CryptoQuant sees signs of capitulation among bitcoin investors

CryptoQuant says aSOPR signals weakening sentiment and possible capitulation.

As the leading cryptocurrency climbed to new highs, the key aSOPR indicator signalled weakening bullishness, noted CryptoQuant analyst Ignacio Moreno de Vicente.

Late Bull, Early Bear, or Just a Reset? aSOPR Holds the Clue

“If current support levels fail and additional technical indicators confirm bearish momentum, we could be entering a capitulation phase.” – By @MorenoDV_ pic.twitter.com/8DuRRMNOXK

— CryptoQuant.com (@cryptoquant_com) January 30, 2026

In his view, each bitcoin price peak was accompanied by increasingly early profit-taking, pointing to waning conviction with each leg higher.

The metric has tracked a downward trend in profit-taking: market participants have been exiting positions more frequently at lower profitability.

At present, aSOPR is closely tracking a descending channel. Each touch of the upper bound has coincided with local price tops, while approaches to the lower bound have matched local lows.

“This makes aSOPR not just a sentiment gauge but a tool for identifying stress points in the market,” the expert said.

Bitcoin is now testing the channel’s lower bound amid extreme fear in the market. Roughly a third of all bitcoin supply is in loss.

Historically, such conditions have created tactical buying opportunities ahead of short-term bounces, the analyst stressed. However, the market is at a crossroads.

A loss of current levels, coupled with further bearish signals, could usher in a capitulation phase. Lower highs in aSOPR throughout the bull cycle point to weakening “strong hands”, and a break of current thresholds could trigger accelerated selling.

A return of risk appetite

On January 30, bitcoin briefly fell to a local low near $81,100, and Ethereum to $2,700. The total market capitalisation of cryptoassets fell 5.6% on the day to $2.9trn.

At the time of writing, bitcoin is trading around $82,800.

