DeFi Bulletin: Uniswap token enters top-10 by market cap as 1inch integrates with Binance Smart Chain

The decentralized finance (DeFi) sector continues to draw heightened attention from crypto investors and traders. ForkLog has compiled the most important events and news from the past weeks in this digest.

Key indicators of the DeFi segment

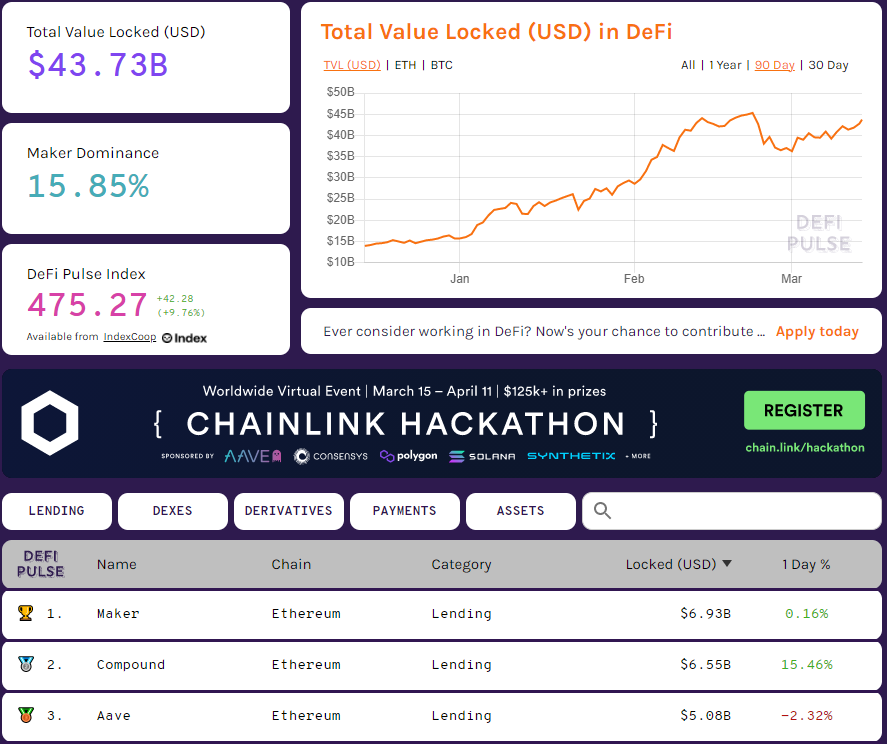

The total value locked in Ethereum-based applications (TVL) reached $43.73 billion. Over the past 30 days the metric rose 9%.

Data: DeFi Pulse.

Lending platforms continue to lead the sector — Maker with a TVL of $6.93 billion, Compound ($6.55 billion) and Aave ($5.08 billion).

In terms of TVL, Uniswap was overtaken by SushiSwap and Curve Finance. Uniswap is now sixth in the DeFi Pulse ranking, with its rivals occupying fourth and fifth place, respectively.

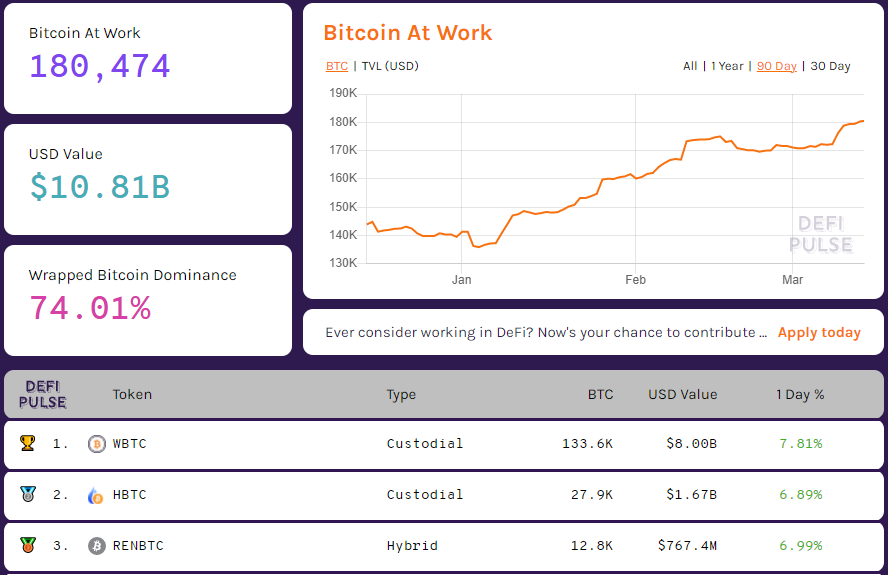

The tokenized-Bitcoin segment continued its steady growth. The total market value of WBTC, HBTC, renBTC and other Bitcoin tokens on Ethereum reached $10.81 billion. A month ago the figure was was around $8.17 billion.

