DeFi Bulletin: Aave to launch a mobile wallet as TVL falls amid market correction

The decentralised finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. The most important events and news of recent weeks have been collated by ForkLog in this digest.

Key metrics for the DeFi segment

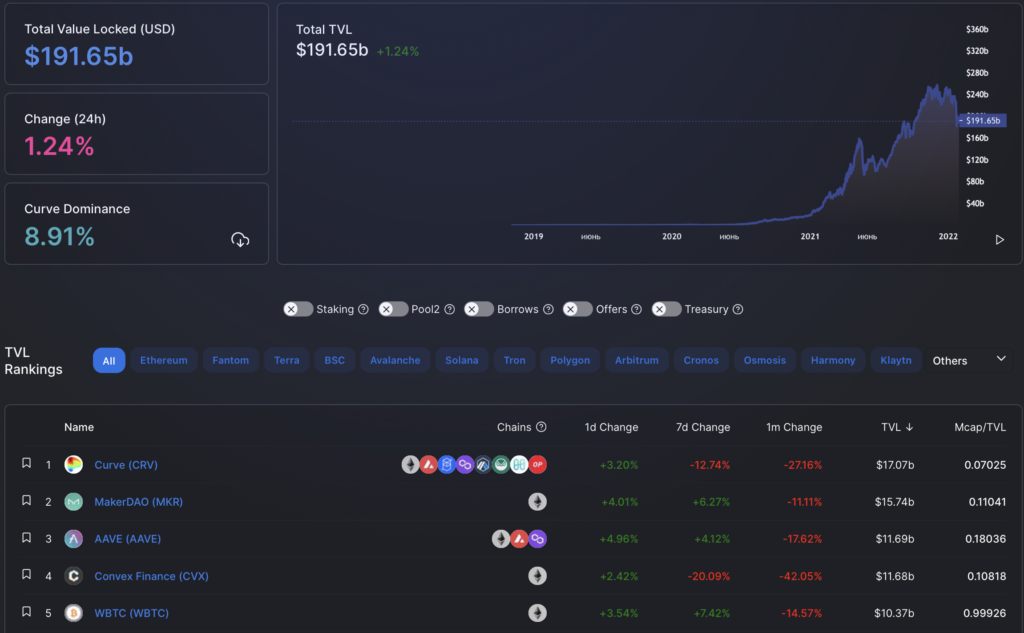

Against the backdrop of the market correction, the total value locked (TVL) in DeFi protocols declined to $191.65 billion. Curve Finance remains in the lead, its figure falling to $17.07 billion. MakerDAO ($15.74 billion) took second place, while AAVE ($11.69 billion) ranked third.

DeFi Llama includes in the final value the group of tokenised bitcoins. WBTC at $10.37 billion ranked fifth. hBTC with $1.52 billion was in 20th place. The aggregate value of “Bitcoin on Ethereum” stood at $13.02 billion.

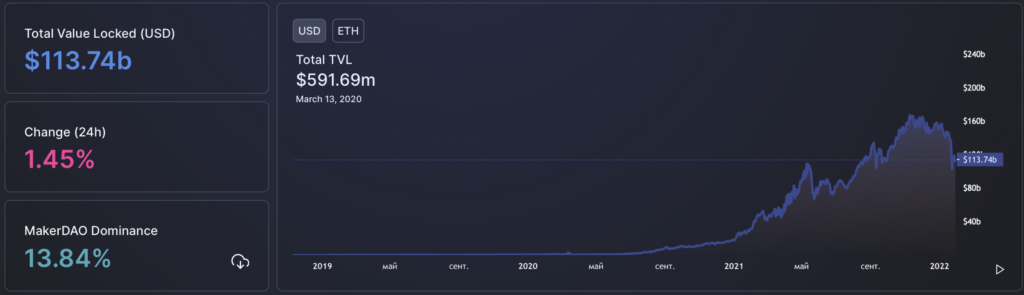

TVL in Ethereum applications declined to $113.74 billion. Over the last 30 days the figure fell by 26% (as of December 29 the value stood at $153.38 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days stood at $98.9 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for more than 72% of total turnover. The second DEX by trading volume is Curve (10%), the third is SushiSwap (6.6%).

DeFi project Aave begins development of a mobile wallet

Stani Kulechov, founder of the lending DeFi project Aave, announced that his team is developing a mobile wallet.

A commenter using the handle 0xLuke suggested that smartphone integration, in the vein of Apple Pay and Google Pay, would drive a parabolic rise in the project’s performance metrics.

In response, Kulechov noted that Aave already holds a e-money licence in the United Kingdom.

Balancer and Aave launch next-generation DeFi pools

The Balancer Labs developers launched “advanced” pools to maximise yields on capital deployed by DeFi investors.

The new product — Boosted Pools — allows idle funds to be placed in lending protocols to earn extra income.

According to the developers, most users will no longer need to expend assets on wrapping and deploying tokens such as DAI and aDAI. The associated costs will be borne by arbitrageurs, “sufficiently interested in this.”

