Cryptocurrency Sectors See Varied Growth Since January

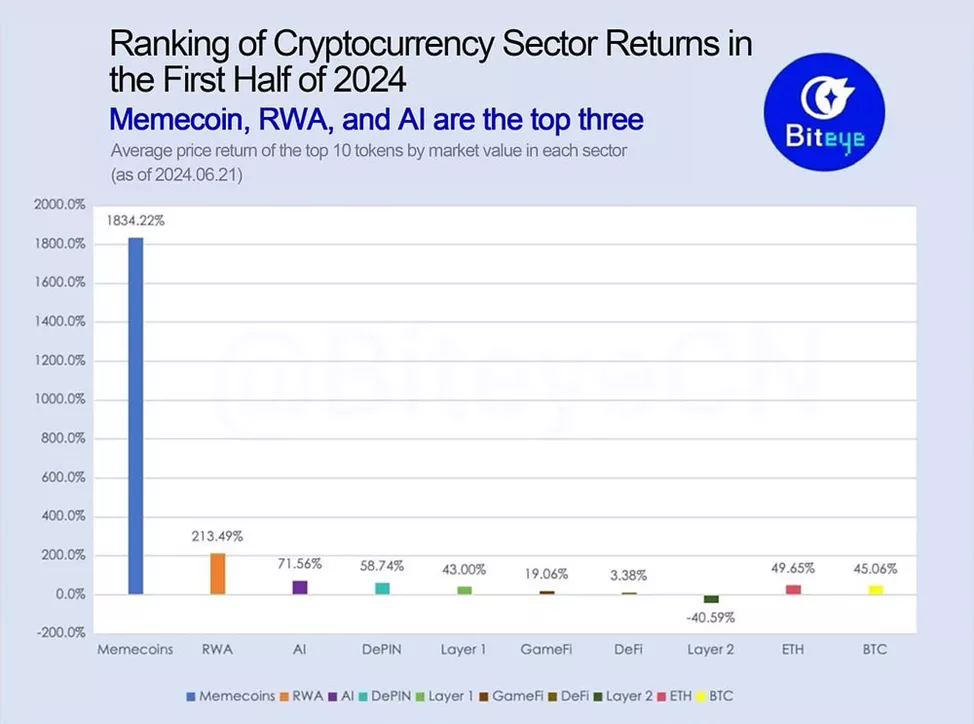

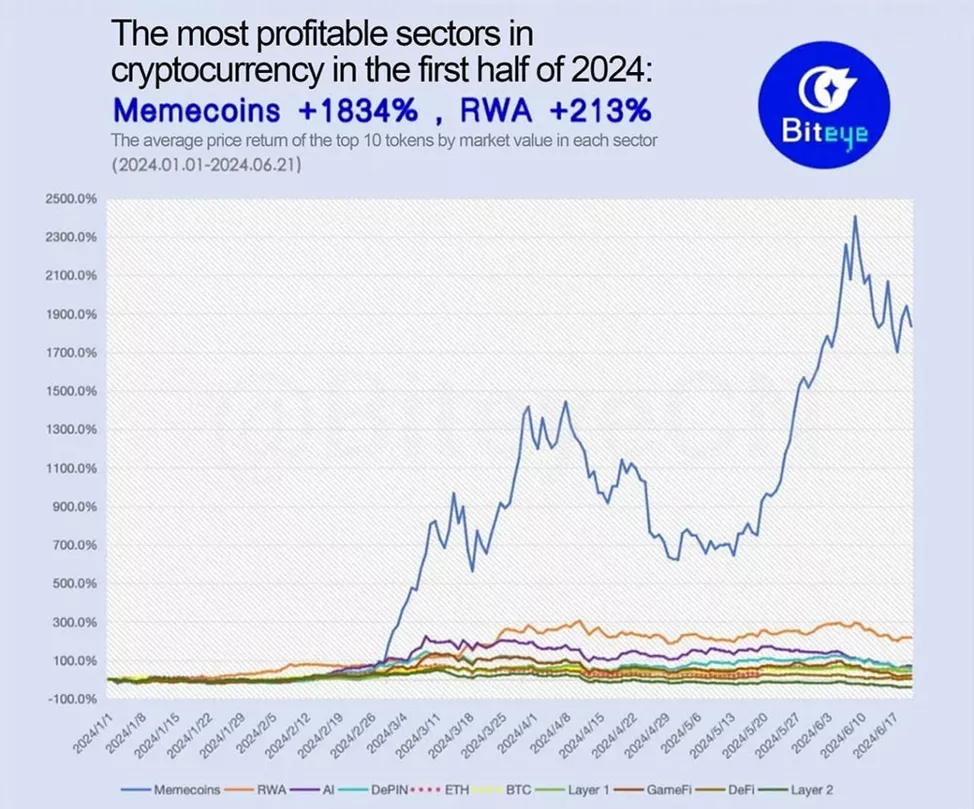

Meme coins, RWA, and AI have led the growth across various sectors of the cryptocurrency market. Since January, the average daily return of the ten largest by market capitalization has been 1834%, 213%, and 72% respectively, according to Biteye.

Analysts used CoinGecko data from January 1 to June 21.

Experts highlighted the popular phrase in the community, “Bet on memes to live in a palace.” This is supported by data, as the sector remains the most profitable in 2024. At its peak, the average return level reached 2405.1%.

As of June 19, three of the top ten meme coins by market value emerged in March-April — BOOK OF MEME (BOME), DOG-GO-TO-THE-MOON (DOG), and Brett (BRETT). The latter surged by 14,353.5% after trading began.

The profitability of meme coins is 8.6 times higher than that of the second-ranked sector, RWA, and 542.5 times that of the laggard, DeFi. Analysts excluded L2 tokens from this comparison due to their price losses.

In RWA, specialists highlighted MANTRA (OM) and Ondo (ONDO) — 1123.8% and 451.1% since the beginning of the year, respectively. They noted that most projects are in early stages and recommended monitoring them. Interest in RWA was driven by investments from BlackRock and other major institutions.

Experts attributed AI’s third-place ranking to the focus of tech giants. The sector’s largest gains were seen in Arkham (ARKM) — 215.5%, AIOZ Network (AIOZ) — 192.2%, Render (RNDR), and Fetch.ai (FET) — 57.5% and 116% respectively.

DePIN and L1

DePIN ranked fourth with a 58.7% increase. JasmyCoin (JASMY) showed the best results, rising by 323.4%, followed by Arweave (AR) and Livepeer (LPT) with 174.1% and 116.1% respectively.

