DAT firms rack up billions in paper losses

DAT firms face big paper losses; BitMine’s unrealised hit is $6.95bn.

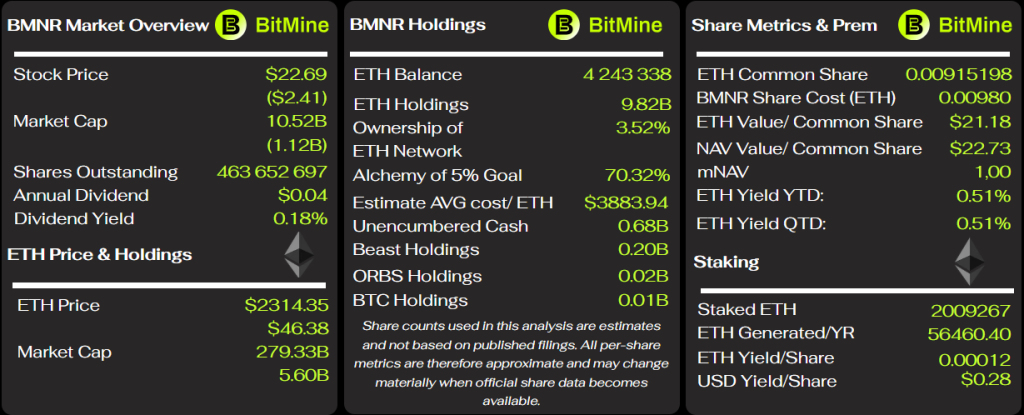

Corporate holders of Ethereum have incurred hefty paper losses after the market correction. The largest holder, BitMine, has lost $6.95bn in unrealised value.

The firm bought coins at an average of $3,883, while the price has slipped to $2,240.

Investor Ross Gerber commented on BitMine founder Tom Lee’s unrealised loss on Ethereum positions, calling it potentially “the worst trade ever”.

Could be close to the worst trade ever… we shall see. https://t.co/FeOmKJLGHc

— Ross Gerber (@GerberKawasaki) February 1, 2026

The second-largest treasury holder, SharpLink Gaming, has seen a $1.09bn drawdown. Its average entry price was $3,609.

The drop in prices has hit the mNAV multiple. BitMine’s fell to 1; SharpLink’s to 0.92.

A reading below one complicates raising capital via equity issuance. That limits companies’ ability to buy more cryptocurrency. At Pantera Capital they believe this dynamic will lead to a “brutal shakeout” of DAT companies in 2026.

The current slump aligns with a forecast from BitMine chairman Tom Lee. He had expected Ethereum to fall to $1,800 in the first quarter of 2026, followed by a recovery by year-end.

After aggressively calling $7,500, Tom Lee is now targeting $1,800.

This is why retail gets rekt.$ETH https://t.co/9HVD1s2emK pic.twitter.com/dJEHya8Yro

— Alejandro₿TC (@Alejandro_XBT) December 21, 2025

Hong Kong’s Trend Research has already begun trimming positions under market pressure. On February 2, the firm sold 33,589 ETH for $79m, realising a loss.

Trend Research 已止损卖出 33,589 枚 ETH ($7912 万),然后从 Binance 提回 7752 万 USDT 还款。

把他们的 ETH 借贷仓位清算价从 $1,880 降到了现在的 $1,830 附近。◎现在还持仓:61.8 万枚 ETH ($14.3 亿),成本均价 $3,180。

◎亏损:$5.62 亿 (已实现亏损 $2771 万+未实现亏损 $5.34 亿)… https://t.co/9o7j6azLGP pic.twitter.com/XcgvgMiR6W— 余烬 (@EmberCN) February 2, 2026

The proceeds were used to repay a loan in USDT to Binance.

Trend Research founder Jack Yi admitted the error of opening a long too early. According to him, the fund considered the asset undervalued around $3,000 when bitcoin traded near $100,000.

作为现在全网压力最大的人,首先必须承认:自从顶部清仓后,确实过早看多eth是错误的,因为btc在10万左右,eth一直在3000,我们认为被低估。目前上一轮利润回吐,仓位决定思路,在控制风险的情况下,继续等待行情向上,谢谢大家关心,投资和交易是最难的,身处行业中,总是时刻忍不住看多。

— JackYi (@Jackyi_ld) February 2, 2026

The firm still holds 618,000 ETH with more than $534m in unrealised losses. Yi said he would wait for a market recovery under strict risk control.

Strategy founder Michael Saylor announced the purchase of another 855 BTC for about $75.3m at roughly $87,974 per coin.

Strategy has acquired 855 BTC for ~$75.3 million at ~$87,974 per bitcoin. As of 2/1/2026, we hodl 713,502 $BTC acquired for ~$54.26 billion at ~$76,052 per bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

As of February 1, 2026, the company holds 713,502 BTC at an average purchase price of $76,052.

Nomura scales back crypto investments

Japan’s financial group Nomura Holdings has revised its risk-management strategy and reduced its presence in digital assets, writes Bloomberg. The reason was losses at its Swiss subsidiary Laser Digital Holdings amid market volatility in October–December 2025.

Nomura CFO Hiroyuki Moriuchi confirmed the introduction of stricter position controls. He said this is necessary to reduce risks and smooth fluctuations in income tied to the crypto market.

According to the agency, losses from digital-asset operations negatively affected Nomura’s quarterly report. Net profit was ¥91.6bn ($591.6m), below analysts’ forecast of ¥95.1bn. At the same time, the company’s core business delivered stable results.

Nomura’s shares on the Tokyo Stock Exchange fell 6.7% to ¥1318. To support the price, the company announced a share buyback of up to ¥600bn ($38.7bn) — about 3.2% of the total shares outstanding.

Despite the poor quarter, Nomura’s management reaffirmed its long-term interest in digital assets, calling the sector a promising area of growth.

In November 2025, Bitwise’s investment director Matt Hougan pointed to the inefficiency of crypto treasuries.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!