CryptoQuant Identifies Bitcoin Correction Target

The price of the leading cryptocurrency is set to return to $96,700, which corresponds to the average purchase price of short-term investors. CryptoQuant believes this level can be seen as a potential rebound point.

Bitcoin at Key Support: Market Awaits Post-Correction Entry Opportunity

“Currently targeting the $96,700 level, which represents a key support zone on the network and aligns with the average purchase price of short-term investors.” – By @abramchart pic.twitter.com/9ydqKL6j9r

— CryptoQuant.com (@cryptoquant_com) June 3, 2025

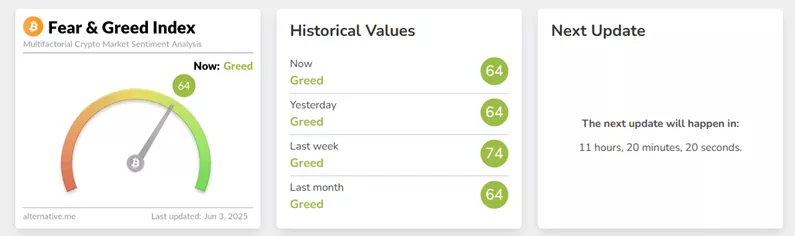

The bearish scenario from analysts stems from the fear and greed index. The indicator has not reached a state of extreme optimism, indicating the absence of typical FOMO buying during the rally to the ATH.

According to experts, altcoins, including Ethereum, are likely to be negatively affected by any correction in the leading cryptocurrency, which would “drain” liquidity from other digital assets.

“We recommend waiting and observing market movements with the possibility of opening new positions after the expected pullback is completed,” the experts concluded.

Bitcoin Magazine also lacks optimism regarding the short-term prospects of Bitcoin.

Analysts noted a return of quotes below the resistance formed by the peaks of December 2024 – January 2025 near $106,000. Bulls need to push the price back above this level, they added.

Earlier, Rachel Lucas from BTC Markets noted that if the price of the leading cryptocurrency remains in the $103,000-105,000 range, it could set the stage for a new wave of growth to $115,000.

Coinbase predicted a positive impact on the digital asset market dynamics from the $5 billion reimbursement to FTX creditors.

Previously, Bernstein identified institutional buying as one of the five key factors for the continued rise in Bitcoin’s price.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!