DeFi Digest: TVL Growth and Abracadabra’s $6.5 Million Loss

The decentralized finance (DeFi) sector continues to capture the heightened interest of cryptocurrency investors. ForkLog has compiled the most significant events and news of recent weeks in this digest.

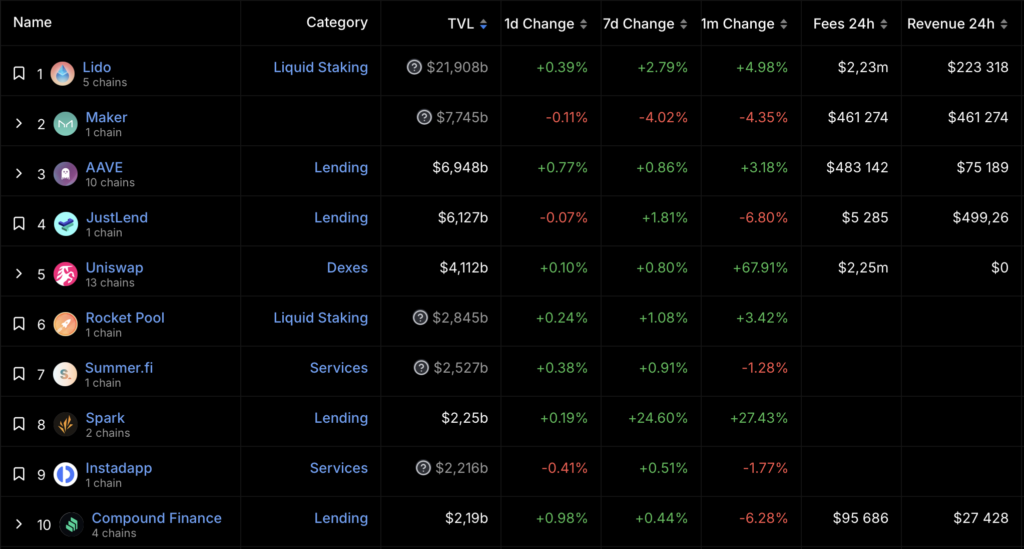

Key Metrics of the DeFi Segment

The total value locked (TVL) in DeFi protocols has risen to $57.8 billion. Lido leads with $21.9 billion, followed by Maker ($7.7 billion) and AAVE ($6.9 billion) in second and third place, respectively.

TVL in Ethereum applications fell to $32.4 billion. Trading volume on decentralized exchanges (DEX) over the past 30 days amounted to $81.5 billion.

Uniswap continues to dominate the non-custodial exchange market, accounting for 56.8% of total turnover. The second largest DEX by trading volume is PancakeSwap (17.2%), followed by Curve (6.1%).

Abracadabra Project Loses $6.5 Million in Attack

The DeFi protocol Abracadabra Finance suffered an exploit, resulting in losses of approximately $6.5 million, as reported by experts at PeckShield.

Blocksec specialists confirmed the project lost “millions of dollars.” They noted the attacks are ongoing and urged protocol users to withdraw their assets as soon as possible.

The Abracadabra team responded to the incident, stating that the exploit involved “several” Ethereum pools or “cauldrons,” as referred to in the project.

dYdX Chain Developers Add Support for Liquid Staking

The team behind the development of the L1 network dYdX Chain, based on Cosmos, added support for liquid staking of the utility token DYDX during the upgrade to v3.0.

The upgrade integrated Inter Chain accounts, providing support for LSP protocols. Derivatives based on staked DYDX can be traded or used in DeFi applications.

Additionally, v3.0 introduced the following changes:

- improved liquidation mechanism;

- more controlled approach to closing positions;

- simplified margin requirements.

Synthetix Launches Third Version of Protocol on Base

The DeFi platform for synthetic assets, Synthetix, has launched the third version of its perpetual derivatives protocol on the Ethereum Layer 2 network Base.

Perps v3 offers several advantages, including the ability to use the stablecoin USDC as collateral and for margin trading. Previously, users could only use the platform’s internal “stablecoin” sUSD for this purpose.

“Experiments with popular assets like USDC significantly expand Synthetix’s ability to attract new collateral and launch fresh derivatives markets,” commented a developer under the pseudonym cavalier.

With the launch of Perps v3, projects on Base gain tools from Synthetix-based protocols such as Polynomial, Kwenta, and DHEDGE to create their own DeFi solutions.

Additionally, the decentralized options exchange Infinex from the platform’s ecosystem will be launched on Coinbase’s L2 network.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!