CoinFLEX creditors back platform’s restructuring plan ahead of schedule

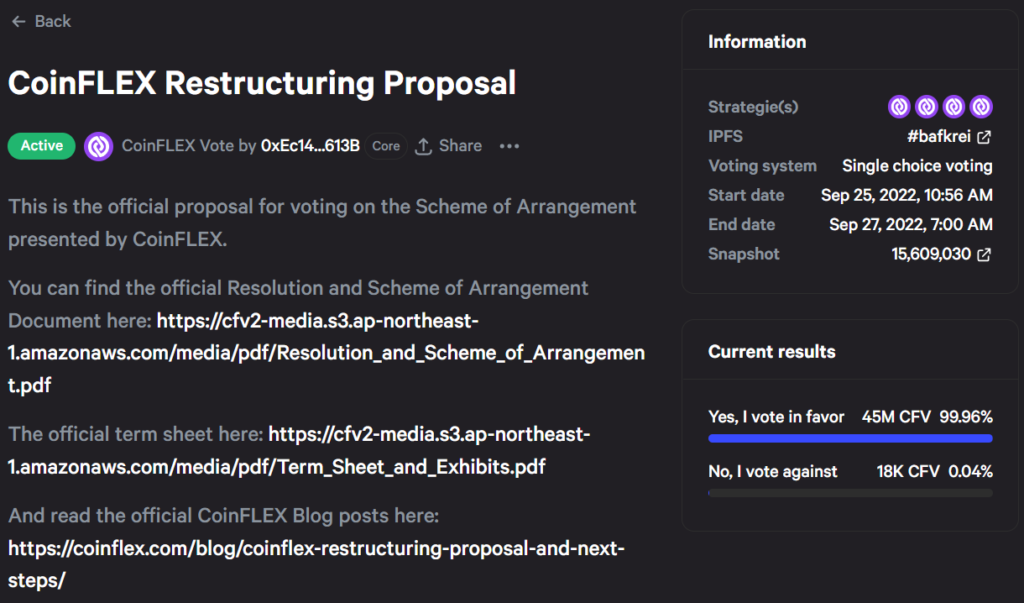

Creditors of the CoinFLEX crypto-derivatives platform overwhelmingly backed the company’s restructuring proposal early.

The vote, conducted on the Snapshot platform, is due to close on September 27. However, just hours after it began, tokens representing 99.96% of creditors’ assets were blocked in favour of the proposal.

The CoinFLEX restructuring plan envisions that 65% of the company’s capital will be transferred to creditors, a further 15% to the team under an ESOP, and the Series B investors to remain shareholders.

Earlier, on June 24, 2022, CoinFLEX suspended user withdrawals due to “extreme market conditions” and “uncertainty regarding the counterparty”.

Lam later said that the aforementioned counterparty is Bitcoin.com’s founder Roger Ver, who owed CoinFLEX $47 million. Because the “Bitcoin Jesus” did not meet his obligations, the company sent him default notice.

The firm turned to the Hong Kong International Arbitration Centre to recover the debt from Ver. The initial assessment of damage by the platform’s representatives was deemed incorrect, as it did not account for the founder of Bitcoin.com’s substantial debt in FLEX tokens.

In July CoinFLEX said it would resume withdrawals in a restricted mode and announced layoffs.

In August the platform filed for restructuring with the Seychelles Court.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!