Cryptocurrency Regulation in 2023: Bitcoin ETFs, MiCA, and Binance Challenges

In 2023, U.S. authorities took significant steps toward regulating the cryptocurrency industry. Major exchanges such as Binance, Coinbase, Kraken, and Gemini faced scrutiny.

However, there were also positive developments. Ripple won its case against the SEC, and the market saw renewed growth in anticipation of the approval of the first U.S. spot Bitcoin ETF. ForkLog reviews the regulatory changes that impacted the industry in 2023.

Regulatory Trends

Bitcoin ETFs in the U.S.

The potential approval of the first U.S. exchange-traded fund based on the spot price of digital gold became a key driver of Bitcoin’s autumn growth.

In June, major asset manager BlackRock filed an application to launch the instrument. Later, Valkyrie, Fidelity Investments, WisdomTree, Invesco, VanEck, and Franklin Templeton joined the effort.

By late summer, a court granted Grayscale Investments’ motion in a lawsuit against the SEC for denying the conversion of GBTC into a Bitcoin ETF. The appellate court ordered the regulator to reconsider its decision.

On August 31, the Commission postponed decisions on several applications until at least mid-October. By the end of September, the regulator had deferred their review to January 2024. Requests from Hashdex and Grayscale were also postponed to the following year.

On October 16, Cointelegraph stirred the community by reporting that the SEC had approved BlackRock’s spot Bitcoin ETF. Amid the rumors, the price of the leading cryptocurrency exceeded $30,000, but the information was later denied by the SEC, BlackRock, and several media outlets.

Cointelegraph apologized and explained the situation: a social media post was published hastily without editorial approval. An internal investigation revealed that the editorial policy on fact-checking news was not followed.

In November, the SEC began discussing Bitcoin ETF details with Grayscale, BlackRock, and other issuers. The Commission also launched a public comment period regarding the instruments.

In the fall, cryptocurrency analysts began citing the potential approval of a Bitcoin ETF as a primary driver for the price increase of the leading cryptocurrency in 2024. Industry experts joined the conversation. For instance, Galaxy Digital CEO Mike Novogratz stated that the adoption of the instrument is only a matter of time.

The U.S. vs. the Crypto Industry

At the beginning of the year, the SEC accused the Bitcoin exchange Gemini and crypto lending platform Genesis Global Capital of selling unregistered securities through the Earn program.

In February, Kraken settled claims with the Commission regarding its staking product. The exchange agreed to close the program and pay a $30 million fine but neither admitted nor denied the allegations.

In March, the New York State Attorney General’s Office filed a lawsuit against KuCoin. The trading platform was accused of violating securities laws by offering tokens without a license. KuCoin will pay over $22 million to settle the claims.

In the same month, the American Bitcoin exchange Coinbase received a notice from the SEC regarding an investigation into its listing procedures and its products Coinbase Prime, Coinbase Wallet, and the staking service Coinbase Earn.

Following this, the platform’s CEO, Brian Armstrong, considered exiting the U.S. market due to a lack of “regulatory clarity.” The UAE was named as a potential strategic hub for international expansion.

Meanwhile, Coinbase expressed readiness to “vigorously defend itself.” The company noted that in 2021, the SEC allowed it to go public on Nasdaq, indicating that at that time, the business was not considered illegal. Coinbase also warned the regulator that it might suffer reputational damage due to its “sudden reversal” if it pursued the company.

By June, the matter reached the courts. The day after proceedings began with Binance, the Commission filed a lawsuit against Coinbase for violating securities laws. According to the SEC, several tokens fall under this definition: SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO.

The agency also accused Coinbase of illegally combining the functions of a broker, exchange, and clearing agency, which are typically separated in traditional markets. Coinbase Earn was also targeted.

In November, Kraken also received a lawsuit from the SEC. The exchange’s parent companies were accused of failing to register as a trading platform. The document also claimed that Kraken’s business practices, internal controls, and record-keeping posed additional risks.

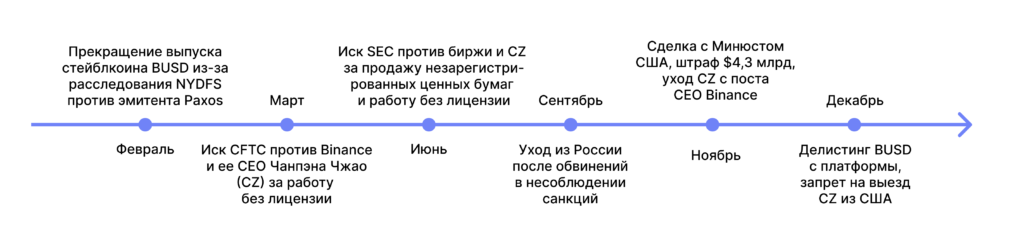

But the worst hit was the cryptocurrency exchange Binance.

Victory Over the SEC

The most positive news in crypto regulation in 2023 was Ripple’s victory in its case against the SEC. In July, the court concluded that programmatic sales and other distributions of the XRP token do not constitute an offer and sale of investment contracts.

Following the news, major cryptocurrency exchanges resumed XRP trading for U.S. users.

