Cryptocurrency Exchange Volumes Decline for the First Time in Seven Months

The combined volume of spot and derivatives cryptocurrency markets fell by 43.8% in April to $6.58 trillion, following a record high in March of $9.12 trillion, according to data from CCData.

This positive trend was interrupted after six months.

Experts attributed the trend reversal to escalating geopolitical tensions and a slowdown in inflows into spot ETFs. Optimism was also dampened by the reduced likelihood of the Fed easing its policy this year.

Cryptoderivatives turnover decreased by 47.7% to $4.57 trillion, while spot contracts fell by 32.6% to $2.01 trillion.

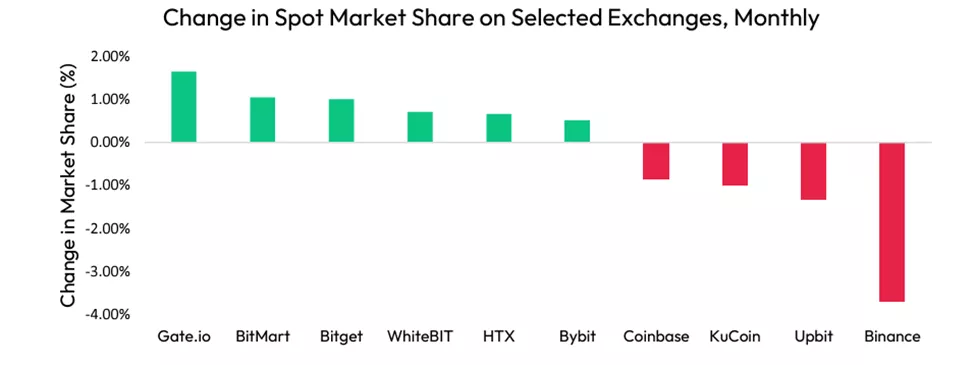

Binance’s market share declined by 2.41% to 41.5%, including a 3.69% drop in the spot market to 33.8% ($679 billion).

Gate.io, BitMart, BitGet, WhiteBit, HTX, and Bybit managed to strengthen their positions.

CryptoQuant noted an increase in fear among speculators, indicated by the NUPL turning negative.

Segmentation of Short Term Holder’s NUPL

“From the chart, it’s apparent that the NUPL for traders has recently dipped into negative territory, signaling a rise in fear within this cohort.” – By @0nchained

Read more ? https://t.co/OyQajAXjuf

— CryptoQuant.com (@cryptoquant_com) May 9, 2024

According to specialists, a similar situation was last observed on January 24 after the approval of spot Bitcoin ETFs. At that time, the price of digital gold fell from $49,000 to $38,000.

This price level may represent a significant support line. A NUPL drop into negative territory for medium-term holders would signal a broader spread of fear, analysts warned.

Market participants in Bitcoin options have bet on a rise to $100,000.

Earlier, trader and analyst Rekt Capital stated that the price of the first cryptocurrency had reached a local bottom at $57,000 and entered an accumulation phase.

Former BitMEX CEO Arthur Hayes suggested that the digital gold price could surpass $60,000 and move towards $70,000 by August.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!