Crypto Funds Attract $3.3 Billion in a Week Amid Weak US Macroeconomic Data

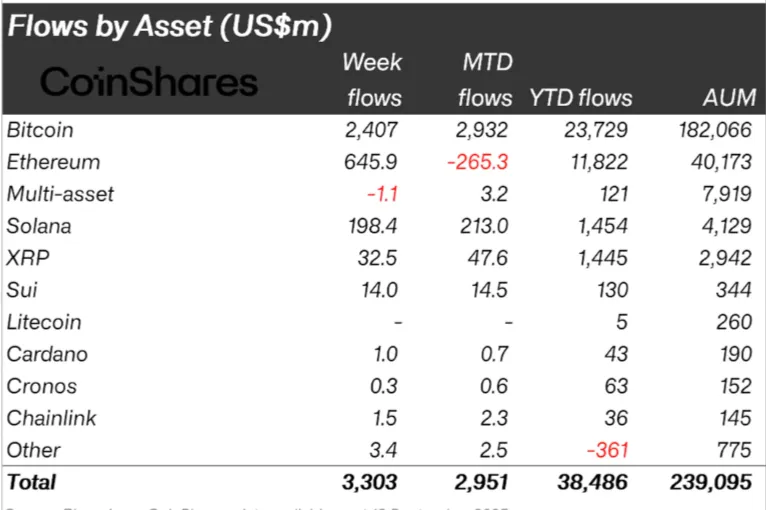

The total volume of assets under management reached $239 billion.