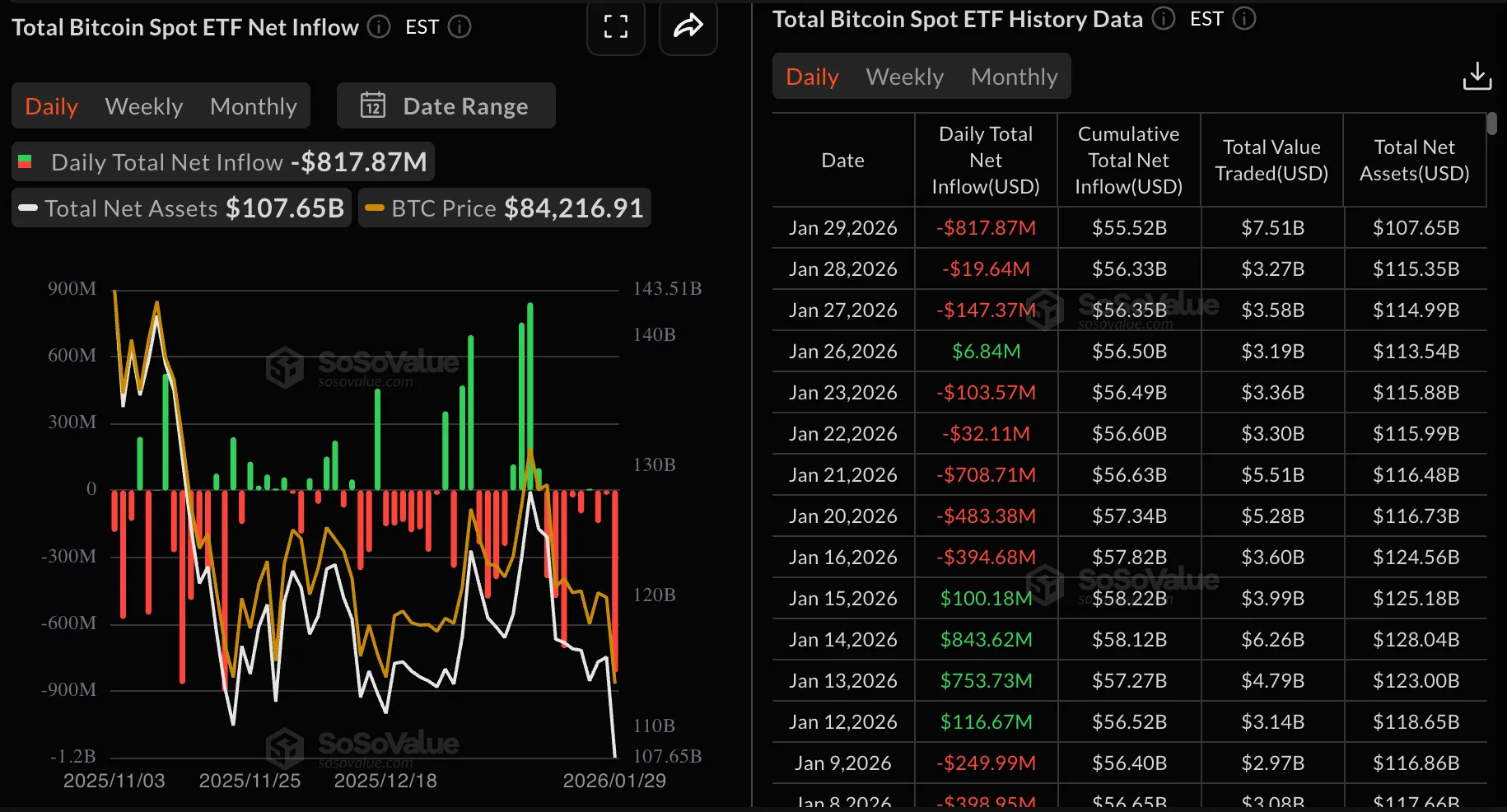

Amid the sell-off, spot bitcoin-ETFs shed $817m. The latest daily outflow was the largest since mid-November.

The crypto slide was driven by declines in technology shares and precious metals. Microsoft fell 12%, setting off a domino effect across global markets.

CryptoQuant analyst Darkfost noted that bitcoin’s “relatively contained correction” triggered $300m of long liquidations within hours. The largest share came on Hyperliquid — $87.1m of longs were closed.

Global Sell Off: -8% Gold, -12% Silver, -5% BTC, while Binance Open Interest back up to Pre-October 10 Levels

“This represents an increase of roughly 31% since then, gradually reflecting the return of risk appetite among investors.” – By @Darkfost_Coc pic.twitter.com/xKvYmbesRu

— CryptoQuant.com (@cryptoquant_com) January 30, 2026

“By comparison, on Binance […] this figure was roughly three times smaller — around $30m. This suggests that many investors still use high leverage to gain market exposure, generating volatility spikes that are often amplified by liquidation cascades,” the expert stressed.

Even so, risk appetite is returning, said Darkfost. Open interest on Binance now stands at 123,500 BTC, 31% above the October 10 level of 93,600 BTC.

Other factors

Liquidity conditions also exacerbated the correction, noted Kraken’s global economist Thomas Perfumo.

“Global liquidity, which most affects crypto market dynamics, remains tight. Interest rates are only one piece of the puzzle. At the same time, gold has historically benefited from a weak US dollar and continues to attract capital from more risk-sensitive investors,” he said.

Short-term positioning added pressure. According to Kraken vice-president Matt Howells-Barby, worries over big tech’s hefty AI spending injected nerves into risk assets. That contrasts with the clear risk-on tone with which these segments started the week.

“Credit spreads were already extremely tight, and markets were clearly risk-on before this move. Bitcoin felt the effects: a wave of long liquidations is pushing prices down. Failure to hold above $83,500 will shift the focus toward the $80,000 area,” the expert stressed.

Beyond macro conditions, on-chain data point to stress in a key sector — bitcoin mining.

According to CryptoQuant’s weekly report, crypto mining saw severe disruptions due to a powerful winter storm in the US.

Extreme weather forced several large operators to pause activity, prompting the steepest drop in the network’s hashrate since October 2021.

The blockchain’s computing power fell by roughly 12% from mid-November levels. At the same time, as bitcoin’s price fell and block production slowed, miners’ daily revenue dropped to a yearly low of about $28m, sharply worsening industry profitability.

More recent data show a recovery: hashrate and average block times are starting to return to previous levels as weather normalises.

Meanwhile, Capriole Investments founder Charles Edwards pointed to a deterioration: production cost has fallen to $69,000, and electrical cost stands at $55,000.

This is not good. As the Bitcoin miner exodus continues, Production Cost has collapsed to $69K. Electrical Cost is $55K. This has expanded the potential range for near term downside. pic.twitter.com/Z0wcTT6CV8

— Charles Edwards (@caprioleio) January 30, 2026

“This expands the potential range for near-term downside,” he stressed.

Earlier, BitMEX founder Arthur Hayes suggested that the leading cryptocurrency could break out of its range if the ФРС supports Japan’s bond market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!