Dollar Index Decline Paves Way for Bitcoin Surge

The cryptocurrency market is poised for a significant price movement. The US Dollar Index (DXY) has fallen to a two-year low, while on-chain metrics indicate hidden Bitcoin accumulation and a supply shortage.

Dollar Loses Ground

For the first time since early 2022, the DXY has dropped below 98. A weaker dollar traditionally creates a favorable environment for risk assets, including cryptocurrencies, noted CoinDesk senior analyst James Van Straten.

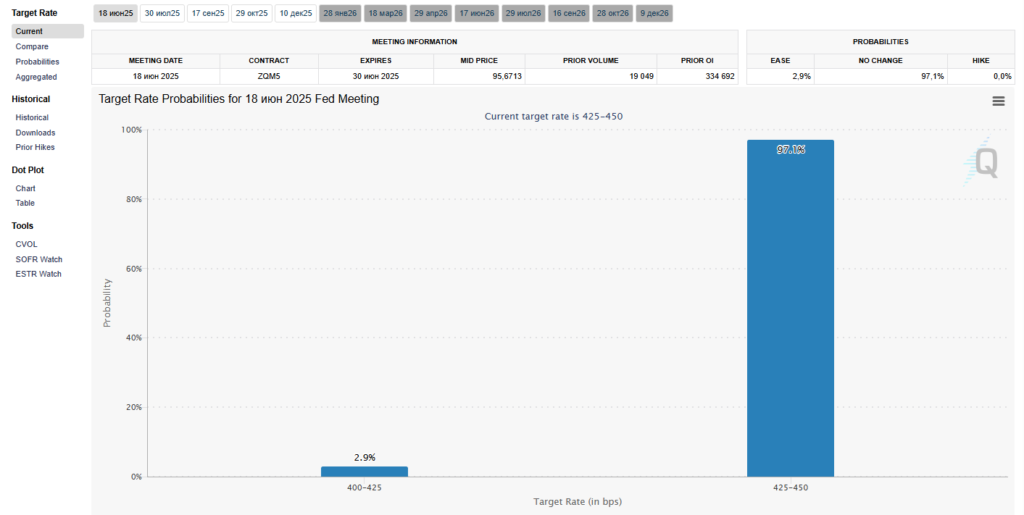

The index’s decline is linked to new US inflation data. The annual rate was 2.4%, below analysts’ forecasts of 2.5%. This has strengthened market expectations for a loosening of the US Federal Reserve’s monetary policy.

According to CME FedWatch, 97% of traders anticipate the key rate will remain unchanged at the upcoming Federal Reserve meeting.

Additional pressure on the US currency comes from discussions on de-dollarization and uncertainty in US trade policy.

Hidden Accumulation Phase

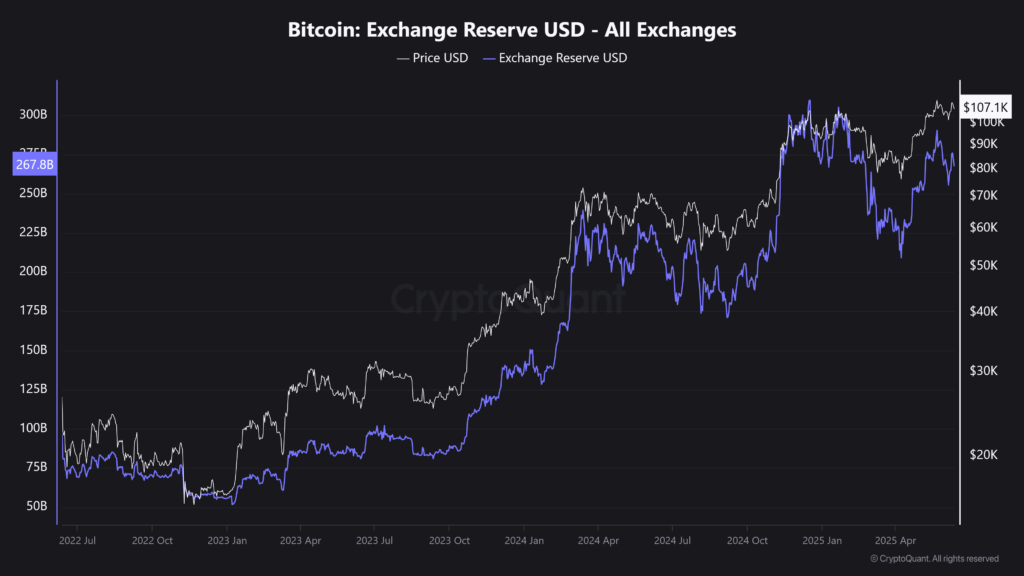

Amid a positive macroeconomic backdrop, Bitcoin’s on-chain data signals a supply contraction. Despite low retail investor activity and recent negative funding rates, major players continue to accumulate the asset.

The number of coins on centralized exchange wallets continues to decline. Since the beginning of 2025, this figure has fallen by 14% to 2.5 million BTC, the lowest level since August 2022.

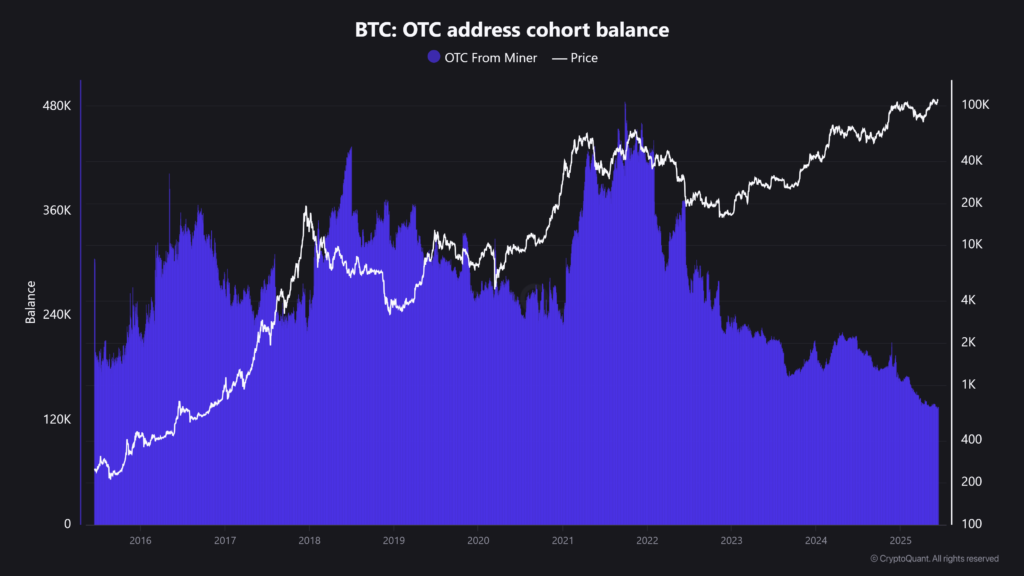

OTC Platform Reserves at a Low

Over-the-counter (OTC) platforms, used for large transactions, are also experiencing a shortage. Their reserves have dropped to a historic low.

According to CryptoQuant, since January, the balances of wallets associated with the OTC segment of miners have decreased by 19% to 134,252 BTC.

Back in late May, analysts recorded a shift from accumulation to sales among Bitcoin whales.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!