Crypto Funds Attract $932 Million Following US Inflation Report

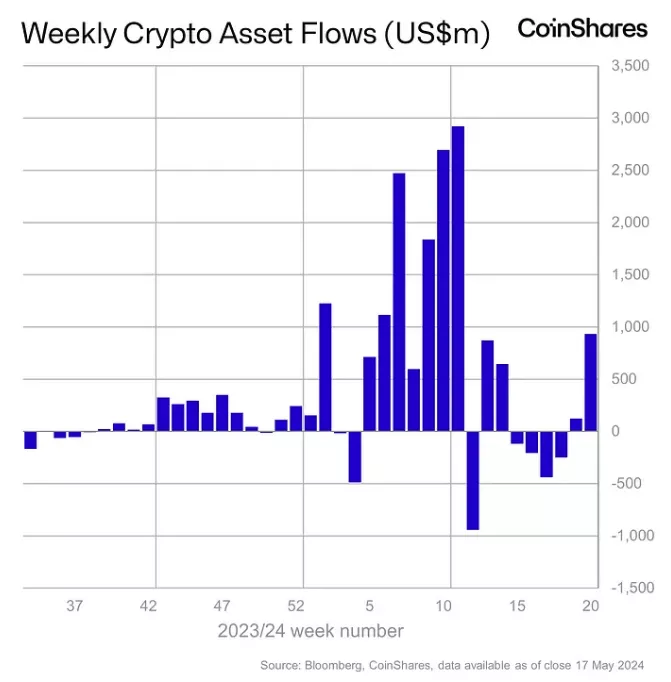

Inflows into cryptocurrency investment products from May 11 to May 17 amounted to $932 million, according to calculations by CoinShares.

Analysts noted that the inflow was an “immediate response” to the US inflation data, with the last three trading days of the week accounting for 89% of the total flows.

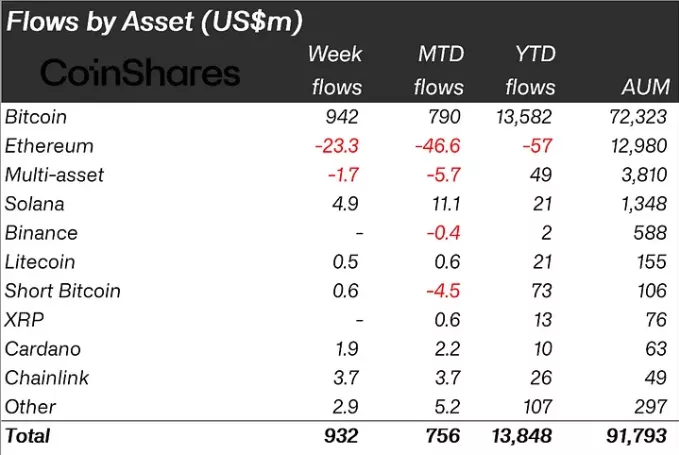

Clients directed $942 million into bitcoin-related instruments, compared to $144 million in the previous reporting period. Structures allowing short positions on the leading cryptocurrency saw almost no inflow.

Bearish sentiment continues to dominate Ethereum funds, with an outflow of $23.3 million. CoinShares attributes this to the uncertain prospects of spot ETH-ETF approval on May 23.

Among altcoins, the most notable inflows were into Solana, Chainlink, and Cardano-based instruments: $4.9 million, $3.7 million, and $1.9 million respectively.

Experts at Bitfinex have forecasted a sideways trend for bitcoin in May, followed by further growth of the asset.

Earlier, Standard Chartered stated that the leading cryptocurrency has already formed a bottom at $56,500, confirming a target of $150,000 by the end of the year and $200,000 by the end of 2025.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!