CryptoQuant Predicts Ethereum Surge Beyond $5000

If current trends in demand and supply, on-chain activity, and investor interest persist, the second-largest cryptocurrency by market capitalization is poised for significant appreciation. This is reported by The Block, citing insights from CryptoQuant experts.

“Based on valuation metrics, Ethereum could exceed $5000 if the current demand and supply dynamics continue,” noted the experts.

According to their observations, the upper limit of Ethereum’s realized value is around $5200, reflecting the peak levels of the previous bull market.

CryptoQuant analysts emphasized that new market participants are purchasing Ethereum at higher prices. This suggests that the mentioned upper limit value will continue to rise, indicating the asset’s growth potential within the current cycle.

On-Chain Indicators

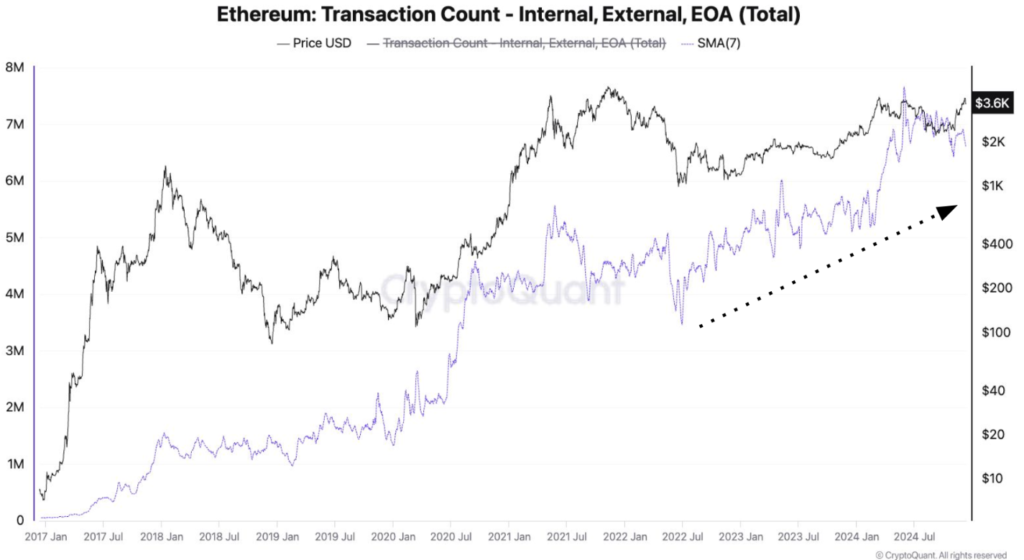

Experts also noted positive changes in network activity. For instance, the daily transaction volume ranges between 6.5-7.5 million — in 2023, this figure was approximately 5 million.

“Moreover, the number of daily smart contract calls — an indicator of dapps usage — has increased to 6-7 million compared to 5 million in 2023,” added the analysts.

The revival of on-chain activity has led to a rise in transaction fees and an increase in the number of coins burned under EIP-1559.

“The growth rate of supply has slowed in recent months as the amount of Ethereum burned through fees has increased since September, exerting some pressure on the digital asset,” explained CryptoQuant representatives.

Institutional Demand

Exchange-traded funds based on Ethereum’s spot price (ETF) have maintained a daily net inflow since November 22.

The total assets under management by Ethereum-based ETF providers exceeded $13 billion. The cumulative net inflow of funds into these structures approached $2 billion; the figure for the last 24 hours was $102 million.

Some experts believe that such dynamics indicate the potential for the second-largest cryptocurrency to reach new price highs in the near future.

At the time of writing, Ethereum is trading around $3948. Over the past 30 days, the asset increased by 21.7%; in comparison, Bitcoin rose by 16.2%.

Earlier, BlackRock and Fidelity acquired $500 million worth of Ethereum for ETFs during December 10-11.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!