DeFi Digest: FTX Collapse Drives DEX Popularity as 1inch Network Upgrades Liquidity-Aggregator Protocol

The decentralized finance (DeFi) sector continues to attract heightened attention from cryptocurrency investors. ForkLog has compiled the most significant events and news of the past weeks in this digest.

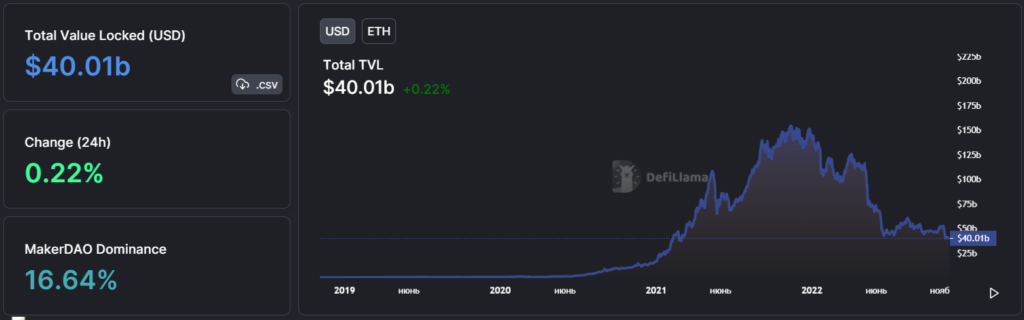

Key metrics for the DeFi segment

Over the past two weeks, total value locked (TVL) in DeFi protocols declined by 24% to $64.41 billion. The leader by the metric is MakerDAO ($6.66 billion); second and third are Aave ($6.66 billion) and Lido ($5.83 billion), respectively.

TVL in Ethereum applications declined by 23% to $40 billion. The ETH-denominated value, by contrast, rose by 3% (32.97 million ETH vs 31.97 million ETH two weeks earlier).

The cumulative trading volume on decentralized exchanges (DEX) over the last 30 days достиг $67.2 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for 62.6% of total volume. The second DEX by this metric is Curve (21.4%), the third is DODO (7.5%).

DeFi project Flare hacked for $17.9 million, DFX Finance lost $7.5 million as a result of the attack

An unknown withdrawn from the DeFi protocol Flare on the BNB Chain assets worth $17.9 million. The attacker’s loot comprised roughly 17 million BUSD and 4,000 BNB. Some of the assets were sent to the Tornado Cash mixing service.

The Ethereum-based decentralized exchange DFX Finance lost in the attack assets worth about $7.5 million.

Experts from PeckShield noted that the breach was possible due to ‘lack of proper protection against reentrancy’.

According to BlockSec, the attacker used flash loans to drain liquidity pools. He swapped the stolen tokens into ETH and withdrew cryptocurrency worth about $4.3 million.

The remaining tokens worth $3.2 million were intercepted by an MEV bot during the so-called ‘sandwich attack’ — a front-running transaction.

1inch Network unveils the fifth version of the liquidity-aggregator protocol for DEXs

The DeFi project 1inch Network launched the fifth version of the liquidity-aggregator protocol for DEXs. The 1inch Router v5 will offer ‘at least 10% gas savings when swapping tokens’ compared with other platforms.

In the fifth version they implemented Limit Order Protocol v3, applied a new interaction logic, and added pre- and post-interactions.

An improved smart-contract error-handling system has been implemented. It includes client errors. The latter explain to users, in a convenient and economical way, why a given operation failed.

Audits of 1inch Router v5 were conducted by ConsenSys, OpenZeppelin and ABDK Consulting. The project runs a bounty programme.

FTX Collapse Boosts DEX Popularity

Events around FTX have also led many users to pivot toward decentralized exchanges. Last week, trading volume in the segment stood at $27 billion — 62% above the prior reporting period.

The spike occurred on November 8 amid a preliminary agreement for Binance, a competitor to FTX, to acquire it. On November 10 the indicator surpassed $8 billion — more than four times the monthly average.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!