CryptoQuant: Bitcoin Hits Local Bottom Amid Positive Indicators

The price of the leading cryptocurrency has seemingly reached a local bottom before rebounding to nearly $66,000 earlier this week, reports The Block, citing a report from CryptoQuant.

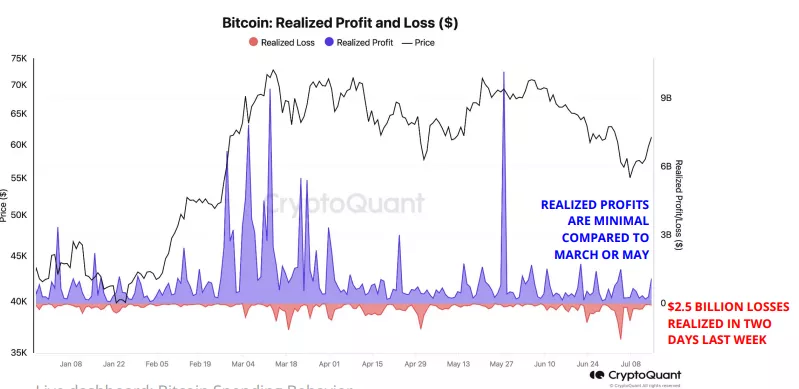

According to analysts, the recent drop in Bitcoin’s price to around $55,000 resulted in the largest realized losses for asset holders in 2024.

“Hodlers of digital gold recorded losses of $2.5 billion over two days last week, while profit-taking remained minimal compared to March. Large realized losses are typically a sign of seller capitulation and are associated with reaching price lows,” the experts noted.

They added that last week, traders’ unrealized margin fell to -17%. This is the lowest level since the FTX collapse in November 2022.

“Prices typically bottom out when traders’ profits fall to extremely negative levels,” the analysts emphasized.

Positive Forecasts

The report states that various Bitcoin metrics have recently bounced off key levels. This is also a sign that the local bottom is behind, and an upward price momentum lies ahead.

“The Bitcoin profit and loss index crossed its 365-day moving average, and the bull/bear market cycle indicator surpassed its 30-day counterpart. Metcalfe’s valuation bands have acted as support for the second time this year,” noted CryptoQuant.

A Note of Caution

The report also indicated that liquidity in the form of stablecoins remains insufficient to drive full-scale growth.

“Stablecoin liquidity is a necessary condition for a sustainable Bitcoin rally,” the experts stressed.

In their view, the market capitalization of USDT is not increasing sufficiently. This “reduces the likelihood of a more significant price increase.”

At the time of writing, Bitcoin is trading around $63,730. Over the past seven days, the asset has risen by approximately 11%, according to CoinGecko.

Earlier, the Chief Investment Officer of Bitwise predicted that digital gold would rise to $100,000 by the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!