Analysts pointed to the sector’s potential to grow more than 20 times. They believe capitalization could reach $500 billion if it accounts for half the value of the DeFi segment, which in turn could grow tenfold.

In 2024, the L1 sector’s return was 43%. Solana (SOL) increased by 22.9% since the start of the year, although it reached 85.1% in mid-March. Ultimately, the most successful cryptocurrencies were Toncoin (TON) and Binance Coin (BNB) with gains of 204.7% and 86.1% respectively.

Laggards

The GameFi sector “gained weight” by 19.1%. FLOKI (FLOKI) delivered the best results, yielding 362.8% to holders. It was followed by Ronin (RON) with 21.2% and Echelon Prime (PRIME) with 5.3%.

The DeFi sector had fairly good results in Q1, aided by Uniswap’s (UNI) late February proposal to distribute fees among holders. However, it lost momentum in the following three months, with the indicator dropping to 3.4%. Maker (MKR) showed the highest return with a 49.9% increase.

The L2 sector showed the worst results, with profitability at -40.6%. AEVO (AEVO) and StarkNet (STRK) performed the worst, declining by 85.4% and 63.2% respectively.

Key L2s for Ethereum also recorded low results: Optimism (OP) incurred a 54.7% loss, and Arbitrum (ARB) — 53.7%. Mantle (MNT) stood out with a profitability of 26.1%.

On June 24, the meme token WaterCoin (WATER) was listed on the Jupiter and Raydium exchanges. Immediately after trading began, the coin’s price jumped by 83%.

In May, 455,000 new coins appeared on the Solana blockchain. The figure reached a monthly high due to low entry barriers and the hype around meme tokens. The popularity of the platform for their launch, pump.fun, played a significant role in this.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!