DeFi Bulletin: Coinbase inadvertently earned $1 million, and the CFTC has threatened DEXs

The decentralised finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news from recent weeks in a digest.

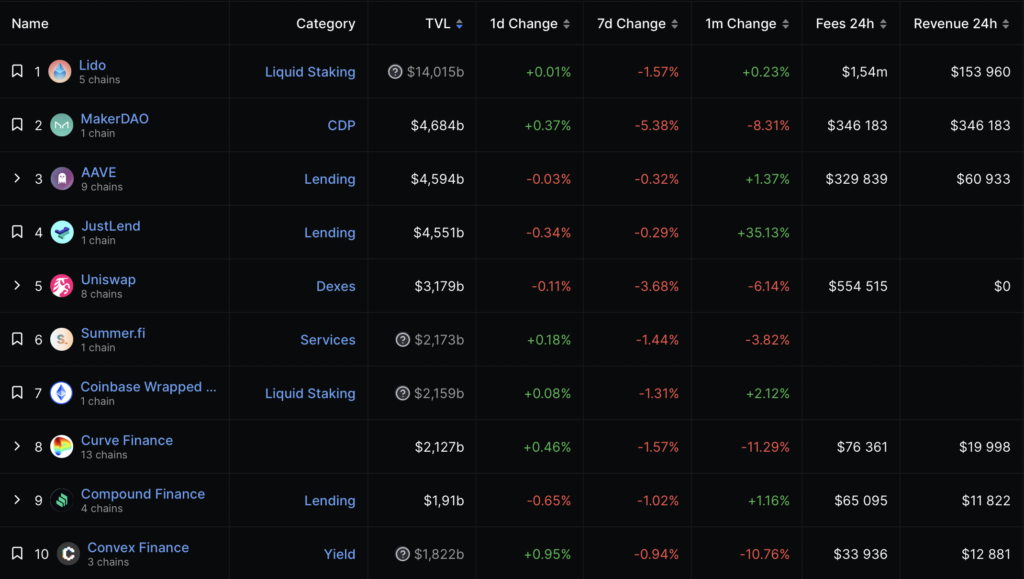

Key metrics of the DeFi segment

Total value locked (TVL) in DeFi protocols barely moved, at $38.09 billion. Lido leads with $14 billion, while MakerDAO ($4.68 billion) and AAVE ($4.59 billion) hold second and third places.

TVL in Ethereum applications fell to $20.8 billion. Trading volume on decentralized exchanges (DEX) over the last 30 days amounted to $36.8 billion.

Uniswap continues to dominate the non-custodial exchange market, accounting for 55% of total turnover. The second DEX by trading volume is PancakeSwap (16.7%), the third is Dodo (8.2%).

Coinbase inadvertently earned about $1 million after Curve hack

The cryptocurrency exchange Coinbase, acting as a validator, processed an Ethereum transaction after the DeFi protocol Curve Finance was hacked and received about $1 million in rewards.

On July 30, an unknown attacked Curve Finance’s stablecoin pools and withdrew approximately $61.7 million. The platform’s asset-pricing system functioned incorrectly for some time.

A trading bot spotted a unique arbitrage opportunity and paid 570 ETH (about $1 million at the prevailing rate at the time) to have the transaction processed out of the queue.

The beneficiary of the reward was Coinbase, according to data from analytics firm Nansen and the lending protocol Alchemix, which was affected by the hack. The latter noted that the exchange did not reimburse the assets even after a request.

The SEC has threatened centralized exchanges and DeFi projects

In addition to Binance and Coinbase, there are other CEX and DeFi protocols whose activities are being examined by the SEC for possible violations. the regulator’s enforcement chief David Hirsch said.

According to the official, non-compliance in the industry “spreads far beyond the two organisations”.

“We will continue to press charges. These could be brokers, dealers, exchanges, clearinghouses or any other entities actively operating in this space. If they are within our jurisdiction and do not meet their obligations either due to registration or due to not providing adequate or complete information,” he warned.

Hirsch explained that the claims could also affect DeFi projects for which the “decentralisation” label will not help.

The head of enforcement lamented the regulator’s heavy workload, which hinders the initiation of new proceedings. He pointed to limited funding.

The CFTC describes DeFi exchanges as an “obvious threat”

Unregulated exchanges in the DeFi sector pose an “obvious threat” to markets and customers protected by the CFTC, said the regulator’s enforcement chief, the CFTC’s enforcement director.

The official noted that DeFi protocols often offer clients trading in derivatives that typically require registration with the regulator.

According to him, such platforms are a set of smart contracts that operate without adherence to KYC, proper disclosure, the separation of corporate and user assets, and other norms. In many cases, the financial products offered may be traded only by clients of a certain category on platforms that follow the rules.

“The existence of unregulated DeFi exchanges poses an obvious threat to regulated markets and clients protected by the CFTC, and we take this very seriously,” the official stressed.

Also on ForkLog:

- The stablecoin ℓUSD collapsed to zero after the hack of the DeFi project Linear.

- In the Coinbase-supported L2 network Base, a fork of Aave v3 was launched.

- Metis will allocate $5 million to develop DeFi protocols in the ecosystem.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!