CryptoQuant Identifies Factors Behind Bitcoin’s Retreat from $66,000

The decline of the leading cryptocurrency by over 3% on September 30 is attributed to a long squeeze in the perpetual contracts market. This view is held by CryptoQuant, reports The Block.

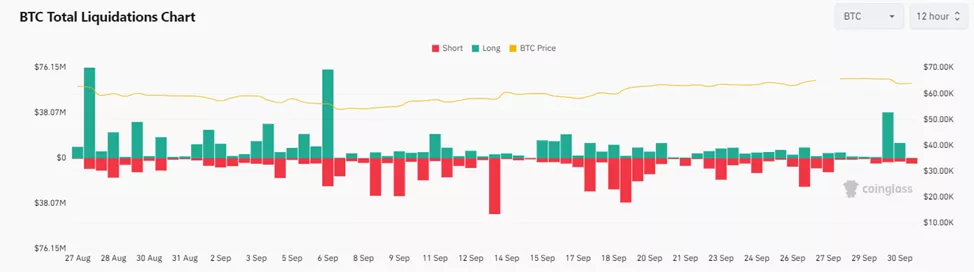

The surge in liquidations of long positions coincided with a wave of caution in stock markets due to rising expectations of a key rate hike by the Bank of Japan.

The catalyst was the ruling party’s decision to select Shigeru Ishiba as the next prime minister. The politician is known to support further tightening of monetary conditions.

Market participants fear a repeat of the situation in late July, when a wave of carry trade position unwinding caused panic in risk assets and led to Bitcoin’s drop from $70,000 to $49,000.

According to data from Coinglass, long positions worth $51.4 million were forcibly closed in the past 24 hours.

The rise in open interest to $19.1 billion contributed to the significant scale of liquidations. Analysts noted that since March 2024, this metric has exceeded $18 billion only six times, each followed by a price decline.

The upcoming U.S. employment report on November 4 is expected to be a key factor for the cryptocurrency market in the coming days.

Earlier, 10X Research predicted an imminent move of Bitcoin towards $70,000.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!