CryptoQuant sets out two scenarios for Bitcoin’s next move

Whales retreat, retail dominates, pressuring Bitcoin; CryptoQuant sees rangebound or correction.

A pullback in whale activity and retail dominance are weighing on the price of the leading cryptocurrency. CryptoQuant analyst EgyHash did not rule out continued sideways trading or a further correction.

Large players keep accumulating the “digital gold”, yet the price remains confined to a narrow range. The key reason, he argues, is a shift in futures-market dynamics, which are the “primary driver for Bitcoin”.

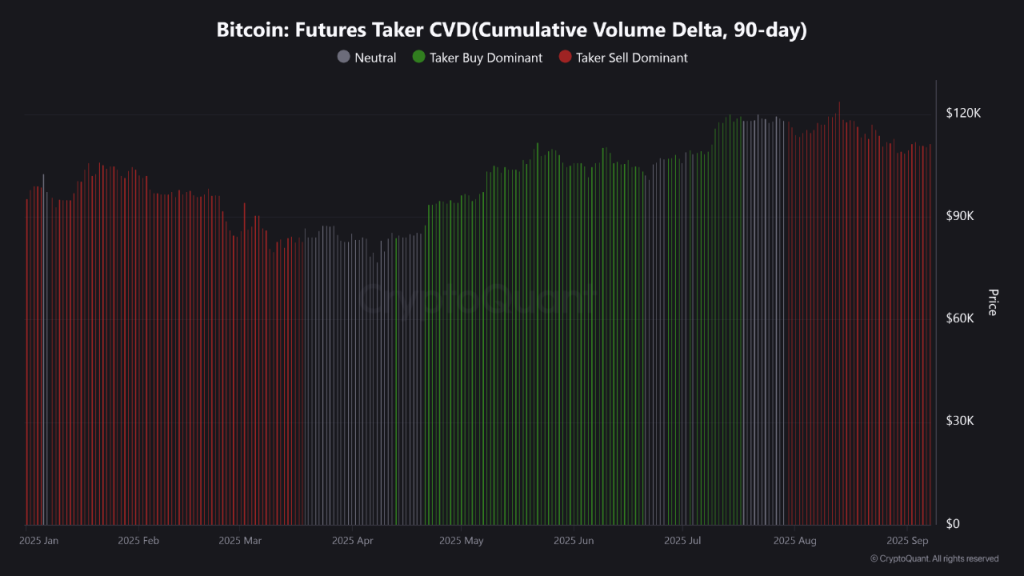

According to the analyst, the average order size points to stronger influence from retail trades. The metric is calculated as total trading volume divided by the number of trades.

“The visualization of the distribution of cryptocurrency turnover further confirms this trend, reflecting the market’s transition into a consolidation phase with a characteristic decline in trading activity,” he added.