Initially idle liquidity will be directed to Aave pools. However, the developers promise to integrate other protocols over time — Compound, Yearn, Badger, Fuse, etc.

1inch introduces the second version of the Limit Order Protocol

DEX aggregator 1inch unveiled the second version of the protocol for limit-order operations — 1inch Limit Order Protocol v2. Users have access to “gasless” swaps for permit-enabled tokens.

The new version of the protocol enables gasless token swaps on ETH. This allows users who do not hold Ethereum on their balance to interact with the aggregator.

The service is available for tokens supporting permits. This feature, proposed in EIP-2612, allows transaction fees to be paid using ERC-20 assets with the tokens themselves, rather than ETH.

In the Ethereum network, permits support 112 assets. A similar feature exists in Binance Smart Chain and Polygon. In the first, 33 projects are compatible; in the second, 15. The tokens include Aave (AAVE), Uniswap (UNI) and Balancer (BAL).

The developers also optimised the RFQ trading mode. For example, market makers can designate a specific taker to execute an order.

Aave to add Fantom support

The Fantom community voted in favour of integrating the lending DeFi project Aave. The proposal received 99.98% of votes.

The Fantom Foundation will provide a team of engineers to address issues during deployment.

Presumably, after launch on the network, Aave could join the Fantom Incentive programme. Under the scheme projects can monthly receive up to 6 million tokens of FTM (~$14.3 million).

The proposal to deploy Aave was initiated by Fantom Foundation CEO Michael Kong, who described himself as a longtime admirer of the DeFi project.

He noted that he does not foresee any technical difficulties, as the platform supports all the necessary Aave tools.

Investments in DeFi

The Graph, a startup developing the data query and retrieval protocol of the same name for blockchains, attracted $50 million following an investment round. It was led by Tiger Global with participation from FinTech Collective, Fenbushi Capital, Reciprocal Ventures and Blockwall Digital Assets Fund.

The Graph supports 26 networks, including Ethereum, NEAR, Arbitrium, Optimism, Polygon, Avalanche, Celo, Fantom, Moonbeam and IPFS.

The API of the startup is used by Uniswap, Synthetix, KnownOrigin, Gnosis, Balancer, Livepeer, DAOstack, Audius and Decentraland.

DeBank closed a funding round worth $25 million at a $200 million valuation. It was backed by Dragonfly, Hash Global, Youbi and other angel investors. Strategic investments were provided by Coinbase Ventures, Crypto.com, Circle and Ledger.

DeBank was founded in 2019 and supports hundreds of DeFi protocols across Ethereum, Binance Smart Chain, Polygon and other networks.

The decentralised trading platform Slingshot Finance (formerly DEX.AG) raised $15 million in a Series A round.

It was led by Ribbit Capital, with participants including K5 Global, Shrug Capital, the Chainsmokers group, singer Jason Derulo, Checkout.com founder Guillaume Pusa and Morning Brew CEO Austin Rife.

Existing Slingshot investors — Framework Ventures and Electric Capital — also joined the round.

The funds will be used to double the team from the current 18 employees, launch a mobile app and support more blockchains.

Slingshot supports Ethereum layer-2 solutions Polygon and Arbitrum. According to CEO Clinton Bembry, the next network will be Optimism, but the team is also considering Solana, Avalanche and Binance Smart Chain.

Hacks and scams

The lending platform Qubit Finance, built on Binance Smart Chain (BSC), was subjected to a hacking attack. PeckShield estimates that the attackers withdrew from the project’s liquidity pool digital assets worth around $80 million.

Analysts noted that the attackers exploited the cross-chain service QBridge exploit, which allowed them to issue a huge amount of tokens xETH. The latter were used to back an illegitimate loan on the platform.

The DeFi platform Qubit Finance allows borrowing against digital assets. The QBridge solution enables using crypto as collateral for loans outside the BSC, and you do not need to move them from one blockchain to another.

CertiK explained that the exploit allowed attackers to mint xETH without an actual deposit. They then converted the assets into BNB.

The project team confirmed the hack. The developers contacted the hackers and offered them a bounty to minimise the negative impact on the community.

The project team tracks the actions of the attackers and controls the affected assets. The developers are cooperating with security partners, including representatives from Binance.

The decentralised finance Grim Finance team reported a hack in which attackers stole $30 million.

The attackers gained access to the Grim Finance wallet using a malicious token in the contract, employing a reentrancy exploit.

The developers paused deposits and urged users to withdraw funds from the platform immediately.

The Grim Finance team also contacted Circle, DAI and AnySwap and provided the attacker’s address to block further illicit transfers of funds.

Also on ForkLog:

- Poll: investor interest in DeFi grew in 2021.

- CertiK valued the amount stolen in 2021 from the DeFi ecosystem at $1.3 billion.

- Chainalysis: rug pull accounted for 37% of malware earnings in 2021.

Read ForkLog’s Bitcoin-news on our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!