DeFi Bulletin: Russia’s Finance Ministry flags DeFi risks; Wonderland founder contemplates shutdown

The DeFi sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most important events and news of the recent weeks in a digest.

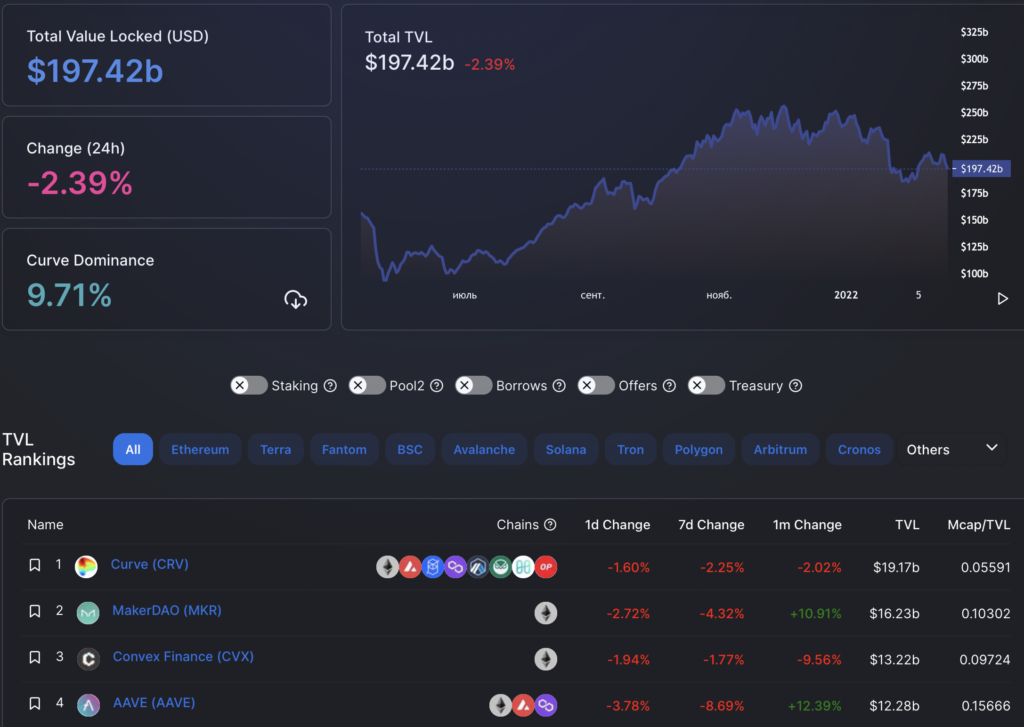

Key metrics of the DeFi segment

Against a market correction backdrop, the total value locked (TVL) in DeFi protocols fell to $197.42 billion. Curve Finance remains the leader with $19.17 billion. MakerDAO ($16.23 billion) ranked second, Convex Finance ($13.22 billion) third.

DeFi Llama includes a final value for a group of tokenized Bitcoins. WBTC with $10.46 billion ranked fifth. hBTC with $1.59 billion placed 19th. The total value of “Bitcoin on Ethereum” stood at $13.19 billion.

TVL in Ethereum applications fell to $115.75 billion. Over the last 30 days the metric fell by 15% (January 19 value was $135.94 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days was $88.8 billion.

Uniswap continues to dominate the non-custodial exchange market — its share accounts for more than 79% of total turnover. The second DEX by volume is Curve (7.2%).

Russia’s Finance Ministry sees risks in DeFi development

Deputy Finance Minister Alexei Moiseev said that the ministry with concern observe the development of the DeFi sector, as it is associated with significant risks due to the lack of proper regulatory oversight.

He noted the risk of violations of anti-money laundering and counter-terrorism financing requirements, and the need to protect consumers of financial services.

«Thirdly, the central bank through macroprudential measures is currently regulating the financial sector with a view to controlling the possible emergence of bubbles and everything else, and the appearance of DeFi — it completely deprives it of these levers», — said Moiseev.

The official noted that the DeFi sector requires a separate study due to the associated risks, while the Finance Ministry generally takes a relatively liberal stance on crypto assets:

«All that we proposed in our concept was to buy cryptocurrency within an existing decentralized system, but that does not move us towards legalizing DeFi».

