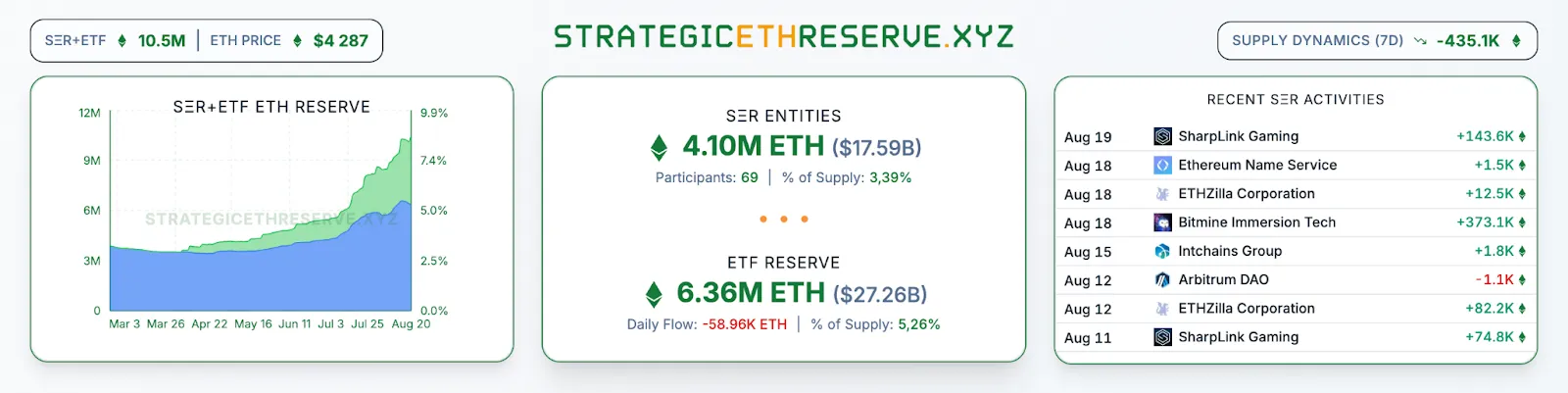

Corporations Amass Over 4 Million ETH Worth $17.6 Billion

Sixty-nine companies now control 3.4% of Ethereum's supply.

Sixty-nine companies have added more than 4.1 million ETH to their reserves, accounting for 3.39% of the total Ethereum supply. The value of these assets has surpassed $17.6 billion, according to Strategic ETH Reserve.

