DAT firm Sequans sells 970 BTC to reduce debt amid bitcoin slide

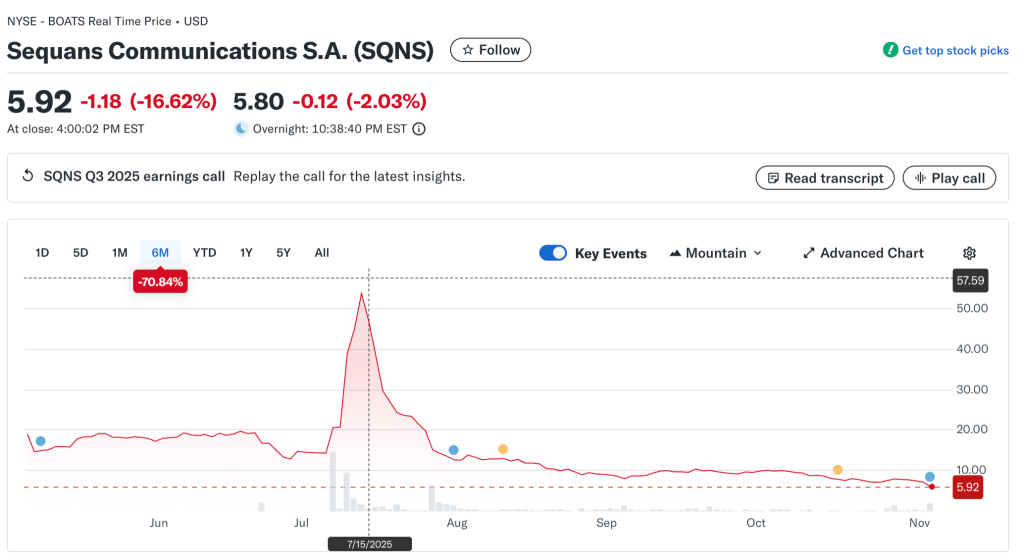

The company’s shares fell 16% in a day

French firm Sequans Communications sold 970 BTC to partially redeem its convertible debt. The transaction totalled about $94.5m.

The company’s reserves fell from 3,234 to 2,264 BTC. The remaining holdings are valued at $232m.

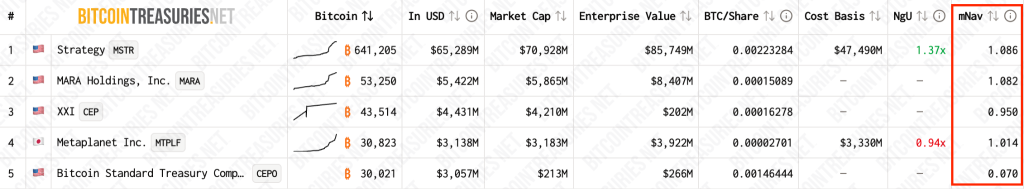

Sequans dropped from 29th to 33rd in the ranking of the largest holders of bitcoin.

Sequans’ debt-to-net-asset-value ratio fell from 55% to 39%. Company representatives said this will increase flexibility for the share buyback programme and a potential preferred-share offering.

Chief executive George Karam called the move a tactical step to unlock shareholder value in current market conditions. He stressed the company’s bitcoin strategy remains unchanged.

Sequans began accumulating bitcoin in June—when it raised $385m through debt and equity placements. Since then the firm’s shares have plunged almost 60% to $5.9.

The mNAV of Sequans fell from a July peak of 20.45 to 0.6, according to BitcoinTreasuries. Readings for the largest bitcoin holders are also low:

Lookonchain analysts drew attention to transfers from addresses linked to miner MARA Holdings. In less than a day the company sent 2,348 BTC worth $236m to FalconX, Two Prime, Galaxy Digital and Coinbase Prime.

Is #MARA, the #Bitcoin mining firm that had been consistently buying $BTC, now selling?

In the past 12 hours, #MARA transferred a total of 2,348 $BTC($236M) to #FalconX, #TwoPrime, #GalaxyDigital, and #CoinbasePrime.https://t.co/9DlN5ZPsBz pic.twitter.com/Sur1Swt1d8

— Lookonchain (@lookonchain) November 5, 2025

Analysts allowed for asset sales. The firm holds 53,250 BTC worth $5.4bn.

According to CoinGecko, over the past 24 hours bitcoin’s price has fallen by almost 3% to about ~$102,000.

Ethereum

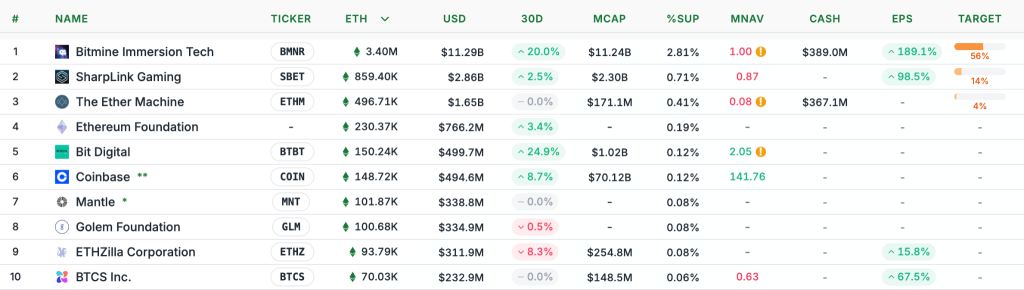

In late October the Ethereum-focused accumulator ETHZilla announced $40m of asset sales to finance a share buyback. Representatives added they would continue selling until mNAV stabilises.

ETHZilla manages 93,970 ETH worth $311.9m.

The biggest holder remains BitMine, which keeps 3.4m ETH worth $11.2bn. Its mNAV is 1; in July the metric reached 5.6.

Amid Ethereum’s decline to ~$3200 the firm faced paper losses of more than $1.3bn, writes Bloomberg citing 10x Research. BitMine’s shares have tumbled 70% from the peak reached in July.

Despite the strain, the company continues to accumulate crypto—between October 27 and November 2 it purchased 82,000 ETH. The firm’s chairman Tom Lee expects Ethereum to reach $15,000.

In October Lee said a bubble in the crypto-treasury segment had burst—80% of such vehicles trade below their net asset value. However, he argued, that signals not collapse but greater investor selectivity.

Solana

The unrealised loss at the company focused on Solana, Forward Industries, reached $382m, noted journalist Colin Wu.

According to Defillama, Solana DAT firm Forward Industries, Inc. (Nasdaq: FORD) holds 6.82 million SOL purchased at an average price of $232. The position is now worth $1.2 billion, reflecting a 24.13% unrealized loss totaling $382 million. The company’s stock has fallen 73.6%…

— Wu Blockchain (@WuBlockchain) November 5, 2025

The firm holds 6.8m SOL bought at an average price of $232. At the time of writing the altcoin trades at $156.

Forward Industries’ shares have slumped by almost 74% from the peak—from $39.6 to $10.44. mNAV has dropped below 1.

Ten companies are currently accumulating Solana. They hold 2.8% of the cryptocurrency’s total supply—15,998 SOL worth $2.5bn.

In August the trend toward creating crypto treasuries sparked debate among market participants.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!