While the ministry does not yet know how to regulate the sector, Moiseev stressed.

The Wonderland DeFi project founder contemplates shutting down

The Wonderland DeFi project co-founder Daniele Sestagalli stated he is prepared to shut it down in light of a serious split in the community.

In late January it emerged that Sestagalli’s partner and treasury manager is Michael Patryn. The man, who goes by the alias 0xSifu, is known as the co-founder of the bankrupt exchange QuadrigaCX. He has previously been convicted of financial crimes.

Because of community backlash, Sestagalli proposed Patryn step down before a vote on approval to the role. 87.56% opposed allowing 0xSifu to continue handling the protocol’s assets.

The next vote on the proposal to dissolve the project and return funds to investors followed. It was supported by over 34%, though at times the figure was higher.

«The Wonderland experiment is drawing to a close. The vote results show the community is split. It is the core and heart of the project. If we cannot agree on whether to continue or not, then we have failed,” wrote Sestagalli.

He said, as the results were nearly 50/50, there is “only one way forward — compensate and wind everything down.” He added that he is working with the team on a new proposal.

1inch Network launches spot-price aggregator

DeFi project 1inch Network introduced the spot-price aggregator. The solution allows “instant” display of token quotes in website and app interfaces, ForkLog representatives said.

The instrument provides a liquidity-weighted average price of a token across multiple DEXs.

According to the team, the need for the solution arose from a specific problem: not all aggregated 1inch tokens are supported by existing price-tracking systems.

The spot-price liquidity aggregator interacts with various DEX through smart contracts to obtain “instant” data from the blockchain. If there is no direct pair between two tokens, the tool calculates data using an intermediary asset.

According to the project team, the main advantages of their solution are:

- no delay in price display;

- support for a large number of DEX on the Ethereum, Binance Smart Chain, Polygon, Avalanche, Optimistic Ethereum, Arbitrum and Gnosis Chain networks.

Among the potential use cases for the new 1inch aggregator are crypto wallets, price trackers and portfolio managers.

Investments in DeFi

The startup Qredo raised $80 million in a Series A round. It was led by 10T Holdings’ Dan Tapiero.

Also participating in the round were Coinbase Ventures, Avalanche and Terra, Kingsway Capital, HOF Capital, Raptor Group and GoldenTree Asset Management.

The startup is valued at $460 million.

According to the team, in the last 12 months they raised $120 million, including from strategic investors.

Qredo provides infrastructure for managing digital assets and products designed “to open new opportunities for institutional investors in cryptocurrencies and decentralized finance.”

Hacks and Scams

The Dego Finance team, specializing in cross-chain compatibility and NFTs, reported a hacking attack.

As a result of the hack, attackers withdrew liquidity from DEGO pairs. The project team contacted Bitcoin exchanges to close deposits in the token.

According to PeckShield, more than $10 million in digital assets were stolen during the attack.

The QiDAO protocol for issuing a stablecoin on the Polygon network reported a hack of the authorization-transfer smart contract, which uses the Superfluid money-flow management platform’s code.

According to SlowMist, the hacker withdrew about $13 million in various coins, including USDC, WETH and the QI DAO governance token.

According to the QiDAO team, user funds were not harmed. The incident affected early investors’ assets and some “other tokens”.

The project temporarily suspended cross-chain bridges and began investigating the incident.

The infrastructure DeFi company Meter lost around $4.3 million in Bitcoin and Ethereum as a result of the hack.

According to PeckShield, the damage amounted to 1391 ETH and 2.74 BTC.

Meter confirmed the hack. The attacker exploited a vulnerability in the automatic “unwrapping” of gas tokens in protocols such as ETH and BNB, the company explained.

PeckShield specialists recorded an unauthorized withdrawal of 4828 BNB (~$1.9 million) from the DeFi protocol Titano Finance on the Binance Smart Chain.

Representatives of the project confirmed the hack of the PLAY contract and called the incident “disheartening,” as the protocol’s code had passed “all safety checks.”

The team paused the PLAY service indefinitely until all vulnerabilities are addressed. The project promised full reimbursement of the lost funds to affected users.

Also on ForkLog:

- In Brazil, the first DeFi-token-focused ETFs were launched.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!