DeFi Bulletin: TVL Halves, Anchor Price Plunges 98%

The DeFi sector continues to attract heightened investor interest. ForkLog has distilled the key developments from recent weeks into this digest.

Key metrics for the DeFi sector

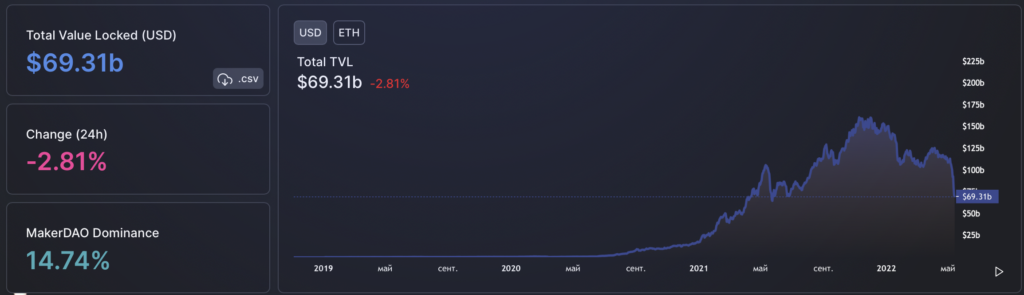

Total value locked (TVL) in DeFi protocols fell to $109.5 billion. MakerDAO led with $10.21 billion, while Curve ($8.48 billion) and Lido ($8.47 billion) held second and third places respectively.

TVL in Ethereum applications fell to $69.3 billion. Over the last 30 days the figure declined by 41% (April 14 reading was $118 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days составил $91.3 billion.

Uniswap continues to dominate the non-custodial exchange market — it accounts for 61.1% of total turnover. The second DEX by volume is Curve (21.4%), third Balancer (6.5%), fourth SushiSwap (5.1%).

Anchor Protocol plunges 98% amid UST collapse

The TVL of the DeFi protocol Anchor (ANC) collapsed by 97.83% amid the drop in the algorithmic stablecoin TerraUSD (UST) and the Terra (LUNA) token used to issue it.

On May 7–8, amid a decline in deposit yield on Anchor, more than 2.2 billion UST were withdrawn, causing the stablecoin to temporarily lose its peg to the US dollar. The situation was stabilised.

On May 11, TerraUSD again lost its peg to the US dollar, and its price fell below $0.20. In the wake of this the LUNA token fell by 98% in 24 hours, to below $1. At the time of writing the asset traded at around $0.00038, according to CoinGecko.

Following the incident, the Anchor community proposed lowering the target yield on deposits in UST to 4% per year. The vote will run until May 18.

Anchor uses a floating rate. If approved, its minimum would be lowered to 3.5%, the maximum raised to 5.5%. At the time of writing, the yield in the protocol stands at 18.13%.

Since the Terra ecosystem crisis began, almost 9.5 billion UST have been withdrawn from Anchor. The largest outflow was recorded on May 9 — 3.33 billion UST. The project’s TVL fell to $355 million.

