DeFi Digest: TVL Keeps Sliding as Chainlink Launches Staking

The decentralized finance (DeFi) sector continues to attract heightened attention from crypto investors. ForkLog has compiled the most important events and news from the past weeks in a digest.

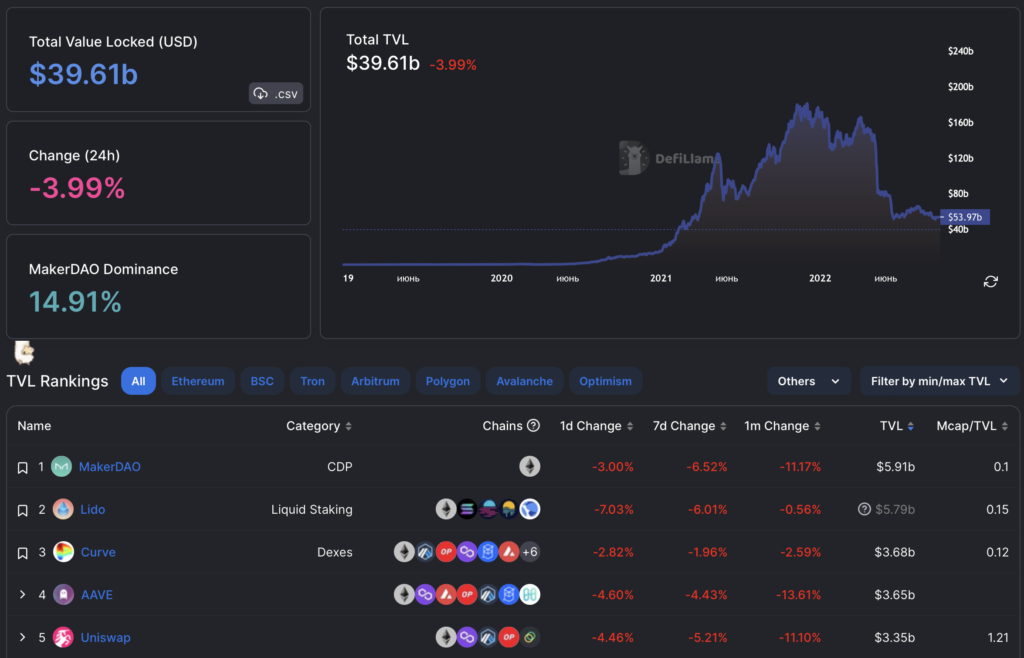

Key metrics in the DeFi segment

The total value locked (TVL) in DeFi protocols fell to $39.6 billion. MakerDAO led with $5.91 billion, with Lido ($5.79 billion) and Curve ($3.68 billion) in second and third places, respectively.

TVL in Ethereum apps fell to $23.12 billion. Over the last 30 days the metric dropped by 7% (as of November 17 it stood at $24.96 billion).

Trading volume on decentralized exchanges (DEX) over the last 30 days totaled $38.9 billion.

Uniswap continues to dominate the non-custodial exchange market — accounting for 69.5% of total turnover. The second DEX by volume is Curve (11.1%), the third is DODO (7.7%).

Chainlink launches staking. LINK token falls 5%

The decentralized oracles Chainlink launched the LINK staking service on the Ethereum mainnet. The token price fell 5% in the last 24 hours.

The total size of the v0.1 staking pool will be 25 million tokens, of which 2.5 million LINK are reserved for node operators.

Assets in staking and rewards will be locked until the Staking v0.2 mechanism launches. This is expected to occur in 9–12 months.

Users can earn up to 4.75% per year with a base rate of 5% due to delegator fees to node operators. After the pool fills to the planned 25 million LINK, the operators could receive rewards up to 7%.

The initial volume of Staking v0.1 accounts for about 2.5% of the total Chainlink token supply. In early 2023, the team planned to present a proposal to increase the pool.

The program, with several initiatives including staking, aims to strengthen Chainlink’s dominance in the oracle sector and turn it into a “global standard”.

MakerDAO raises DAI Savings Rate to 1% APY

The DeFi platform MakerDAO increased the savings rate for the DAI Savings Rate (DSR) stablecoins DAI from 0.1% to 1% per year.

The proposal to raise yields received broad community support (71.25%). In the vote, 77,599 MKR governance tokens were cast.

The team justified the possibility of higher payouts with additional project income. The authors noted cooperation with Gemini, joint initiatives with Coinbase, transfer of 500 million DAI into US Treasury bonds and other measures.

Three options were considered: keep the rate unchanged, raise by 0.25%, or by 1%.

In the vote, the community approved a number of other decisions, including:

- distributing 103,230 DAI among 20 delegates as an incentive for participating in governance;

- providing the ability to borrow in DAI collateralized by Gnosis (GNO) tokens;

- disabling such a possibility for the “wrapped” version of Bitcoin from Ren Protocol — renBTC.

Other questions up for approval largely concerned various technical parameters of collateral and loans for a number of other assets.

Compound accused of selling unregistered securities

A lawsuit has been filed against the decentralized organization behind the lending platform Compound, its co-founder Robert Leshner, and venture investors backing the project filed with charges of selling unregistered securities.

Three individuals in a filing with the US District Court for the Northern District of California reported damages from holding the COMP utility tokens worth $98. The document requests the case be moved to class-action status.

Compound DAO and its partners oversaw the sale of COMP in violation of the Securities Act. They made false and misleading statements about the prospects of profits from owning the tokens, the plaintiffs stressed. Since then the asset price has fallen sharply.

One plaintiff bought the token in January 2022 at $130 for $75. The other two allocated $2 and $3 for these purposes. The latter received an additional COMP worth $9 as part of the Coinbase Earn program. Since then the token has fallen from the $400–$426 range by more than tenfold to around $34.3, according to CoinGecko.

The group urged the court to classify COMP as a security, to compel Compound DAO and other defendants to stop selling the utility tokens, to compensate damages and cover plaintiffs’ legal costs.

Also on ForkLog:

- Bybit integrated the ApeX Pro decentralized exchange.

Follow ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!