CryptoQuant Analyst Warns of Bitcoin’s Final Growth Phase

The bitcoin rally is “under threat” due to whale sell-offs and weak retail investor participation, according to an anonymous CryptoQuant analyst known as Arab Chain. He shared this conclusion.

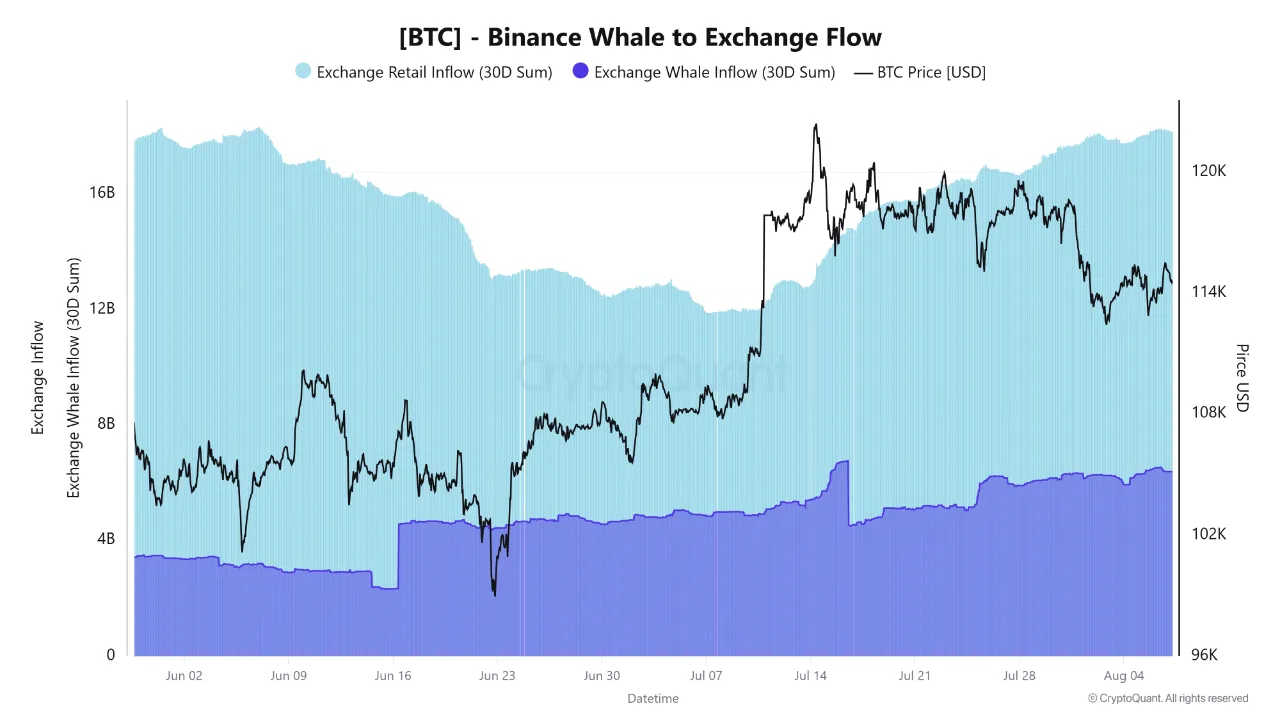

The expert suggests that the leading cryptocurrency is likely nearing the end of its bullish cycle. This is indicated by the Whale to Flow indicator data on Binance.

In July and August, bitcoins worth approximately $5 billion were transferred to the crypto exchange. Such transactions by large players often precede major sell-offs, the analyst noted.

Meanwhile, retail investors are increasing their deposits on Binance. The light blue area on the chart shows their growing activity at the end of last month and the beginning of this month. Historically, the late entry of small market participants coincides with the final phase of the market cycle.

“When small investors join so late, it is usually a sign of the end of growth — whales use them to lock in profits,” explained Arab Chain.

Despite the inflow of funds, momentum is fading, he added. Currently, the price of digital gold is moving sideways, indicating a depletion of buying demand.

If the trend continues, selling pressure could trigger a correction to $112,000. At the time of writing, bitcoin is trading at $116,586.

Back in August, CryptoQuant analysts stated that bitcoin had entered a “bullish pause” phase. According to the head of research at the platform, Julio Moreno, new catalysts are needed for the leading cryptocurrency to resume growth. He cited a potential interest rate cut by the Fed in September as one such catalyst.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!