Chainalysis: 97% of crypto stolen in 2022 came from DeFi protocols

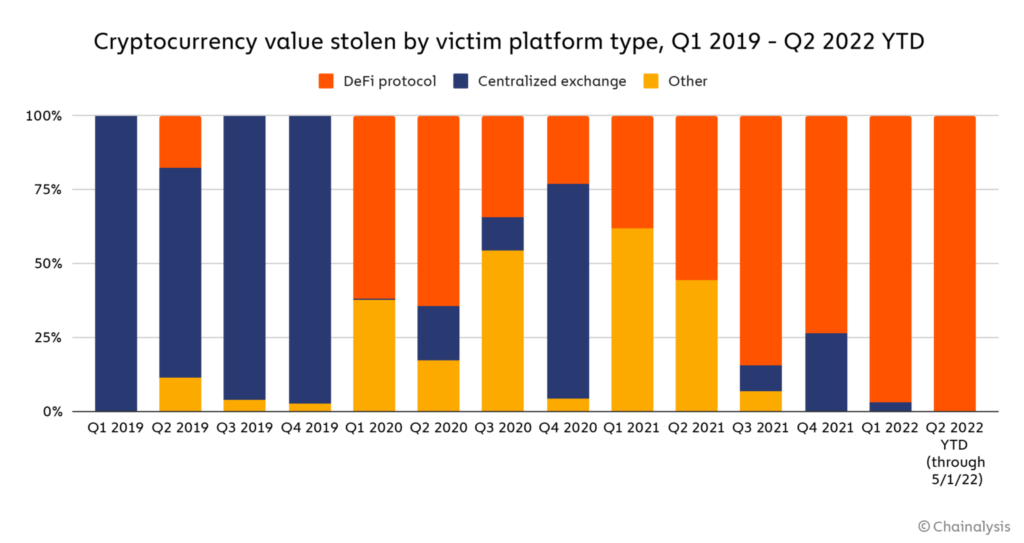

According to analytics firm Chainalysis, overall illicit cryptocurrency transactions have fallen sharply in recent years, but cybercrime in the DeFi sector has risen.

Among the main drivers, Chainalysis cites hackers targeting funds via DeFi projects and their use for laundering.

In 2021, decentralized protocols were the primary target for hackers.

As of May 1, DeFi projects accounted for 97% of the total $1.68 billion in crypto stolen in 2022, according to experts.

The bulk of funds stolen from attacks on decentralized protocols ended up with hackers connected to North Korea. This year they have stolen more than $840 million from such projects.

Another serious problem is money laundering through the DeFi sector, experts say.

In 2022, decentralized protocols received 69% of all funds sent from addresses related to criminal activity. In the previous year this figure stood at 19%.

Samson Mow: DeFi protocols lag Bitcoin on decentralisation

Most DeFi protocols cannot compete with Bitcoin as an effective monetary network due to insufficient decentralisation, according to former Blockstream strategy chief Samson Mow.

According to him, DeFi project teams can adjust the protocol at any time.

“Money, at a fundamental level, must be immutable. If you can make changes at will, that is no better than fiat currency controlled by a central bank,” Mow explained.

The decentralised nature of Bitcoin does not readily permit protocol changes, which, the expert argues, makes Bitcoin the best candidate for a global monetary system.

He noted that despite the immutable base of digital gold, developers of dapps can use layer-2 scaling solutions.

Investments in DeFi

Developers Aurora, the Layer-2 protocol on the NEAR network, launched a fund in AURORA tokens worth around $90 million to accelerate DeFi development.

The initiative is implemented in partnership with Proximity Labs, which will manage the fund and award grants to developers interested in building dapps on the protocol. The funds from Aurora Labs were allocated from the DAO treasury DAO.

The liquidity-staking solution pSTAKE-backed startup Persistence attracted an undisclosed amount from Binance Labs for a strategic round.

Hacks and Scams

An unknown attacker exfiltrated assets worth about $80 million from the DeFi protocol Rari Capital, stored in its Fuse lending pools.

BlockSec, a smart-contract security auditor, named a “typical reentrancy vulnerability” in Fei Protocol’s code as the cause of the hack.

The developers confirmed the information, paused crypto lending, and offered the hacker a $10 million bounty for returning the stolen funds.

Following the incident, the governance token RGT fell 20% to $11.50.

Deus Finance DAO was again hacked. According to PeckShield, the attacker withdrew assets worth about $13.4 million from the smart contracts, though the project “could have lost more.”

The Deus Finance DAO team confirmed the breach. Developers said user funds were safe, positions were not liquidated. Lending operations with DEI were suspended, and the stablecoin’s dollar peg was restored.

An unidentified hacker breached the Saddle Finance stablecoins and wrapped-asset exchange. The hacker’s proceeds totalled more than $10 million in Ethereum. The project team said it is investigating the incident. Withdrawals from some pools have been paused.

BlockSec, a DeFi-focused cyber-security company, detected the initial breach. Its specialists managed to recover Saddle Finance funds worth $3.8 million.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!