Crypto Funds See Inflows for Third Consecutive Week

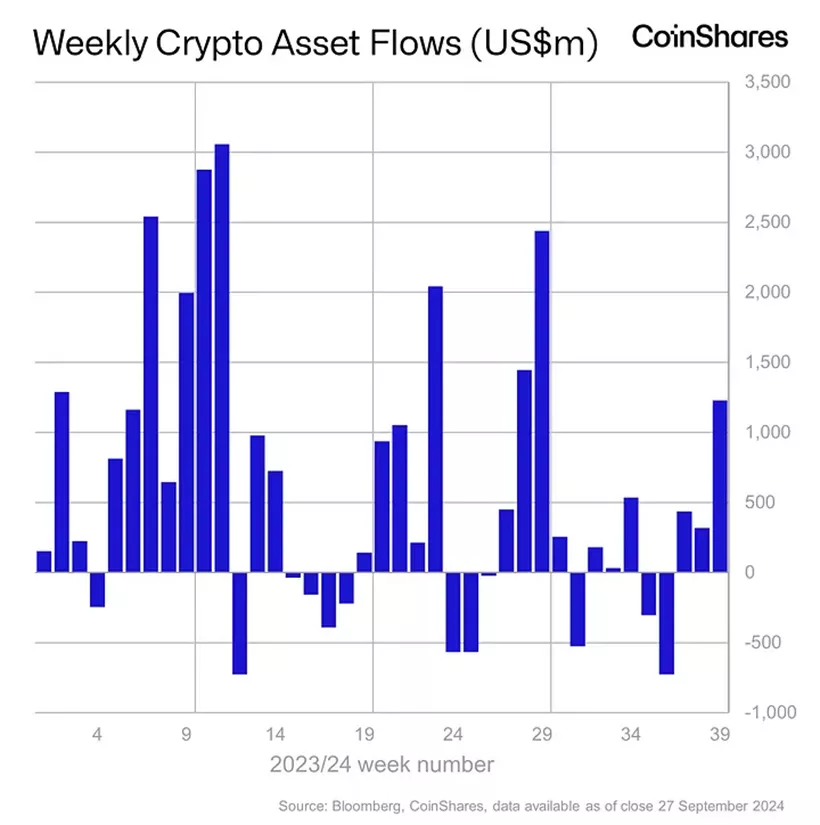

Inflows into cryptocurrency investment funds from September 22 to 28 amounted to $1.29 billion, following $321 million the previous week, according to data from CoinShares.

The positive trend continued for the third consecutive week. Analysts attributed this to expectations of further measures by the Fed following a 50 basis point interest rate cut on September 18.

The volume of assets in crypto funds increased by 6.2% to $92.7 billion.

Trading volume of ETP decreased by 3.1% to $9.2 billion.

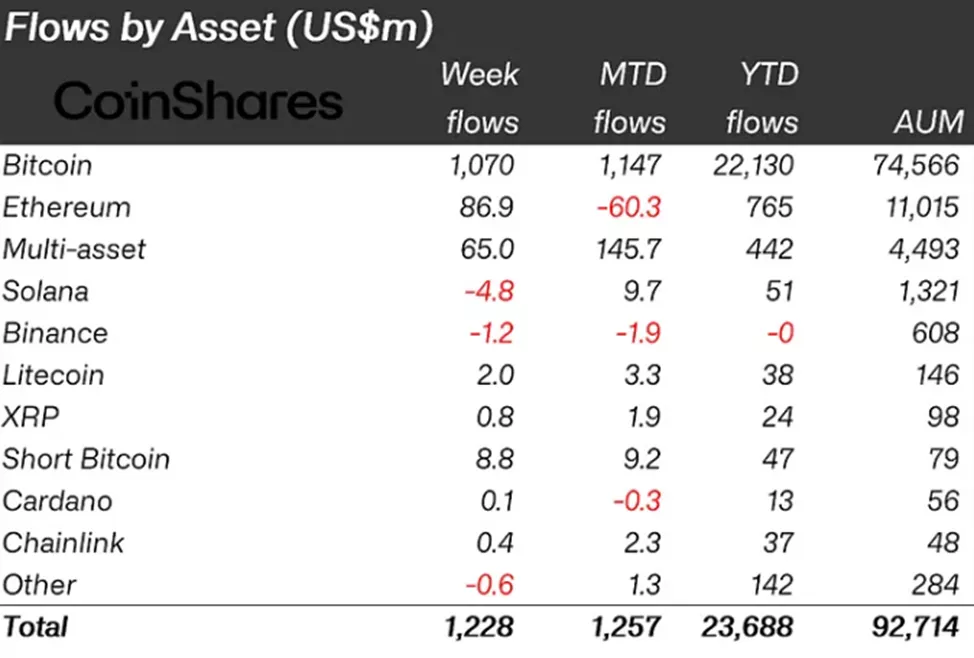

Clients directed $1.07 billion into bitcoin-related instruments, up from $284 million the previous week.

Investors added $8.8 million to structures allowing short positions on digital gold, compared to $5.1 million in the previous reporting period.

Ethereum funds saw an end to a five-week streak of outflows, with $87 million flowing into products.

Instruments based on Solana experienced the opposite situation—after five weeks of inflows, investors reduced investments by $4.8 million.

Sentiments in other altcoins were also mixed: inflows into Litecoin and XRP-based funds amounted to $2 million and $0.8 million respectively, while instruments based on Binance and Stacks saw outflows of $1.2 million and $0.9 million.

Earlier, Grayscale identified 20 cryptocurrencies with high potential for the end of the year.

In 10X Research, a forecast was made for bitcoin’s imminent move to $70,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!