CoinShares: Crypto funds attracted a record $4.5 billion in Q1 2021

Net inflows into crypto-based investment products in January–March 2021 totalled a record $4.5 billion, according to digital-asset manager CoinShares.

Compared with Q4 2020, the figure was up 11%, when it stood at $3.8 billion.

In the previous quarter, growth stood at 240%. CoinShares did not see this as a slowdown of the broader trend, noting that quarterly growth rates tend to vary.

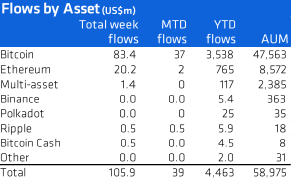

The largest inflows in Q1 went into Bitcoin-based products — $3.54 billion; Ethereum was second with $765 million.

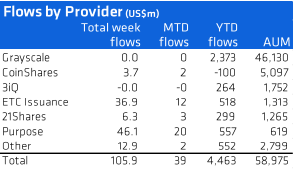

Total assets under management by the funds rose to a record $59 billion. A year earlier this figure stood at $37.6 billion. Grayscale accounted for $46.1 billion of that amount, while CoinShares accounted for $5.1 billion.

In the report, the firm notes that daily turnover of crypto funds rose from $3.5 billion to $11.6 billion. The figure amounts to 6.7% of the activity on reputable Bitcoin exchanges.

The share of investments in actively managed funds last quarter fell from 3.6% to 1.5%.

The shift toward passive strategies can be linked to the launch in Canada of three exchange-traded funds from Purpose Investments, Evolve Funds Group, and from CI Global Asset Management (CI GAM) and Galaxy Digital’s Mike Novogratz.

Regulators in the US have proposals to launch bitcoin ETFs from VanEck, Bitwise Asset Management, Valkyrie Digital Assets, NYDIG and WisdomTree.

As of writing, the regulator has begun reviewing only the first of them.

Subscribe to ForkLog’s channel on YouTube!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!