CoinGecko Researchers Observe Zero Correlation Between Bitcoin and S&P 500

Meanwhile, altcoins maintained a moderately high dependence on the stock index.

In the third quarter, the price of the leading cryptocurrency demonstrated independence from the movements of the American stock market, according to a CoinGecko report.

CoinGecko’s 2025 Q3 Crypto Industry Report is now LIVE 📊

The crypto market kept up its momentum in Q3, climbing to its highest level since late 2021. Liquidity surged with majors like $ETH and $BNB hitting new all-time highs.

Here are 7 key highlights you shouldn’t miss 👇 pic.twitter.com/xFdVen1hcp

— CoinGecko (@coingecko) October 16, 2025

Analysts recorded a decrease in the correlation between Bitcoin and the S&P 500 index from 0.9 to zero. Meanwhile, other digital assets maintained a moderately high dependence on the stock index—0.68 compared to the previous 0.88.

Overall market volatility decreased significantly: the annual S&P 500 index fell from 30.7% to 10.6%, while Bitcoin’s dropped from 42.1% to 29.2%.

Meanwhile, the statistical relationship between the leading cryptocurrency and gold reached peak levels. On October 14, the indicator approached a historical high of 0.9, amid a new price record for the precious metal at $4179.48 per ounce.

Experts note that this indicates a growing interest among investors in the asset as a reliable store of value.

Altcoins Outpace Bitcoin in Growth Rates

The correlation between Bitcoin and the overall crypto market weakened, with the indicator falling from 0.99 to 0.64. CoinGecko specialists attributed this to the leading dynamics of altcoins, which significantly outperformed digital gold in growth rates in the third quarter.

“A structural divergence is observed: while Bitcoin shows independent dynamics, altcoins and other crypto assets remain heavily dependent on positive sentiment in the US stock market,” they added.

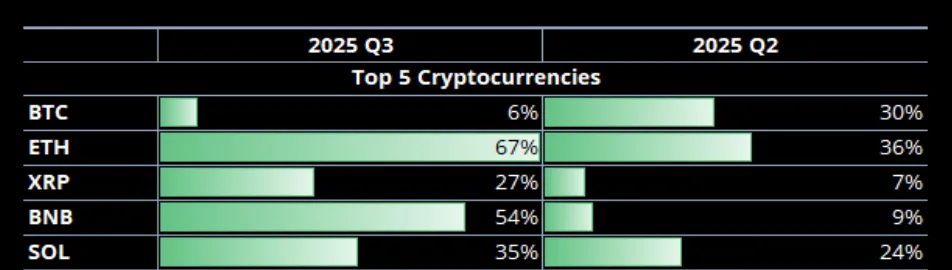

For comparison, Ethereum and BNB rose by 67% and 54% respectively, while Bitcoin increased by only 6.4%. The price of XRP rose by 27%, and Solana by 35%.

The growth rate of the leading cryptocurrency lagged behind gold, which rose by 15.6%, as well as the Nasdaq and S&P 500 indices, which grew by 12.2% and 7.9% respectively.

Analysts noted positive dynamics: the average daily trading volume of Bitcoin increased by 28.4% to reach $41.1 billion, breaking the trend of declining activity observed in the first two quarters.

Earlier, Glassnode analysts noted the concentration of options premiums on digital gold in the range of $115,000 to $130,000.

Peter Brandt stated that the price of the leading cryptocurrency will exceed $125,000 after another decline.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!