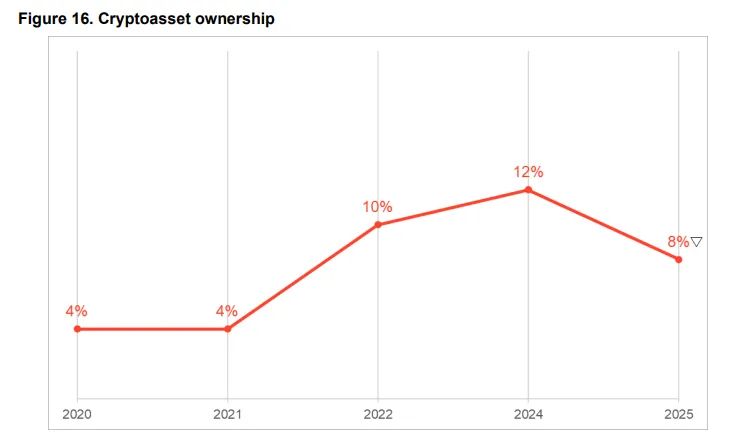

Cryptocurrency Ownership Among Britons Falls from 12% to 8% in a Year

UK cryptocurrency ownership fell from 12% to 8% between 2024 and 2025.

Between 2024 and 2025, the proportion of the adult population in the UK holding digital assets decreased from 12% to 8%, according to a report by the FCA.

For comparison, the figure was 4% in 2021 and 10% in 2022.

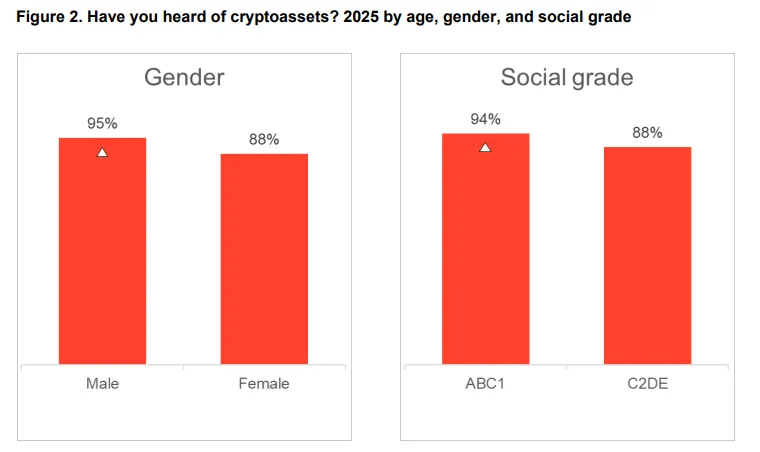

Public awareness of cryptocurrencies remains high at approximately 91%, with little change from previous years.

Despite the decline in the proportion of citizens holding cryptocurrencies, the average value of assets held by investors has increased.

While the number of users with a portfolio worth £100 or less continues to fall, the number holding £1,000-£5,000 is steadily rising, reaching 21% of all British crypto investors. The share of market participants with investments up to £10,000 stood at 11%.

According to the study, centralised exchanges remain the most common method of acquiring assets.

About 73% of respondents stated they usually make purchases through Coinbase, Binance, or Kraken. 15% use payment companies offering cryptocurrency services.

Ease of use, reputation, security, and reliability were cited as the most important factors when choosing an exchange.

The survey also revealed a gap in risk tolerance between cryptocurrency users and the general public. About 63% of digital asset holders are willing to engage in riskier trades to increase profits, compared to only 24% of regular investors who chose the same option.

Opinions on regulation were divided. A quarter of surveyed crypto users said they would be more likely to invest with a clearer regulatory environment in the UK. Conversely, 11% fear government intervention. Another 25% doubted the effectiveness of any form of regulation.

From January 1, 2026, the country’s tax authority will begin tracking information on crypto asset owners for tax calculation and collection. Penalties are proposed for data concealment.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!