DeFi ecosystem TVL falls to $70.72 billion

Amid a market crash, the DeFi ecosystem’s overall TVL fell to $70.72 billion, roughly in line with March 2021 levels.

From its peak in early December 2021 of around $250 billion, the metric has fallen by 71%.

The top spot in the DeFi Llama rankings is held by the sector veteran — the lending service MakerDAO, associated with the decentralized stablecoin DAI.

Among the top-five services, the largest declines in TVL were at Aave, Curve and Lido. The first two platforms were in active interaction with Celsius and Three Arrows Capital, which faced a liquidity crisis and weighed on the market.

The sharp decline in Lido is largely linked to the Terra crash, as the service offered liquid staking of LUNA, and also to issues around stETH.

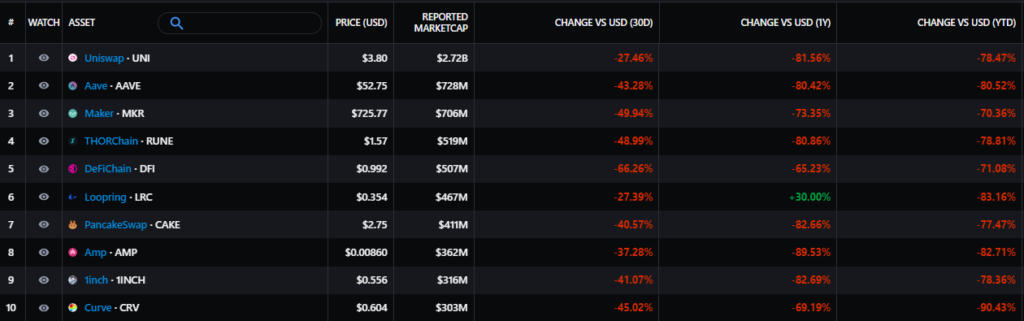

Since the start of the year, leading DeFi tokens have fallen by 70–90%.

Low activity in the segment is also evidenced by the low gas fees, despite Ethereum’s price collapse.

In May, venture funding for the DeFi sector fell to $176.3 million. This was the lowest figure since September 2021.

According to Chainalysіs, 97% of crypto thefts in 2022 occurred on DeFi protocols.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!