Crypto Fund Outflows Reach Second Highest Level This Year

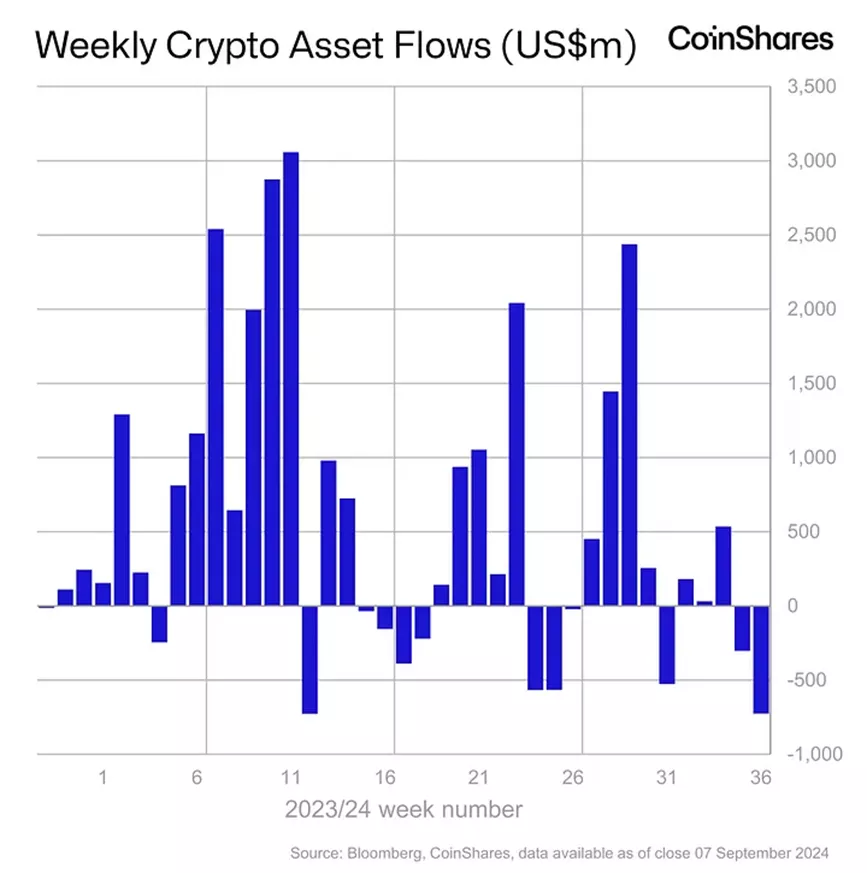

From September 1 to 7, withdrawals from cryptocurrency investment funds totaled $726 million, up from $305 million the previous week, according to CoinShares.

Analysts attributed the continued negative trend to macroeconomic data in the United States, which increased the likelihood of a 25 basis point rate cut by the Fed. By the end of the week, the pace slowed as employment data divided market opinions on the Fed’s next steps, they added.

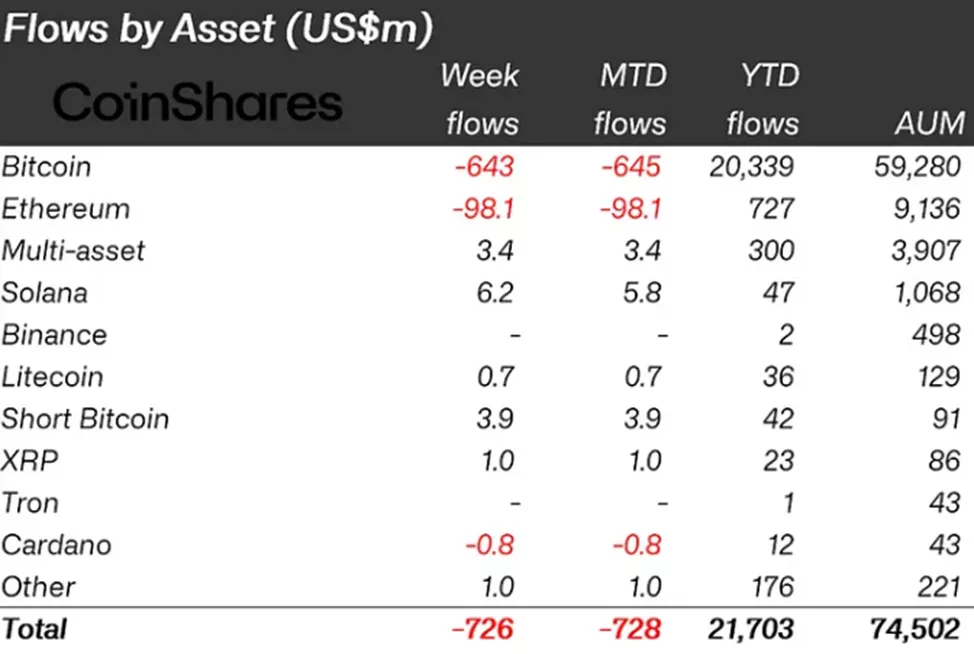

Negative sentiment spread from digital gold to Ethereum. Outflows from Ethereum-based funds increased from $5.7 million to $98.1 million.

Clients withdrew $643 million from bitcoin-related instruments, up from $319 million the previous week.

Investors added $3.9 million to structures allowing short positions on digital gold, compared to $4.4 million in the previous reporting period.

Solana-based products received $6.2 million (the previous week — $7.6 million).

According to Jim Bianco, CEO of Bianco Research, broader adoption of crypto-ETFs will take more time. He cited the 2028 halving and significant development of on-chain tools as catalysts.

His comment came amid an outflow of $1.2 billion from bitcoin-based exchange-traded funds over the past eight days.

In May, Robert Mitchnick, head of digital assets at BlackRock, stated expectations of a new wave of inflows into products due to institutional participation.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!