Cryptocurrency Inflows Reach $2 Billion in May

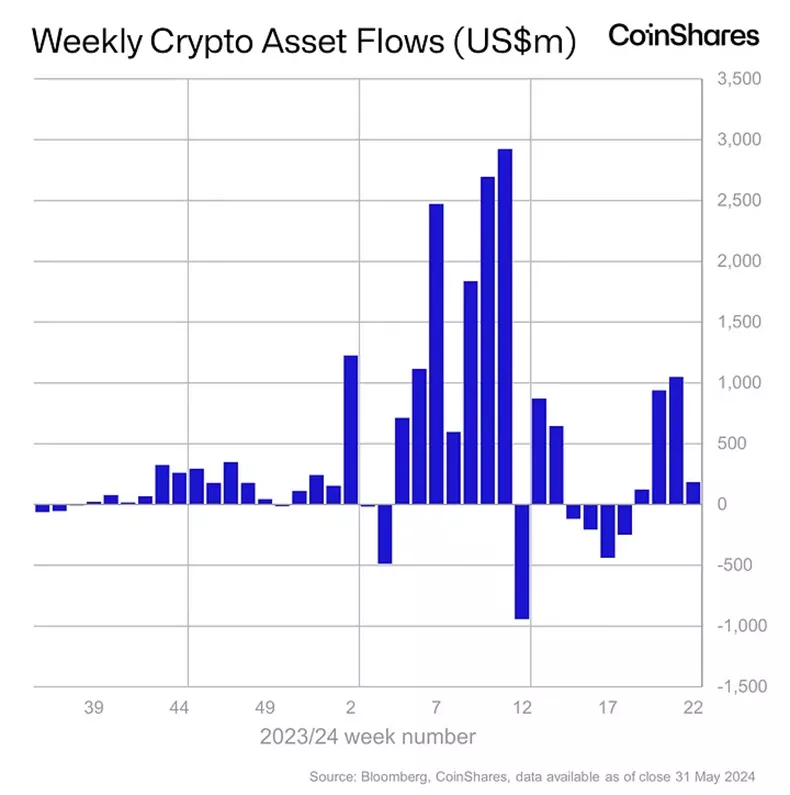

Inflows into cryptocurrency investment products amounted to $185 million from May 25 to 31, with a total of nearly $2 billion for the entire month, according to calculations by CoinShares.

This positive trend has continued for the fourth consecutive week. Year-to-date inflows have exceeded $15 billion.

Trading volumes for ETP fell from $13 billion to $8 billion.

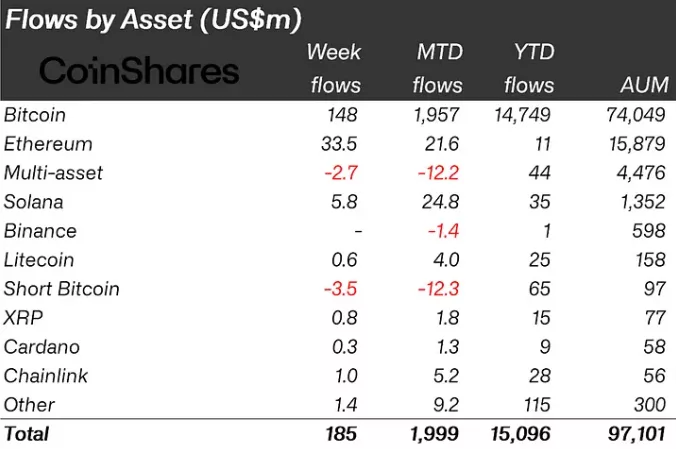

Clients directed $148 million into bitcoin-related instruments, compared to an outflow of $1.01 billion in the previous reporting period.

Investors withdrew $3.5 million from structures allowing short positions on the leading cryptocurrency, down from $4.3 million earlier.

Inflows into Ethereum funds continued for the second consecutive week, though the pace slowed from $35.5 million to $33.5 million. Analysts cited the anticipated July launch of an ETH-ETF as a driver.

“This indicates a shift in sentiment regarding the asset, from which there was a $200 million outflow over the previous ten weeks,” specialists commented.

Among other altcoins, notable inflows were seen in Solana-based instruments ($5.8 million) and Chainlink ($1 million).

Earlier, Matrixport co-founder Daniel Yan suggested SOL as a new candidate for exchange-traded funds. In a similar vein, Standard Chartered’s head of research, Geoffrey Kendrick, expressed similar views.

Previously, JPMorgan analyst Nikolaos Panigirtzoglou expressed doubts about the readiness of the SEC to approve a Solana-based ETF.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!