Crypto Funds Suffer $1.7 Billion Loss Amid Investor Gloom

Crypto funds face $1.7 billion outflow amid investor gloom.

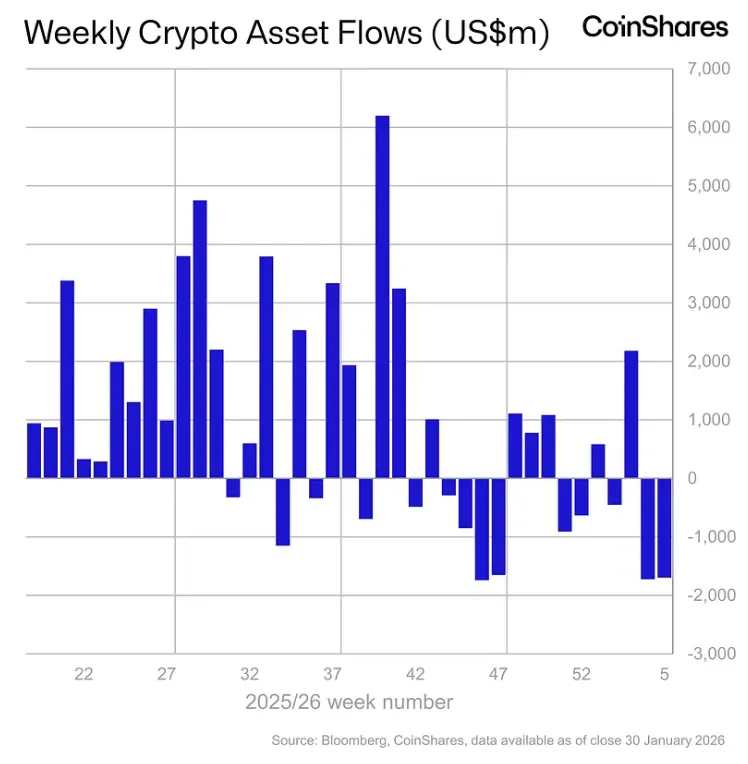

Investment products based on digital assets have experienced a capital outflow of $1.7 billion. This negative trend has persisted for the second consecutive week, according to a report by CoinShares.

Since the beginning of the year, the net balance of inflows has turned negative by $1 billion. Assets under management have decreased by $73 billion compared to the peak in October 2025.

Analysts attributed investor pessimism to three factors:

- the appointment of a monetary policy hawk as the head of the Federal Reserve;

- sales by whales driven by the four-year cycle;

- increased geopolitical tensions.

Geography and Assets

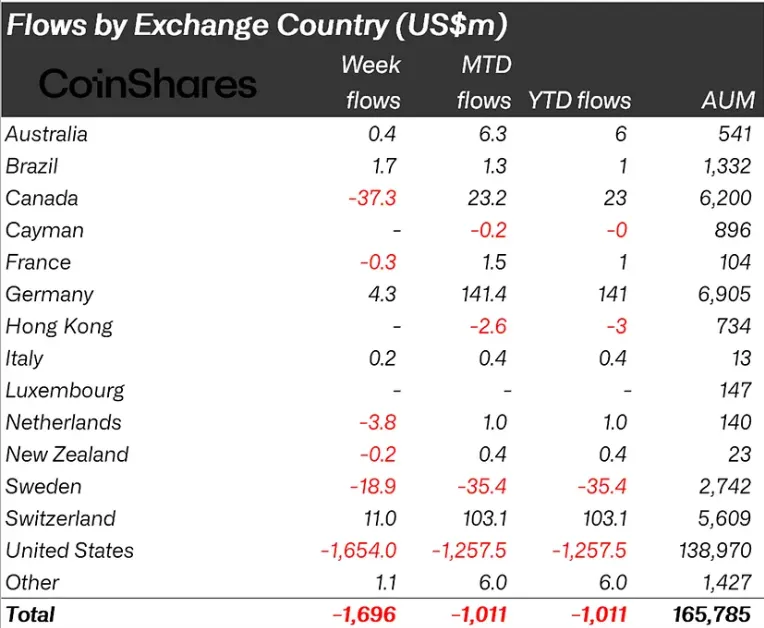

The majority of the fund withdrawals occurred in the United States, amounting to $1.65 billion. Outflows were also recorded in Canada ($37.3 million) and Sweden ($18.9 million). A slight capital inflow was observed only in Switzerland and Germany.

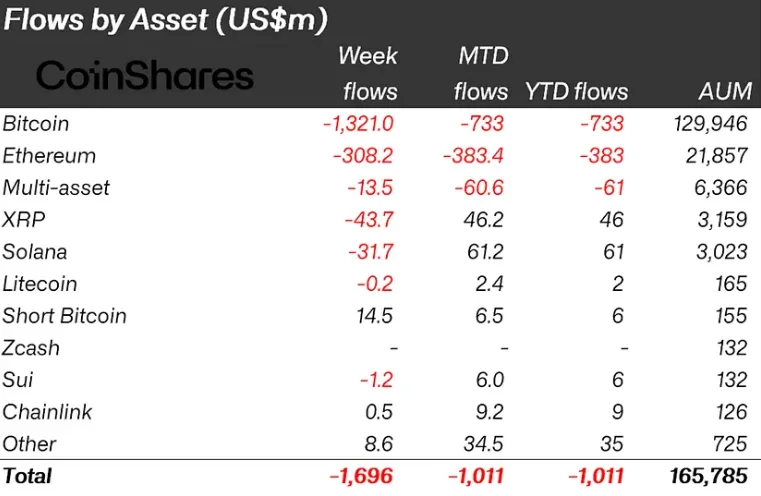

In terms of assets, the primary cryptocurrency was hit hardest, with investors withdrawing $1.32 billion. Ethereum-based products lost $308 million.

Interest also waned in recent market favorites: funds based on XRP and Solana saw withdrawals of $43.7 million and $31.7 million, respectively.

The exception was instruments allowing short positions on digital gold (+$14.5 million). “Hyped investment products” also showed positive dynamics (+$15.5 million), benefiting from a surge in on-chain sales of tokenized precious metals.

Earlier, from January 17 to 23, cryptocurrency investment products recorded a fund outflow of $1.73 billion.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!