues will partially offset the decline in fees. The platform earned $332 million from these assets.

In May, the American cryptocurrency exchange reported a data breach due to the bribery of overseas support staff. According to the latest financial report, this resulted in a $307 million loss for Coinbase, lower than the projected $400 million.

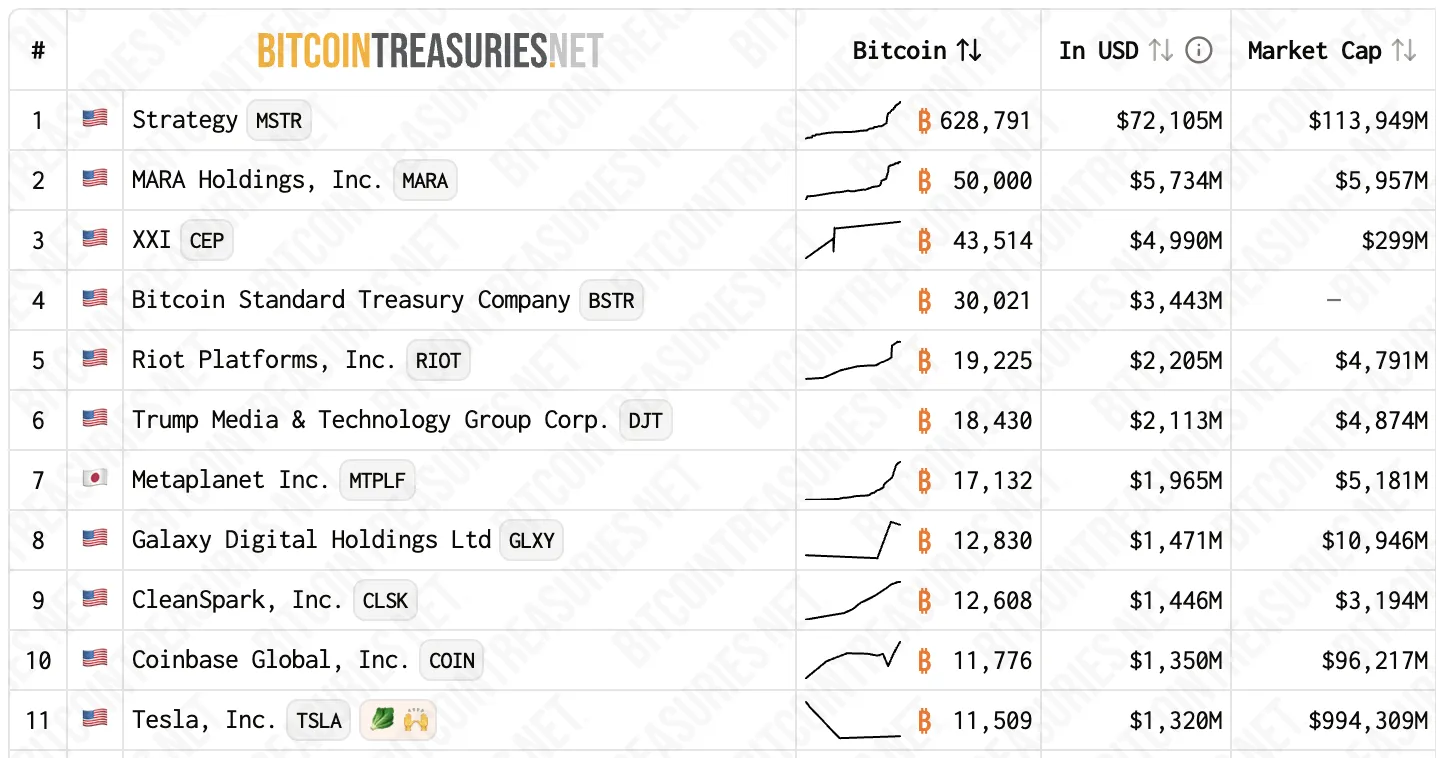

The platform also disclosed that its bitcoin reserves increased by 2509 BTC. By the end of the second quarter, the figure reached 11,776 BTC (~$1.26 billion), surpassing Tesla. Coinbase now ranks among the top 10 corporate holders of digital gold.

After the close of trading, the exchange’s shares fell by 3% to $363.80, but later stabilized at $377.76. Since the beginning of the year, their value has increased by 47%.

Earlier, Coinbase CEO Brian Armstrong was suspected of a conflict of interest following the listing of ResearchHub.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!