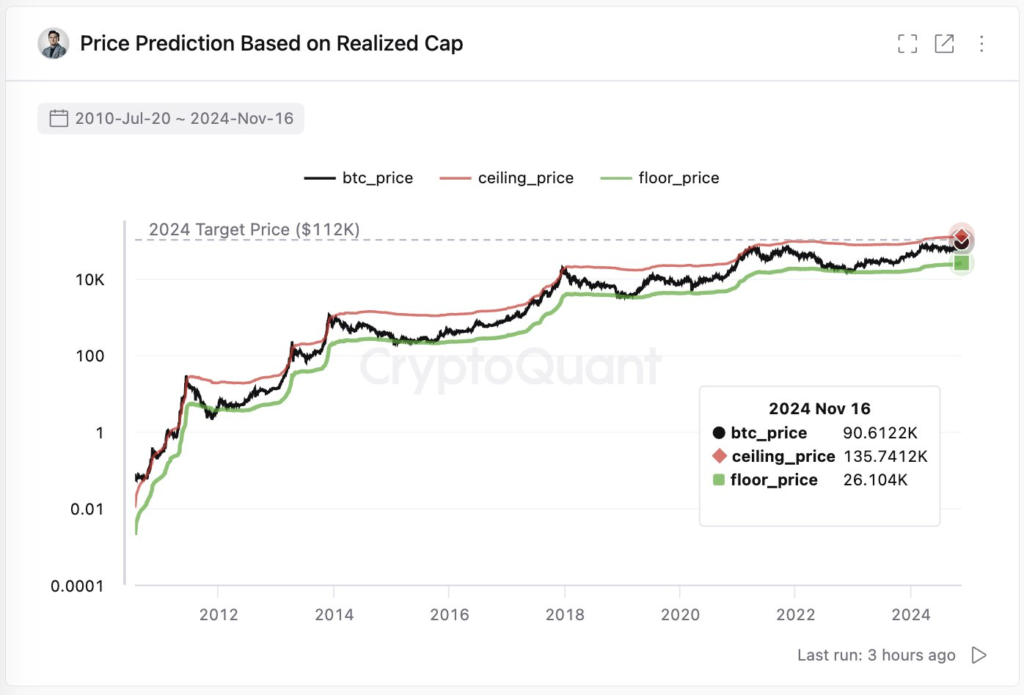

CryptoQuant CEO Raises Bitcoin Forecast to $135,000

Based on the cumulative capital inflow into the bitcoin market, the target price for the digital asset in the current cycle is set at $135,000. This conclusion was reached by Ki Young Ju, founder and CEO of CryptoQuant.

Thus, the expert adjusted his February forecast for the first cryptocurrency’s price based on realized capitalization. A month earlier, spot bitcoin ETFs began trading.

The head of CryptoQuant suggested that inflows into these products would drive a bull market, potentially pushing the price to $112,000 by year-end.

According to SoSoValue, the cumulative net inflow into exchange-traded funds as of November 15 approached $27.5 billion.

“We are in a bull market. Bitcoin will continue to rise,” the analyst emphasized.

However, he cautioned that this does not preclude corrections, as “the perpetual futures market is excessively leveraged.”

“Stay long-term optimistic, but be cautious with leverage if you are a trader,” concluded Ki Young Ju.

At the time of writing, the leading cryptocurrency is trading around $91,400 (CoinGecko).

$90,000 — An Entry or Exit Point for Investors?

CryptoQuant analyst known as Percival noted that not all long-term bitcoin holders (at least 155 days) “are counting on a six-figure price.” Some have started taking profits after the price reached $90,000.

However, this does not pressure the digital gold’s price, as the realized coins are absorbed by ETF inflows, Percival highlighted.

In his assessment, sales mainly come from investors who acquired the cryptocurrency less than a year ago. Their average “paper profit” is about 150%, and $90,000 seems like a “good exit point.”

Meanwhile, most of those who invested in bitcoin earlier continue to hold the asset, expecting returns of more than tenfold, Percival noted.

According to CryptoQuant analyst Burak Kesmeci, on November 15, the NVT Golden Cross indicator signaled a “local bottom.” A metric value below 1.6 points indicates an excessively cooled market zone.

NVT Golden Cross metric triggered a “local bottom” alert

“When the NVT GC drops below -1.6 points, it suggests that the price is cooling off excessively, signaling a potential local bottom area.” – By @burak_kesmeci

Read more ?https://t.co/pwXMT7ug7a pic.twitter.com/dVN7mH5YBE

— CryptoQuant.com (@cryptoquant_com) November 16, 2024

On that day, following a statement by Fed Chair Jerome Powell, the bitcoin price dipped to $87,000 but rose by 3.8% over the next 24 hours.

“In this context, investors are presented with an opportunity for gradual buying,” the expert stated.

Earlier, Tom Lee, co-founder of the analytical firm Fundstrat, also reaffirmed his forecast of bitcoin exceeding $100,000 by the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!