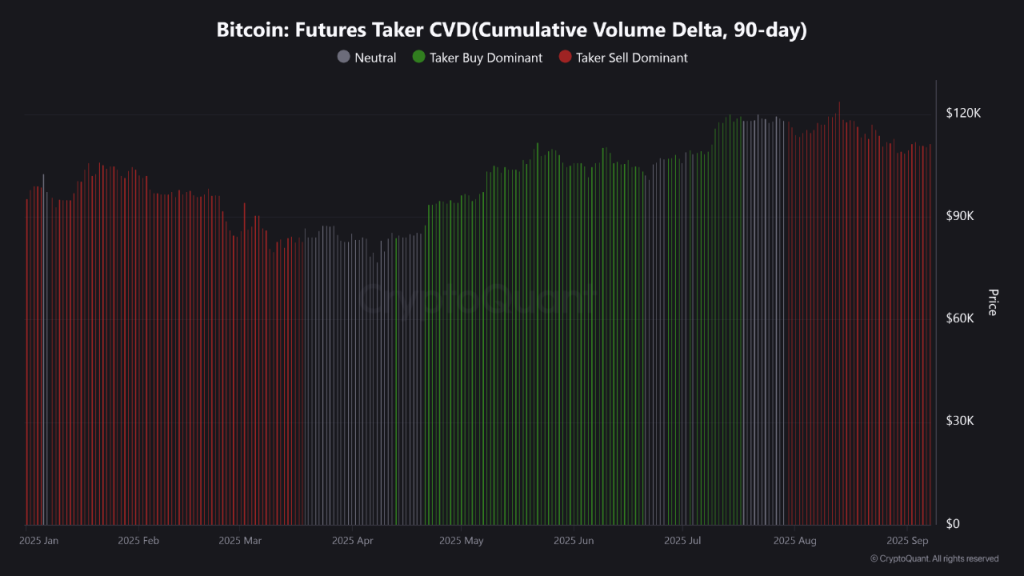

The CVD indicator over the past 90 days shows sellers in the ascendant, signalling bearish sentiment among futures traders about the path ahead for the digital gold.

EgyHash stressed that without whales returning and stronger demand from large players, Bitcoin’s price will remain rangebound or face additional selling pressure.

At the time of writing, the leading cryptocurrency trades at $112,700, up 0.5% over 24 hours and 2.2% on the week.

Options-market sentiment

Bitcoin’s recovery above $112,000 after a dip to $108,000 has not been enough to restore trader confidence, Cointelegraph writes.

Market participants are trying to determine what is holding back sentiment and whether the coin has the momentum to break above $120,000.

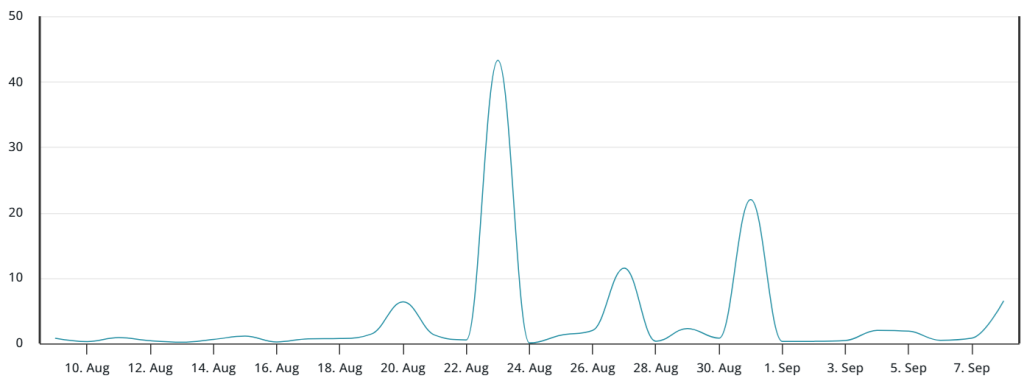

In options, demand for protection has risen, pointing to stronger appetite for neutral-to-bearish strategies. Many expect a pullback below $108,000, although this may also be a reaction to last week’s volatility.

Caution also reflects Bitcoin’s failure to match record highs in the S&P 500 and gold. Meanwhile, weak US employment data have strengthened expectations of monetary easing by the Fed.

