DeFi Bulletin: Aave launches third version of the protocol, as the EU tightens sector regulation

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news of recent weeks in this digest.

Key metrics of the DeFi segment

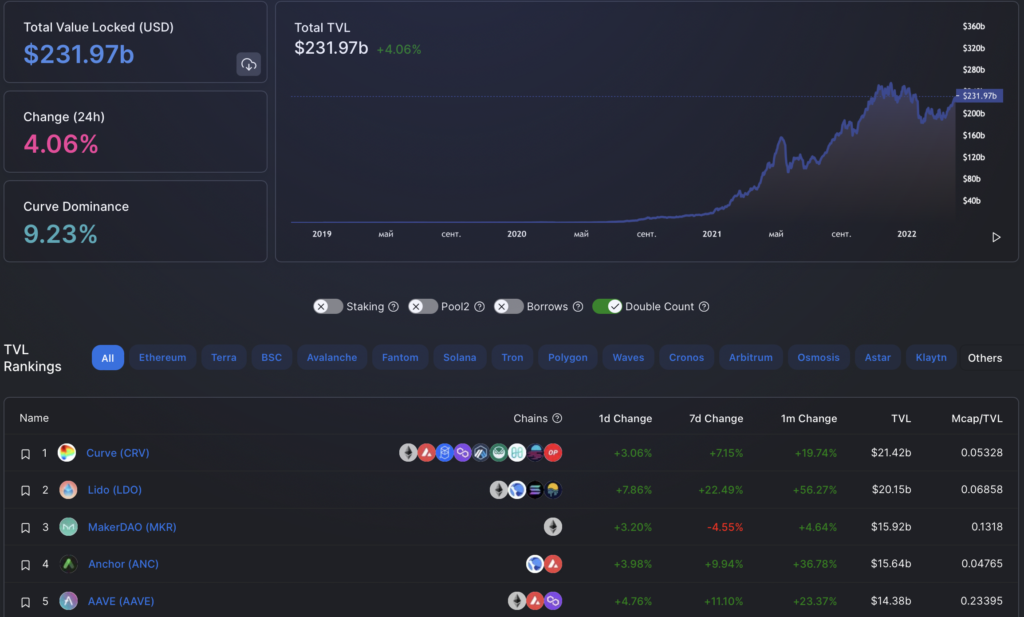

Total value locked (TVL) in DeFi protocols rose to $232 billion. Curve Finance remains the leader with $21.42 billion. Lido ($20.15 billion) jumped to second place, while MakerDAO ($15.92 billion) slipped to third.

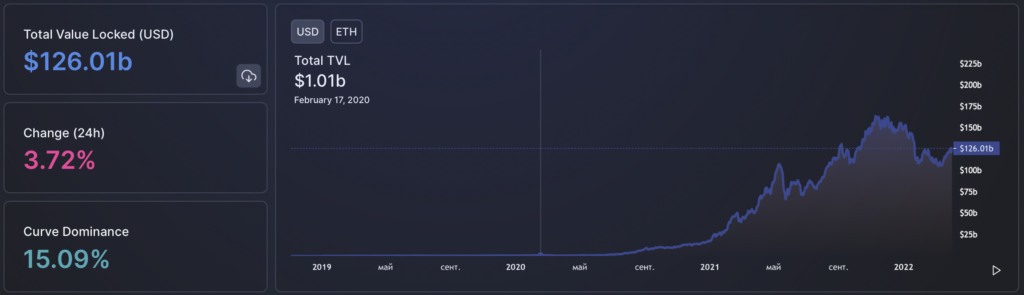

TVL in Ethereum applications rose to $126 billion. Over the last 30 days the figure increased by 11% (on March 2 the value stood at $113.58 billion).

Trading volume on decentralised exchanges (DEX) over the last 30 days stood at $63.7 billion.

Uniswap continues to dominate the non-custodial exchange market, accounting for 77.8% of total turnover. The second DEX by volume is Curve (6.3%), the third Sushiswap (6%).

Price of Aave token surges after launch of the third version

On March 17, the lending DeFi platform Aave announced the launch of the third version of the protocol. Since then the project\’s token price has risen by more than 70%.

Market capitalization of the asset surpassed $3 billion, according to CoinGecko.

According to the developers, Aave V3 features a higher level of security and improved capital efficiency for users.

The new platform is integrated with six networks: Polygon, Fantom, Avalanche, Arbitrum, Optimism and Harmony. Support for Ethereum mainnet will follow soon.

With Aave V3 already interacting with many well-known DeFi projects, including ParaSwap, 1inch, Instadapp, DeBank, DeFi Saver, Zapper and Zerion.

In the new version cross-chain compatibility has been improved. Gas consumption has also been optimised, making transactions “as cheap as possible”.

Implemented the “isolation mode”: interacting with potentially high-risk tokens, users can borrow limited amounts of funds. According to the developers, this approach allows adding a multitude of new assets to the platform.

Morgan Stanley flags obstacles to continued explosive growth in DeFi

Excess supply and regulation will act as constraints on the continued exponential growth of the DeFi sector in the coming years. Analysts at Morgan Staley reached this conclusion.

Analysts noted that they did not find much evidence to support the claim that DeFi protocols significantly improve the traditional financial system.

“Projects appear to be a means of attracting cash flows to enrich their operators. DeFi is susceptible to hacks and financial crime risks because its defining feature is anonymity,” they wrote.

The lack of KYC/AML will limit adoption among institutions, and integrating these requirements will make DeFi more centralised, the analysts explained.

- Compound community halved farming rewards.

- The DeFi project 1inch launched a mobile wallet for Android devices.

Read ForkLog’s bitcoin news on our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!