Crypto-trading hamster portfolio outperforms Warren Buffett’s Berkshire Hathaway

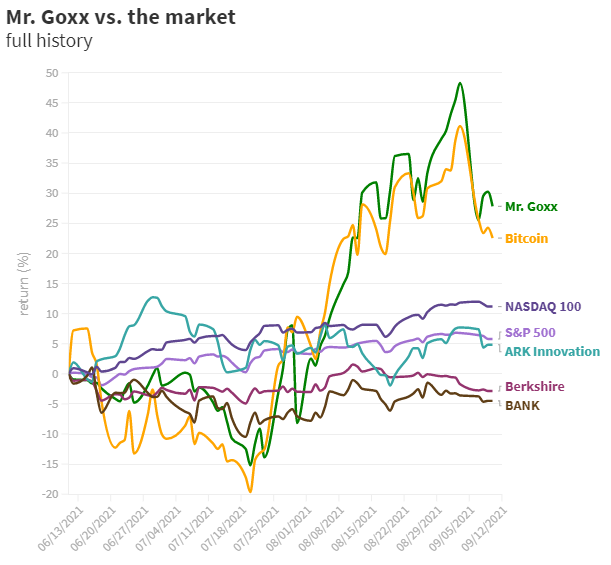

Over three months, the value of Mr. Goxx’s portfolio—the Twitch-based crypto-trading hamster—rose by 30%. Over the same period, Warren Buffett’s Berkshire Hathaway fund assets fell by 2%, and Cathie Wood’s ARK Innovation ETF rose by about 5%.

In June 2021, the hamster’s owner built him a special cage, equipped with optical sensors connected to an Arduino Nano controller. This allows the rodent to ‘trade’ digital assets.

By spinning the running wheel, the hamster ‘selects’ a specific cryptocurrency for trading. The program will sell the coin when the rodent runs through the left tunnel, and buy if it runs through the right.

Initially, Mr. Goxx’s portfolio was valued at $390. In less than three months, its value rose to $498. On Monday, 20 September, the hamster’s assets stood at $580, but the value later fell.

The rodent managed to beat not only Berkshire Hathaway and ARK Innovation, but also the S&P 500 (+6% over the same period) and the NASDAQ-100 (+12%), as well as Bitcoin itself (+23%).

The hamster’s best trades were:

- purchasing the Chiliz (CHZ) token at $23.60 and selling at $36.44 (+54%);

- purchasing the Pantos (PAN) token at $23.57 — selling at $35.33 (+50%);

- purchasing Dogecoin (DOGE) at $23.79 and selling at $34.80 (+50%).

The largest holding in Mr. Goxx’s portfolio is Tron (TRX). The hamster bought it five times; since the first trade, the cryptocurrency’s price has risen by 40%.

In the summer of 2018, Coinspot launched a YouTube show Hamster Insider, in which the rodent predicted the market direction for the next ten days. Only two episodes were released on the channel.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!