CoinShares Deems Ethereum Investment Returns ‘Uncertain’

- The price growth of Ethereum largely hinges on organic transactional demand for the asset, according to CoinShares experts.

- Currently, on-chain activity is primarily focused on speculative use cases.

- Analysts criticized EIP-4844, which they believe has created imbalances between the first layer and L2.

Professional financial market players are beginning to show interest in Ethereum due to its capabilities in deploying dapps, yet the asset’s investment potential remains somewhat unclear, as stated in a CoinShares report.

Analysts believe the primary factor influencing Ether’s value is transactional demand.

“It depends on how much users are willing to spend on the services provided by Ethereum,” noted expert Matthew Kimmel.

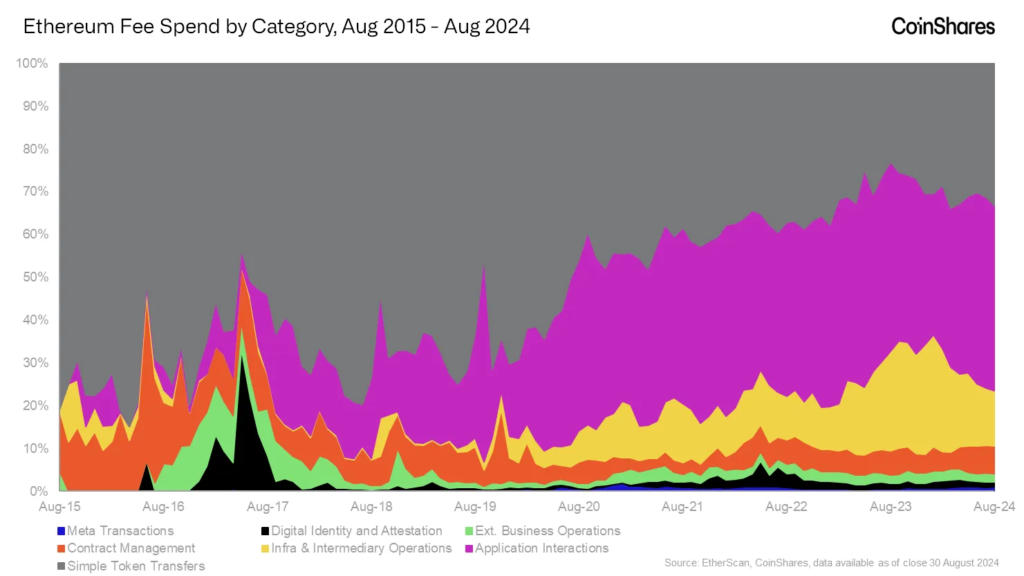

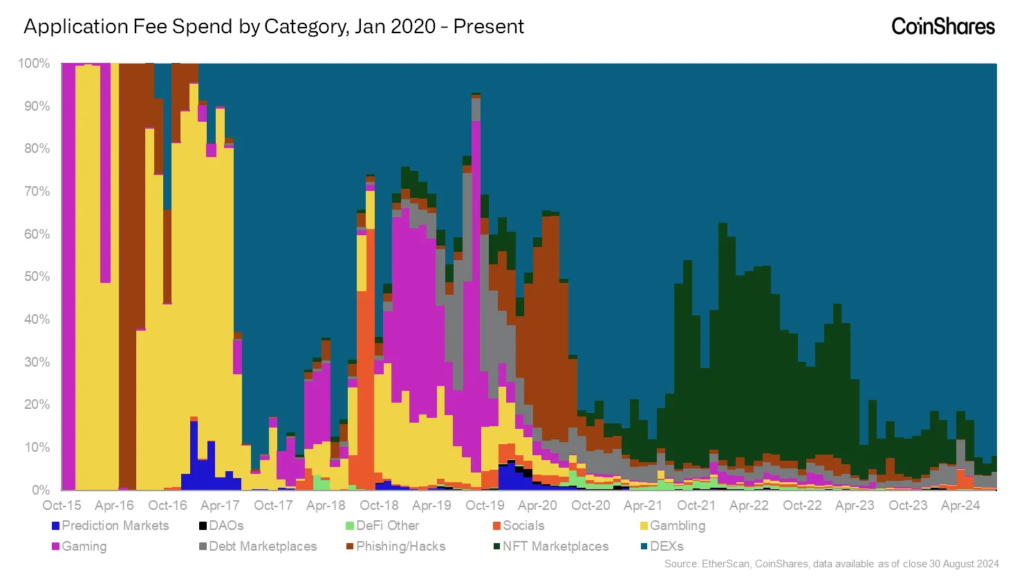

Although the ecosystem continues to expand, on-chain activity is significantly concentrated in a few speculative use cases, says Head of Research James Butterfill.