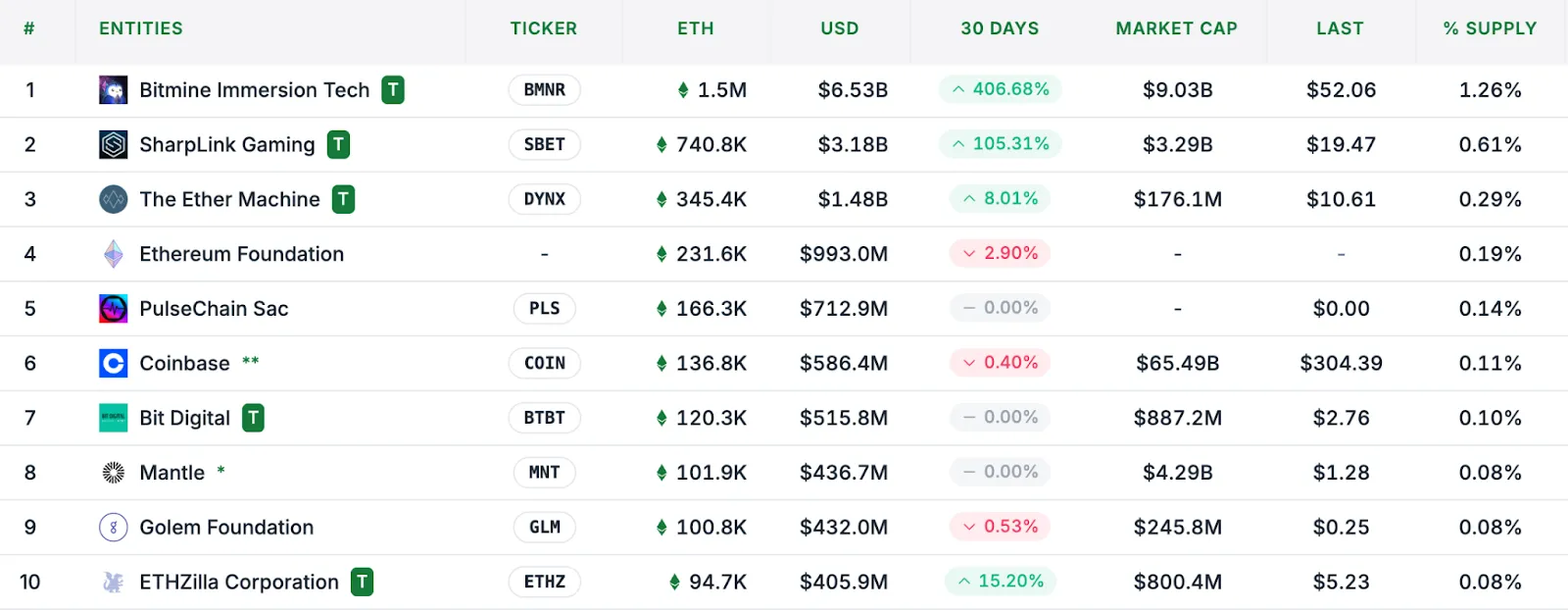

The largest corporate holder of ether is BitMine Immersion Technologies, which has shifted its focus from Bitcoin mining to accumulating the second-largest cryptocurrency by market capitalization. It manages 1.5 million ETH worth $6.5 billion.

SharpLink Gaming ranks second with 740,800 ETH ($3.2 billion). They are followed by The Ether Machine and the Ethereum Foundation, which have acquired 345,400 ETH ($1.4 billion) and 231,600 ETH ($993 million) respectively.

The trend of corporate crypto reserves is one of the drivers of Ethereum’s recent rally. On August 13, its price tested $4700. Standard Chartered forecasted that due to demand from public companies, the cryptocurrency’s price could reach $7500 by the end of 2025.

Bitcoin Whale Bets on Ethereum

A major Bitcoin holder has liquidated part of their assets to open a long position on ether. According to Lookonchain, the anonymous investor sold 670 BTC for $76 million and acquired 68,130 ETH.

A Bitcoin OG holding 14,837 $BTC($1.69B) sold 670.1 $BTC($76M) today and opened massive longs of 68,130 $ETH($295M).

A whale deposited 670.1 $BTC($76M) to Hyperliquid in the past 20 hours and sold it, then went long on $ETH across 4 wallets with positions totaling 68,130… pic.twitter.com/2xdG2LjgYl

— Lookonchain (@lookonchain) August 21, 2025

Before the transaction, the whale held 14,837 BTC valued at over $1.6 billion, purchased through Binance and HTX in 2018.

They opened several long positions at $4300 with 10x leverage, but after the transaction, the cryptocurrency’s price fell to $4080, bringing the investor closer to the liquidation zone ($3699-3732).

A crypto analyst under the pseudonym MLM noted that a few hours after the initial transactions, the investor deposited another 1000 BTC (~$113 million) to the decentralized exchange Hyperliquid. However, instead of opening another long position through futures, they bought Ethereum on the spot market.

Update on this guy: things have gotten even crazier, and he’s still going.

Over the past 5 hours since the last post in this thread, he deposited another 1,000 BTC ($113M) to Hyperliquid. This time, however, he chose to buy ETH spot instead of longing perps.

So far, he has…

— MLM (@mlmabc) August 21, 2025

“In total, he sent 1670 BTC (~$189 million) to Hyperliquid from two addresses, of which 300 BTC (~$34 million) remain unsold,” the expert wrote.

Currently, the whale holds 55,000 ETH (~$240 million) and 1472 BTC (~$167 million) across four wallets. MLM suggested that the anonymous investor might transfer all remaining coins to Hyperliquid.

“For the first time, due to this whale’s actions, the spot trading volume for ETH and BTC exceeded HYPE volumes,” he added.

At the time of writing, Ethereum is trading at $4305. Over the past 24 hours, the asset’s price has risen by 2.6%, according to CoinGecko.

Analysts at Lookonchain also noted two wallets linked to institutional players. On August 19, they acquired 9044 ETH for $38 million.

Despite the market downturn, institutions keep buying $ETH.

Two institution-linked wallets, 0x50A5 and 0x9bdB, received another 9,044 $ETH($38M) from #FalconX ~25 minutes ago.https://t.co/Th1ZDigVk2https://t.co/fQneKzik7t pic.twitter.com/Bbut9xALd8

— Lookonchain (@lookonchain) August 19, 2025

On August 20, as Ethereum fell to around $4000, “longs” suffered losses.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!