The SEC filed an appeal, which the court accepted but did not grant. The next hearing is scheduled for April 23, 2024.

European Union

In March, the European Parliament passed a bill on a digital identification system. The initiative involves using zero-knowledge proofs to protect the privacy of EU citizens. The technology will verify location without disclosing additional information.

The document also provides for the creation of a digital wallet for every EU citizen. It will allow storing and managing identification data, particularly for accessing government services.

In April, the European Parliament supported a bill for comprehensive regulation of the crypto industry, known as MiCA, which was adopted by the EU Council the following month. The document requires companies to obtain a license to operate within the bloc and mandates stablecoin issuers to have reserve backing.

While the U.S. is only approaching the race for spot Bitcoin ETFs, Europe launched its first such instrument. It is listed on Euronext Amsterdam under the ticker BCOIN and regulated by the Guernsey Financial Services Commission.

The Jacobi FT Wilshire Bitcoin ETF is positioned as the “first digital asset fund compliant with Article 8 SFDR due to its decarbonization strategy.” It includes a solution for certifying renewable energy sources, allowing “institutional investors to access the benefits of Bitcoin while achieving ESG goals.”

The European Commission also presented a strategy for “developing Web 4.0 and virtual worlds reflecting EU values and principles.” The term encompasses artificial intelligence, IoT, blockchains, metaverses, and augmented reality.

The authorities outlined several key development strategies:

- empowering people in the digital sector by providing access to reliable information and creating a talent pool of specialists. As part of this step, EU lawmakers will present guidelines for virtual worlds by the end of 2023;

- supporting the European Web 4.0 ecosystem to “enhance service quality and address fragmentation issues”;

- digitizing public services and supporting social progress. The authorities will launch two projects — an immersive urban environment for planning and management called CitiVerse, and a medical service called European Virtual Human Twin;

- establishing global standards for new technologies. The European Commission will engage with stakeholders in computer development and recommend rules in line with the EU’s vision.

Other Jurisdictions

In China, a court recognized the first cryptocurrency as a “unique and irreplaceable” digital asset, affirming its value at a legal level.

According to the report, Bitcoin has inherited key currency characteristics, including scalability, ease of circulation, storage, and payment. Despite its decentralized nature, the coin continues to be used worldwide, emphasized Judge Ren Suxian.

France adopted new licensing rules for cryptocurrency companies, requiring them to undergo a more rigorous registration process. The document complements the pan-European MiCA.

The United Kingdom introduced a three-year plan to strengthen measures against the use of cryptocurrencies for criminal purposes. The document outlines actions to reduce fraud, combat money laundering, counter kleptocracies, and limit opportunities for sanction evasion.

Thailand required VASP specializing in custodial services to create a digital wallet management system. The country also eased tax burdens for investment token issuers and banned the use of crypto assets in lending.

In neighboring Indonesia, the Financial Sector Development and Strengthening Law was passed, introducing changes to cryptocurrency regulation. Cryptocurrencies are now classified as securities rather than exchange commodities.

Following last year’s collapse of the Terra ecosystem, South Korea passed a digital assets bill. It introduces the term and defines liability for offenses such as insider trading, market manipulation, and unfair trading practices.

Notably, Kuwait completely banned cryptocurrency operations. The measures cover payments, investments, and mining. Local regulators are prohibited from issuing any licenses for providing services in the virtual asset sector.

Opinions

Amid increasing regulatory claims, Ripple CEO Brad Garlinghouse suggested that cryptocurrency companies might leave the U.S. He believes Europe, the UAE, the UK, and Singapore offer more clarity in terms of digital asset legislation.

Coinbase CEO Brian Armstrong stated that the U.S. is lagging in preparing industry regulations, while the rest of the world is already utilizing cryptocurrencies.

In April, before the SEC lawsuits against major Bitcoin exchanges, Social Capital founder Chamath Palihapitiya accused U.S. agencies of “killing” the crypto industry in the country.

Former Binance CEO Changpeng Zhao suggested that crypto entrepreneurs consider relocating to countries with favorable industry regulations. He identified Dubai (UAE), Bahrain, and France as such locations.

Tron founder Justin Sun noted that decisions on digital asset adoption should not rely solely on the U.S. He argued that if 7.7 billion people start using cryptocurrencies as legal tender, the 300 million Americans will follow suit.

U.S. presidential candidate Robert Francis Kennedy Jr. criticized the SEC and the FDIC for their “war on cryptocurrencies,” which he claimed led to a banking crisis in the country. He later called Bitcoin the “currency of freedom.”

Conclusions

Despite numerous lawsuits and accusations against crypto industry representatives, 2023 cannot be deemed entirely negative in terms of regulation.

Experts agree that Binance’s settlement with the U.S. Department of Justice is a positive sign for the industry, as is Ripple’s victory in its case against the SEC. Grayscale’s successes in its confrontation with the agency also served as a driver.

It is difficult to predict what digital asset regulation will look like in 2024, but analysts are confident in the imminent approval of a spot Bitcoin ETF. In light of this and the upcoming halving, specialists anticipate growth in cryptocurrencies.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!