Crypto ETF Providers Begin 2024 on a Positive Note

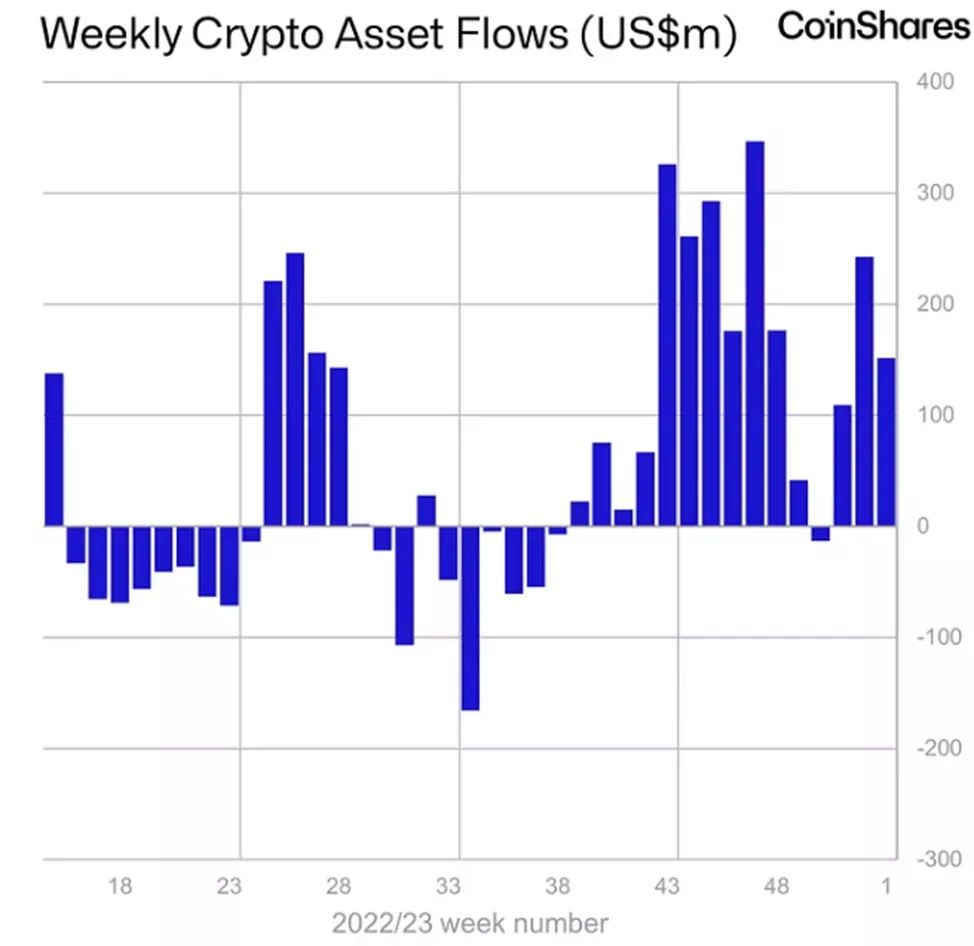

From January 1 to January 5, inflows into cryptocurrency investment products amounted to $151 million, according to a report by CoinShares.

Throughout 2023, the total reached $2.23 billion.

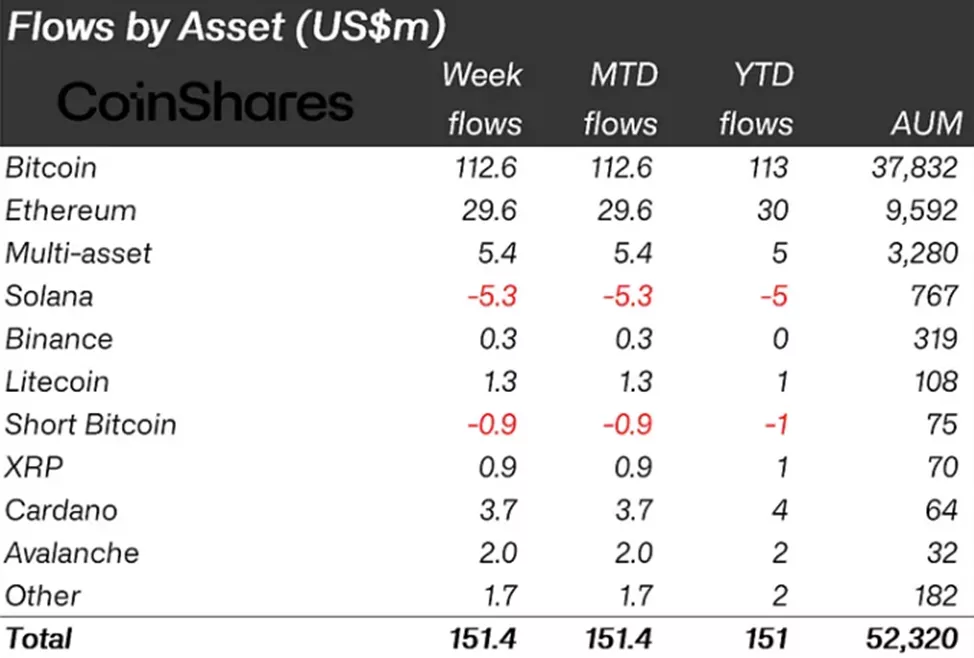

Investors allocated $112.6 million to bitcoin-related instruments. Inflows over the past nine weeks equate to 3.2% of AUM.

After three weeks of outflows, structures allowing short positions on the leading cryptocurrency recorded an inflow of $0.9 million.

“If many believed that the launch of an ETF in the US would be a ‘buy the rumor, sell the news’ event, we would undoubtedly have seen active inflows into short bitcoin ETPs. Instead, outflows over the past nine weeks amounted to $7 million,” specialists commented.

Ethereum funds attracted $29.6 million, with the figure over the past nine weeks reaching $215 million. Analysts believe this indicates a “shift in sentiment.”

Investors put $3.7 million, $2 million, and $1.3 million into instruments based on Cardano, Avalanche, and Litecoin, respectively.

Solana had a rough start to the year, with funds based on the cryptocurrency recording an outflow of $5.3 million.

Earlier, former BitMEX CEO Arthur Hayes warned that in the coming months, the price of bitcoin might experience a correction of 20–30% due to reduced dollar liquidity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!