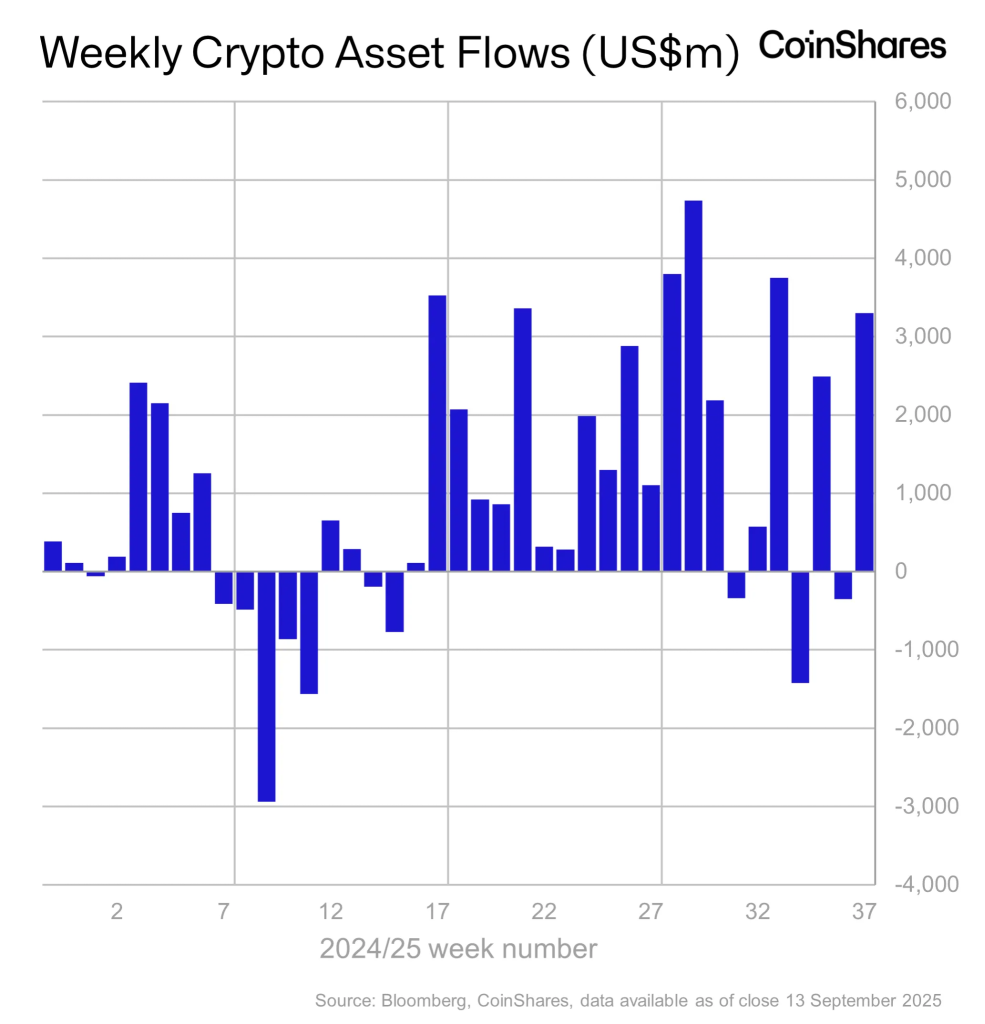

Between September 5 and 13, investment products based on digital assets recorded an inflow of $3.3 billion, according to a report by CoinShares.

The total volume of assets under management reached $239 billion, the highest level since August. The cumulative inflow since the beginning of the year has risen to $38.4 billion.

The recovery was aided by macroeconomic news from the US. On September 10, negative data on industrial inflation emerged, after which the price of Bitcoin reached $114,000 for the first time since late August, while Ethereum rose to $4,400.

The following day, information on the consumer price index was released, with figures matching forecasts. Unexpectedly, unemployment benefit claims hit record levels not seen since October 2021. The price of the leading cryptocurrency exceeded $116,000.

Market participants are increasingly confident in the imminent easing of monetary policy by the Fed amid worrying signals about the state of the labor market. Investors anticipate a cut in the key rate following the FOMC meeting on September 17.

The majority of the weekly inflow was directed towards Bitcoin products — $2.4 billion. Analysts noted that such figures were last observed only in July of this year.

Ethereum funds attracted $646 million. Previously, these instruments had been losing funds for eight consecutive trading sessions.

Structures focused on XRP and Solana continued their positive trend. Last week, they received $198 million and $32 million, respectively.

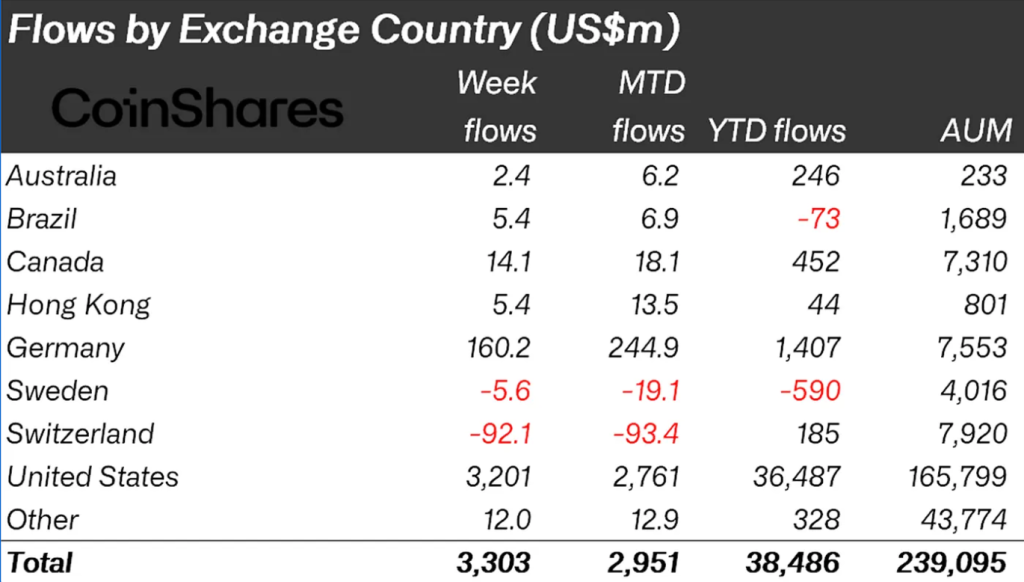

Regionally, the US regained leadership with an increase of $3.2 billion. Germany recorded the second-largest inflow at $160 million.

Earlier, from August 29 to September 6, $352 million was withdrawn from digital asset-based investment products.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!