Data: DeFi Pulse.

Trading volume on decentralized exchanges (DEX) over the last 30 days totaled $64.8 billion.

54.4% of the total turnover of non-custodial exchanges comes from Uniswap. The second DEX by trading volume is SushiSwap (15.4%), the third Curve (13.3%).

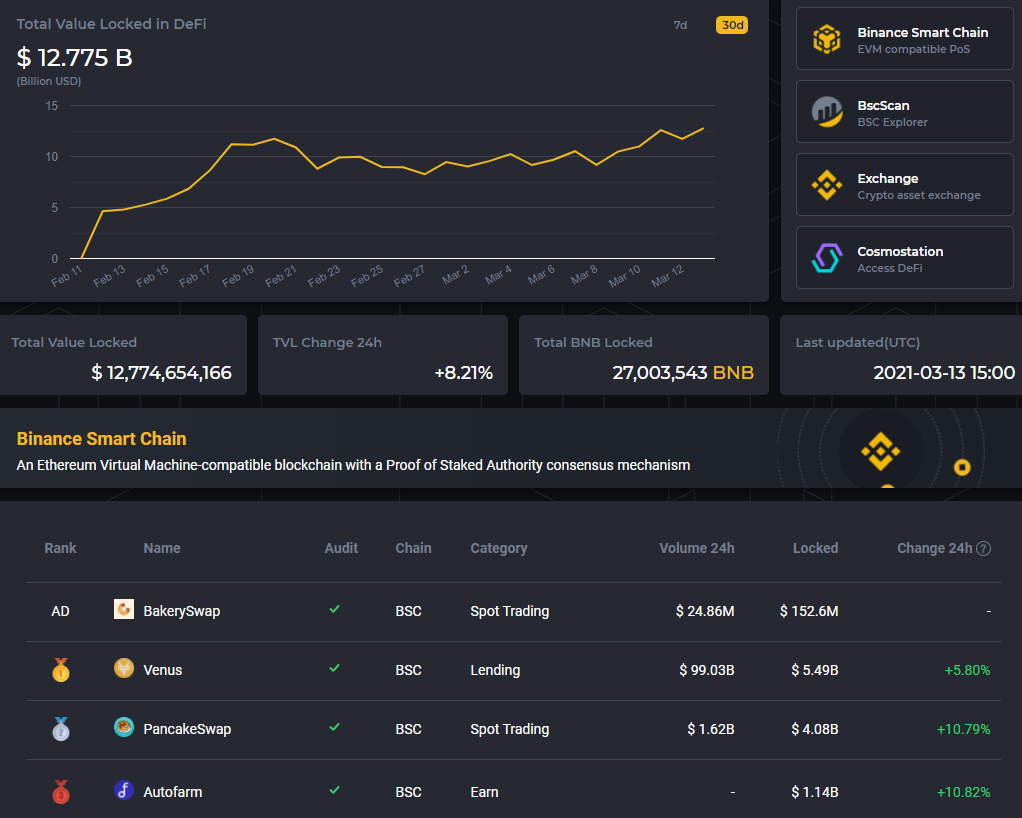

TVL of projects on Binance Smart Chain (BSC) is rising robustly. The aggregate figure reached $12.77 billion, a 183% increase over the past 30 days.

Data: DeFi Station.

The corresponding figure for Huobi ECO Chain apps reached $6.27 billion (a month ago it was around $2 billion).

Uniswap UNI token enters the top 10 by market capitalization

Over the last 30 days, the UNI token of the Uniswap decentralized exchange rose 58.2%, ranking 8th in CoinGecko’s crypto assets capitalization ranking.

Data: CoinGecko.

As of writing, UNI’s market capitalization stands at $16.9 billion. The token trades around $32.50.

By market capitalization among DeFi assets, it ranks first.

PancakeSwap surpasses Uniswap in TVL

Earlier in the month, PancakeSwap on Binance Smart Chain (BSC) surpassed the Ethereum-based exchange Uniswap in TVL terms.

