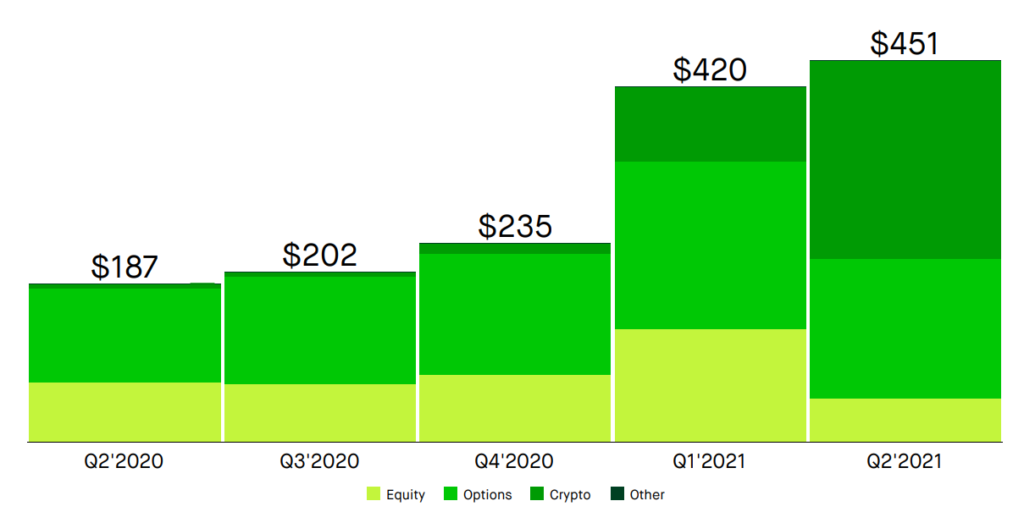

Crypto trading accounted for more than 40% of Robinhood’s revenue in the second quarter

The online broker Robinhood for April–Junegenerated revenue of $565 million, up 8.2% from January–March. The share of digital-asset trading in the figure rose from 17% ($88 million) to 41% ($233 million).

Sixty percent of the 22.5 million clients with non-zero account balances in the second quarter traded cryptocurrencies. Sixty-two percent of the digital-asset–related revenue came from trading Dogecoin (34% in January–March).

This is the first quarterly report in which stock and options trading ceased to be the main driver of the business.

«If trading activity or the price of Dogecoin falls, this could affect financial results», the company noted.

The platform supports seven digital assets — Bitcoin, Bitcoin Cash, Bitcoin SV, Dogecoin, Ethereum, Ethereum Classic and Litecoin.

Founder Vlad Tenev noted the crypto activity of clients together with access to a IPO as among the factors that affected the financial results. In July he named digital assets the cornerstone of the company’s future development.

Robinhood is working on implementing crypto-wallet–related features, as well as launching new products, including lending and savings accounts in digital assets. In addition, Bloomberg discovered testing of a feature to shield crypto investors from volatility.

Robinhood’s net loss in the second quarter was $502 million, versus $1.45 billion in January–March. The negative result was due to adverse revaluations of the company’s notes and warrants.

Client assets on the companies’ balance sheets rose from $81 billion to $102 billion in the second quarter. The app’s monthly active user base grew from 17.7 million to 21.3 million.

In the forecast for the third quarter, Robinhood managers flagged a possible decline in trading activity due to seasonal factors. A similar warning was also included in the revised S-1 filing for the IPO.

Earlier this year, Robinhood’s stock-market debut proved one of the worst in history. On the fifth day of trading, the company’s shares jumped 80%. Nasdaq halted trading three times.

Subscribe to ForkLog’s news on Facebook!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!