Diverging Views on Bitcoin’s September Prospects

The reduction of the Federal Reserve’s key interest rate and the resilience of the US economy in September may have a greater impact on Bitcoin’s price than the typically negative seasonality of this month. This was stated by Cointelegraph by Tyr Capital’s CIO Ed Hindi.

“The chances of the first cryptocurrency closing the month above $60,000 are greater than it falling below this level,” added Hindi.

Former BitMEX CEO Arthur Hayes maintains a bearish stance at least until the Federal Reserve meeting on September 18.

The expert confirmed his forecast for Bitcoin to drop to $50,000 and clarified that the quotes could reach this target as early as the coming weekend. This implies a 10.5% decline from the value at the time of writing ($55,830).

$BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen.

— Arthur Hayes (@CryptoHayes) September 6, 2024

“I took a cheeky short. Pray for my soul, for I am a degen,” he wrote.

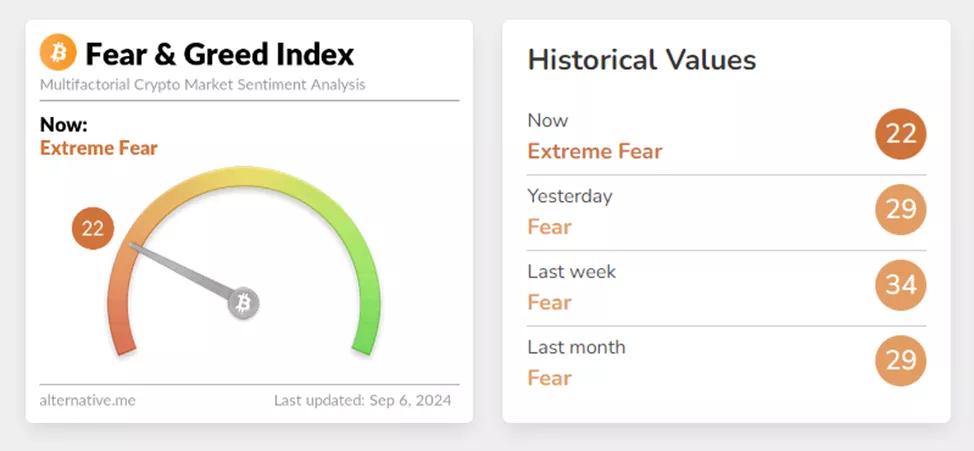

On September 6, the Fear and Greed Index fell to 22, entering the “extreme fear” zone. The previous day, the indicator was at 29 points.

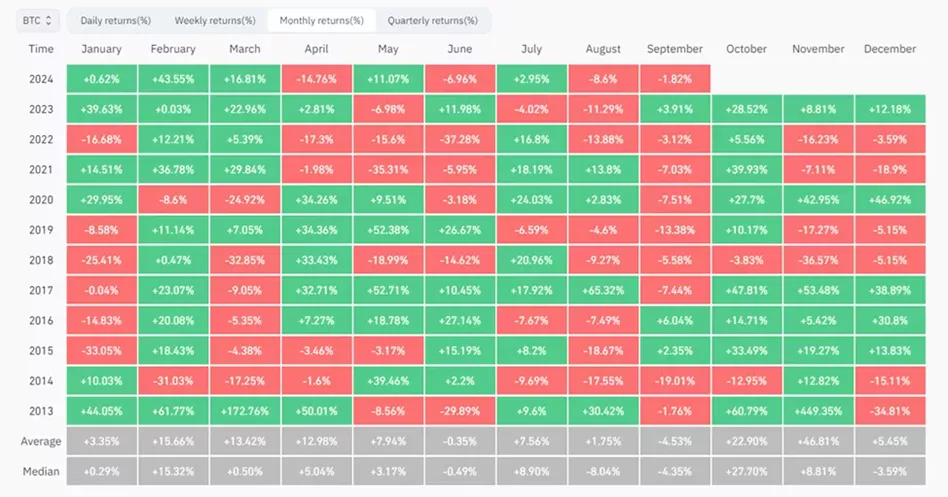

Historically, digital gold has depreciated by an average of 4.5% in September. Since 2013, positive dynamics have been recorded in three out of 11 instances.

Short, then Long?

Some experts have urged not to forget about the upcoming Uptober. Among them is a trader known as Ali. He reminded that October is known as one of the best months for Bitcoin.

Even though September has historically been a rough month for #Bitcoin, keep in mind that October is just around the corner. Often called “Uptober,” it’s known as one of the best months for $BTC. pic.twitter.com/UzwXuT9CNc

— Ali (@ali_charts) September 5, 2024

In previous years, digital gold appreciated in nine out of 11 instances in the second month of autumn, with an average increase of 22.9%.

Lookonchain noted the activity of one of the largest Bitcoin whales, who accumulated coins worth over $500 million. Specialists recorded a new transaction of 322.37 BTC (~$19 million).

This whale bought 322.37 $BTC($19M) again 1 hour ago.

He bought 2,322.37 $BTC($136M) in 5 days and currently holds 8,881 $BTC($523M).

Address:

3G98jSULfhrES1J9HKfZdDjXx1sTNvHkhN pic.twitter.com/JcdZGaqYJy— Lookonchain (@lookonchain) September 3, 2024

“In five days, he bought 2,322.37 BTC (~$136 million) and currently holds 8,881 BTC (~$523 million),” they assessed.

Bitfinex has suggested that the price of the first cryptocurrency could fall to $40,000.

Earlier, QCP Capital proposed buying digital gold during corrections throughout September, with a view to taking profits in October or towards the end of the year, considering its seasonality.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!