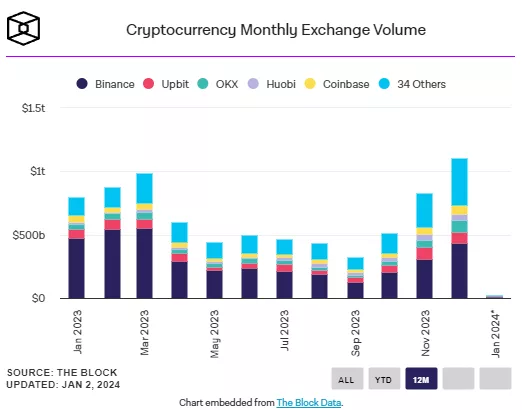

Cryptocurrency Exchange Trading Volume Surpasses $1 Trillion

For the first time since September 2022, the monthly trading volume on cryptocurrency exchanges has exceeded $1 trillion.

According to data from The Block, December’s figure stands at $1.1 trillion. The last higher value was recorded in May 2022, at $1.35 trillion.

Binance accounted for 39.3% of the total trading volume in December ($432.7 billion). Upbit’s share was 8.3% ($91.8 billion), and OKX’s was 8% ($87.5 billion).

ETF Optimism

The December surge in trading activity is likely fueled by market enthusiasm regarding the potential approval of spot Bitcoin ETFs in the United States.

“Given the holiday season, December is historically a sluggish month for cryptocurrency trading,” noted The Block Research head Steven Zheng. “The fact that for the first time in over a year, monthly spot trading volume exceeded $1 trillion truly indicates the industry’s optimism about the upcoming approval of a spot Bitcoin ETF and the revival of a bull market.”

However, K33 Research analyst Vetle Lunde suggests that the anticipated approval of the new product between January 8 and 10 could trigger a “sell the news” scenario. According to him, a significant portion of short-term investors sees the “green light” from the U.S. Securities and Exchange Commission as a signal to lock in profits.

Nonetheless, Lunde considers there is a 20% probability of a scenario where substantial inflows into spot Bitcoin ETFs could offset the selling pressure from speculators.

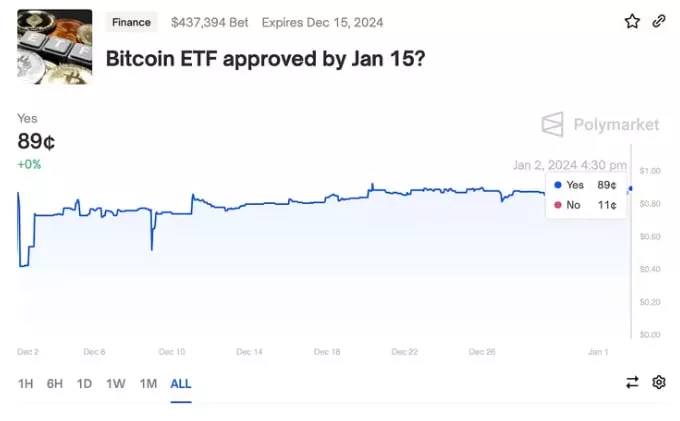

Data from the prediction platform Polymarket indicates an 89% probability of approval for exchange-traded funds based on digital gold by January 15. Last month, this figure was 50%.

Earlier, K33 Research analysts suggested that the approval of a spot Bitcoin ETF would occur by January 10, 2024.

On January 2, Bitcoin’s price surpassed the $45,000 mark.

The last time digital gold traded at such high levels was in early April 2022, before the Terra collapse and the subsequent “contagion” in the crypto industry.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!