CryptoQuant Analysts Warn of Potential Bitcoin Price Correction

Bitcoin’s price has partially recovered after a brief dip below $41,000 on January 3. Despite this, risks of a new correction remain due to a potential wave of unrealized profit-taking, reports The Block, citing a CryptoQuant report.

The resurgence of the leading cryptocurrency is fueled by ongoing anticipation of the U.S. SEC’s approval of spot Bitcoin ETFs. Another positive factor is information from the Federal Reserve’s protocol, indicating the regulator is considering a gradual rate cut in 2024.

In the past 24 hours, Bitcoin’s price has risen by 3.4%, according to CoinGecko. The asset is trading around $44,120.

However, according to the latest CryptoQuant report, the unrealized profit of short-term investors remains high.

“This has historically preceded price corrections as traders locked in profits,” noted the experts.

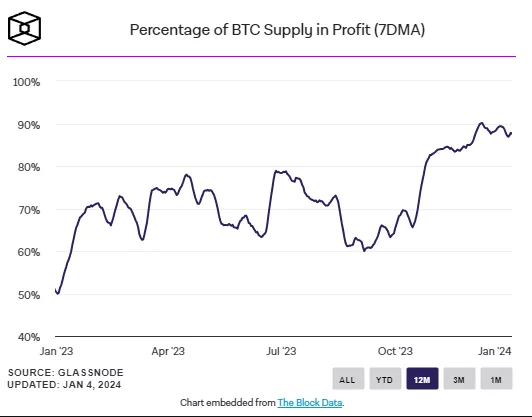

The percentage of Bitcoin supply “in profit” stands at 87.59%, nearing a 12-month high.

Specialists also pointed to the dominance of selling in perpetual futures markets. They observed that the takers’ buy/sell volume ratio has fallen below 1, which is a bearish signal.

Analysts also noted an increase in centralized crypto exchange reserves by 28,000 BTC, which could lead to potential selling pressure.

Earlier, CryptoQuant experts suggested a “sell the news” scenario following the approval of a spot Bitcoin ETF, where Bitcoin could drop to $32,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!