CoinShares reports second consecutive weekly outflow from crypto funds

The weekly outflow from cryptocurrency investment products slowed from $110 million to $47 million. Analysts at CoinShares attributed the decline in inflows to concerns about tightening regulation of the industry in the United States.

[1/2] The Digital Asset Fund Flows Weekly Report is now available! Written by @jbutterfill, the headline for this week is: Outflows continue with US$47m, negative sentiment focussed on North America.

To access the report, click here https://t.co/MbvaGEUdwi pic.twitter.com/CEGz3gnCgs— CoinShares 👩🚀 (@CoinSharesCo) March 21, 2022

North American-based funds again contributed the largest negative impact. A week earlier, analysts cited the directive from US President Joe Biden on coordinating federal agencies in regulating cryptocurrencies. They also cited the war in Ukraine.

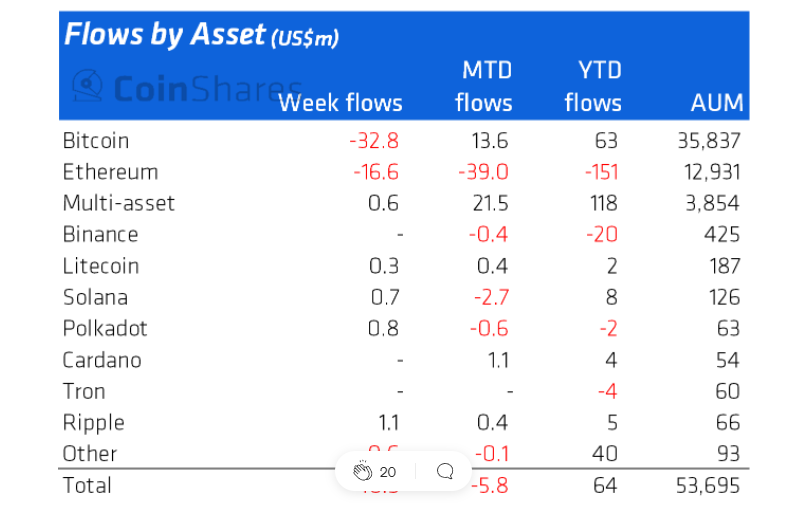

Outflows from Bitcoin funds totaled $32.8 million, from Ethereum-based funds $16.6 million.

For other altcoin-based structures, activity was mostly positive, ranging from $0.3 million (Litecoin) to $0.8 million (Polkadot). Changes in Cardano-, Tron- and Binance-based funds were zero; for all others, overall negative (-$0.6 million).

The assets in basket-based cryptocurrency products rose by $0.6 million to $3.85 billion. Year-to-date they have led inflows.

Earlier, Elon Musk stated that he was hodling cryptocurrencies in anticipation of inflation.

Subscribe to ForkLog news on Telegram: ForkLog Feed — the full news feed, ForkLog — the most important news, infographics and opinions

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!