We have just finished some exhaustive work on mapping Ethereum usage, summarised below:

— The primary driver of ETH’s value is demand for Ethereum transactions, particularly in applications and token transfers, rather than staking yield or other factors.

— Ethereum usage is…

— James Butterfill (@jbutterfill) September 24, 2024

According to him, the current situation “calls for a focus on the long-term value of the platform and fostering sustainable network utility.”

Structure of On-Chain Activity

The company notes that transactions on the Ethereum network have a much more significant impact on its value than staking revenues, monetary, or other factors.

The platform has long surpassed simple asset transfers, focusing on complex interactions with dapps, financial instruments, staking, and L2 solutions.

“The bitter truth is that only a limited range of services consistently ensures a significant share of Ethereum usage,” noted Kimmel.

According to him, the primary use case for Ether is decentralized exchanges. In this segment, Uniswap consistently leads, accounting for about 90% of transaction fees.

While NFT marketplaces like OpenSea showed a brief surge in 2021, their influence has waned. As a result, DEX aggregators like 1inch and MetaMask have become the main drivers of dapp activity. This, Butterfill asserts, confirms that speculation is the primary use case.

Stablecoins

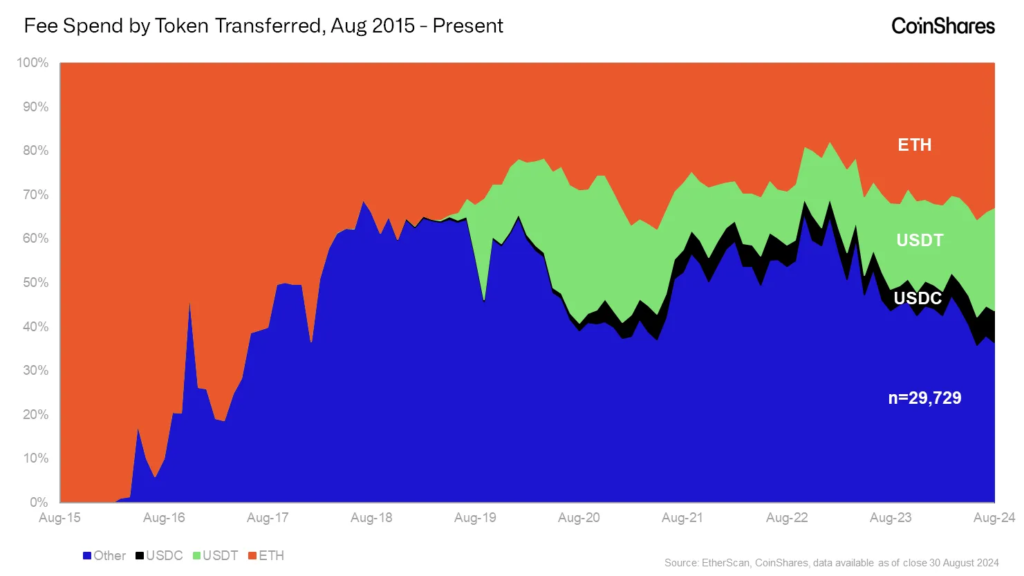

Analysts believe token transfers are also a significant component of on-chain activity. Meanwhile, stablecoins are playing an increasingly important role as one of the most intuitive and viable use cases for crypto assets.

“As the Ethereum ecosystem expands, the types of tokens transferred have significantly diversified, but Ether and ‘stablecoins’ have become the dominant assets in terms of fee expenditure,” explained Kimmel.

The L2 Factor

While Ethereum has matured and supports numerous applications for which users are willing to spend “billions of dollars,” there is a steady trend of declining demand for Ethereum.

According to Kimmel, the popularity of L2 solutions in recent years has helped solve scaling issues but also “absorbed” demand for the base layer of the network. As a result, “the relationship between Ether’s value and the broader ecosystem has become more complex.”

“In our view, the latest major change — EIP-4844, which strongly incentivized second-layer solutions, worked against the economic benefits of EIP-1559, which linked Ether’s value to demand for the first-layer platform,” he added.

Moving forward, the main task is to create utility on the blockchain. This will not only scale but also provide significant long-term value for users, fostering sustainable demand for Ethereum services, concluded Kimmel.

Earlier, Galaxy Digital experts noted an increase in bot activity and failed transactions in L2 following the activation of the Dencun update.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!