On March 4, PancakeSwap’s TVL surpassed $4 billion. At that time Uniswap’s TVL stood at $3.73 billion.

As of writing, PancakeSwap’s TVL stands at $4.08 billion, while the Ethereum rival’s is $4.24 billion.

1inch project integrated with Binance Smart Chain

The liquidity aggregator from decentralized exchanges, 1inch, integrated with the BSC ecosystem.

Users gained the ability to switch between the Ethereum and BSC blockchains, with 1inch Liquidity Protocol, 1inch Aggregation Protocol and staking features made available.

The 1inch team also launched a liquidity mining program on February 26 at 00:01 (UTC) in the BNB-1INCH pool.

Investments in DeFi

The startup Oxygen closed a funding round of $40 million led by Alameda Research. Multicoin Capital, Genesis Capital and CMS also participated.

The Oxygen protocol will be launched within the Serum decentralized ecosystem built on the Solana blockchain.

Oxygen helps users access liquidity, leverage, yield generation, and short-term loans.

The synthetic assets platform Synthetix raised $12 million in funding through a direct sale of native SNX tokens. Coins from the synthetixDAO treasury were bought by venture firms Paradigm, Coinbase Ventures and IOSG.

The firms will support the project by providing liquidity in SNX where possible and will participate in the protocol’s governance system.

The Centrifuge blockchain platform raised $4.3 million in a financing round under the SAFT model.

The round was led by investment firm Galaxy Digital and the research fund IOSG Ventures. It also included Rockaway, Fintech Collective, Moonwhale, Fenbushi, TRGC and HashCIB.

The Centrifuge startup aims to bring together decentralized and traditional finance by creating new pools, improving user experience, and via solutions built on Polkadot.

The DeFi mutual-insurance project Nexus Mutual raised $2.7 million for further development of the protocol through the sale of native NXM tokens.

A strategic contribution came from venture firm Collider Ventures. The round also included Blockchain Capital, Version One, Dialectic and other major investors.

Nexus Mutual plans to reach users of existing cryptocurrency exchanges and custodians, including Coinbase, Binance, Kraken and Gemini.

Hacks and Scams

Hackers stole 13.96 million BUSD and 73,635 BNB from the Meerkat Finance protocol on Binance Smart Chain.

According to the blockchain watchdog, the assets were distributed among several wallets. The alleged attackers modified the project’s smart contract using a developer account. In this way, the hackers could obtain the founders’ keys, or this was an exit scam.

The attacker compromised the Furucombo proxy server. As a result of the attack, the damage amounted to about $14 million in Ethereum and ERC-20 tokens.

Furucombo provides users with a tool that allows visually chaining transactions across different DeFi protocols.

According to The Block researcher Igor Igamberdiev, the hacker used a forged contract that made Furucombo decide that Aave v2 had a new implementation. This allowed interacting with the DeFi protocol to transfer approved tokens to an arbitrary wallet.

The expert listed the stolen assets.

What was stolen ($14M+):

— 3,9k stETH

— 2.4M USDC

— 649k USDT

— 257k DAI

— 26 aWBTC

— 270 aWETH

— 296 aETH

— 2.3k aAAVE

— 4 WBTC

— 90k CRV

— 43k LINK

— 7.3k cETH

— 17.2M cUSDC

— 69 cWBTC

— 142.2M BAO

— 38.6k PERP

— 30.4k COMBO

— 75k PAID

— 225k UNIDX

— 342 GRO

— 19k NDX— Igor Igamberdiev (@FrankResearcher) February 27, 2021

The Binance Smart Chain-based exchange DODO lost $3.8 million in the attack.

“The attack targeted several second-version DODO crowd pools — WSZO, WCRES, ETHA and FUSI. Funds in other pools, including all first-version pools, are safe. Total losses from the attack were about $3.8 million, of which $1.88 million is expected to be returned,” said representatives of the platform.

The project team is investigating the incident in collaboration with white-hat hacker samczsun, PeckShield, SlowMist, 1inch exchange and Binance Smart Chain developers.

The Ethereum project PAID Network was attacked — an exploit in the smart contract allowed the attacker to mint an additional $160 million worth of PAID tokens.

The hacker obtained 59.7 million PAID tokens, which he swapped on Uniswap for more than 2,000 ETH worth over $3 million.

Subscribe to ForkLog’s YouTube channel!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!