Crypto firms accounted for 3% of global venture funding in 2021

In the first half of 2021, venture funding in the blockchain and digital assets industry reached $8.8 billion (excluding инвестиций Block.one in the Bullish exchange). The sector accounted for just over 3% of total deal value, which amounted to $288 billion, according to Crunchbase News.

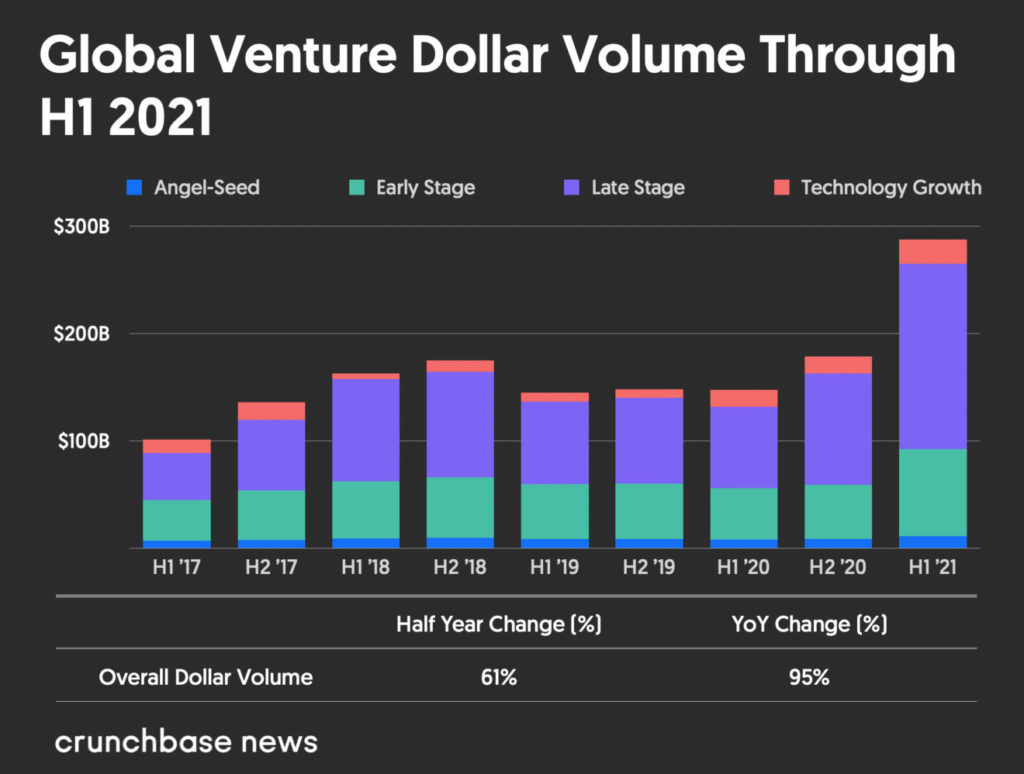

The first half of 2021 was a record for venture deals: the figure rose 61% from the previous peak of $179 billion, recorded over the last two quarters of 2020.

In six months, participants in the digital assets industry attracted more funding than in the previous two years.

In Q1 venture funding in cryptocurrency companies составил около $2,6 млрд. In Q2, the figure increased by 90%, до рекордных $6,2 млрд, — accounting for nearly 4% of global funding, which reached about $163 billion.

According to CB Insights, in April–March every fifth dollar of venture funding went to fintech companies, which drew a total of $33.7 billion.

Almost 20% of these investments were captured by blockchain players. In 2019–2020 their share stood at around 6%.

According to Crunchbase, during the period under review, investors favoured late-stage companies. This held true for the cryptocurrency industry as well.

The trend was particularly evident in Q2, when such companies closed more than 40 deals — in the first three months of 2021 their number did not exceed 23.

The increased funding activity may be linked to the activity of crossover investors (crossover investors) such as Tiger Global Management. The latter participated in 144 deals, overseeing 87 investment rounds.

Pictured: a Series B founder with moderate product-market fit opens an unsolicited envelope from Tiger Global pic.twitter.com/WaiJluWBok

— Everett Randle (@EverettRandle) February 23, 2021

The firm did not overlook the cryptocurrency industry either. For example, Tiger Global Management led funding for the bitcoin exchange Bitso for $250 million and participated in Amber Group’s $100 million funding round.

The interest from crossover investors, perhaps linked to the growing popularity of SPAC deals. In 2021, every fifth fintech company signing a merger agreement to go public oriented its activities toward cryptocurrencies, or provided services related to this class of assets.

In OpenSea привлек $100 млн в рамках раунда финансирования Серии B, led by Andreessen Horowitz. The company’s valuation was $1.5 billion.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!