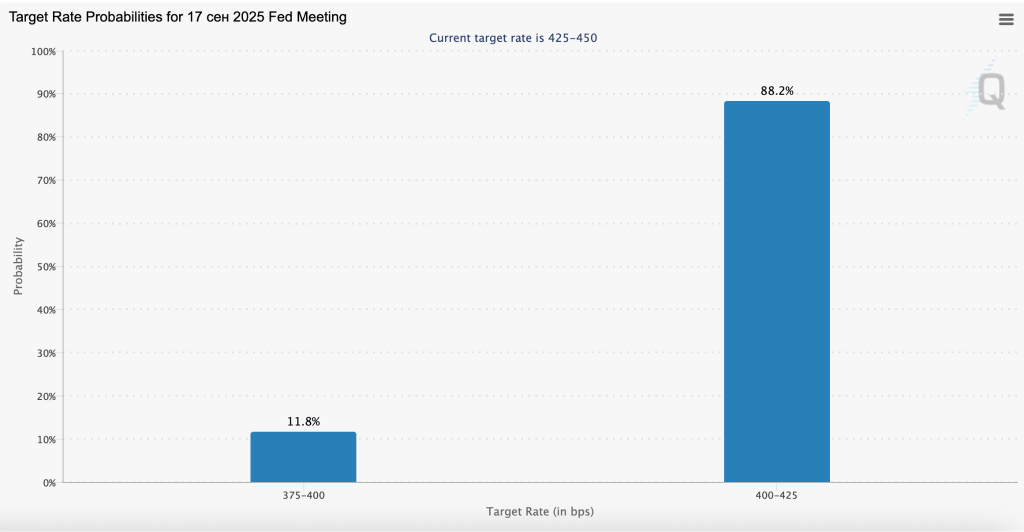

At the time of writing, traders assign a 100% probability to a rate cut at the September 17 meeting.

Analysts say a positive decision by the regulator could trigger a crypto rally in the next quarter.

ETF

Investor caution is compounded by ongoing outflows from spot Bitcoin ETFs. The vehicles attracted $368 million last week, but that is far below readings in prior months. In July, the seven-day figures consistently topped $1 billion.

Companies and exchange-traded funds have been accumulating Ethereum more actively, which may also be weighing on investor sentiment toward the digital gold.

What next?

Glassnode analysts noted a recovery in Bitcoin’s on-chain metrics. Active addresses have returned to their prior range, hinting at some revival, they said.

However, transaction volumes have fallen alongside fees, suggesting there is no serious rush.

$BTC has been trading just above the short-term holder cost basis, oscillating near $111k. This week’s Market Pulse reviews fragile stabilization across spot, futures, ETFs, and on-chain signals, with cautious sentiment still dominating: https://t.co/MR4cISBH98 pic.twitter.com/S7QEVuQiqS

— glassnode (@glassnode) September 9, 2025

They also observed that investors are behaving cautiously: there is a small inflow of capital, but long-term conviction remains scarce. Most participants are taking moderate profits.

“Overall, the market shows fragile stabilization above the short-term holders’ cost basis. Improvements in momentum and profitability are offset by declining trading volumes and a wait-and-see stance. Sentiment is slightly pessimistic, but short-term spikes in growth are possible if demand appears,” they concluded.

The analyst known as BitBull stressed that “Bitcoin has one good rally left now.”

$BTC has one good rally left now.

The chart pattern is exactly similar to 2023 and 2024 which led to a big breakout.

This time MCap is bigger, so the rally won’t be 2x or 3x.

Instead, I’m expecting a 40%-50% rally by November/December before a blow-off top.

What’s your price… pic.twitter.com/d2ZnXnfEeA

— BitBull (@AkaBull_) September 9, 2025

“The chart is forming a pattern exactly mirroring the models of 2023 and 2024 that led to a significant breakout. This time the market capitalization is higher, so the rise will not be 200–300%,” he noted.

He says that by November–December the price of the leading cryptocurrency will rise by 40–50% from current levels “before a blow-off top”.

Crypto trader Hardy believes that after clearing $112,000 the next target for the digital gold is $116,000.

MN Capital founder Michaël van de Poppe pointed to Bitcoin’s break above the 20-day moving average. The cryptocurrency could follow gold, which continues to set record highs, he said.

There we go.

✅ #Bitcoin breaks through the 20-Day MA and $112K

✅ Gold is printing strong new ATHs —> $BTC likely following.

✅ #Altcoins are starting to heavily outperform and breakout everywhere. pic.twitter.com/S8wb9nDrpi— Michaël van de Poppe (@CryptoMichNL) September 9, 2025

Earlier, analysts suggested crypto-market volatility ahead of US macro data releases.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!