Dormant Whale Transfers 750 BTC to Binance After Seven Years

Amidst the market correction, major holders of Bitcoin and Ethereum are exhibiting divergent strategies.

Amidst the market correction, major holders of Bitcoin and Ethereum are exhibiting divergent strategies. Some are locking in profits, while others are buying the dip.

Analysts at Lookonchain have noted the reactivation of a whale dormant for 12 years, who transferred 750 BTC ($83.3 million) to Binance.

A Bitcoin OG “bc1qlf” sold another 750 $BTC($83.11M) in the past 2 hours.

12 years ago, he received 5K $BTC($1.66M then) at only $332 and only started selling after $BTC broke $90K in December 2024.

He has sold 1,750 $BTC($189.3M) at $108,160 avg, leaving 3,250 $BTC($360.75M).… pic.twitter.com/m3G3lhgm9C

— Lookonchain (@lookonchain) August 27, 2025

The crypto investor acquired the coins in 2013 when Bitcoin was trading at $332 and began selling them last December. According to on-chain specialists, his profit amounted to $510 million.

According to Arkham, following the latest transaction, the whale’s balance still holds 750 BTC, while an associated wallet contains 2,500 BTC (~$276.5 million).

A user by the nickname Doxxed speculated that the investor is preparing to purchase Ethereum. Previously, experts reported on another major holder of digital gold, who became active for the first time in seven years and bought 62,914 ETH ($270 million) on the spot market.

Lookonchain noted that the address might be linked to another whale who conducted a similar operation. On August 21, this whale sold 670 BTC ($76 million) to purchase 68,130 ETH ($295 million).

Ethereum Whales Seize the Opportunity

On August 26, an Ethereum whale inactive since 2021 withdrew 6,334 ETH ($28 million) from the Kraken exchange, reported an analyst under the pseudonym CryptoGoos.

After 4 years of silence…

This whale just bought $28M worth of $ETH.

He knows something. pic.twitter.com/DQIgDFy6AG

— CryptoGoos (@crypto_goos) August 26, 2025

According to CoinGecko, in recent days, the price of Ether has dropped by 13% — from $4,900 to $4,300. Experts believe that large investors see the correction as a suitable time to accumulate the asset.

A more extensive operation was conducted by another unknown participant, who purchased Ethereum worth $2.55 billion through Hyperliquid and locked it in staking.

Arkham specialists also reported that nine whale-associated addresses bought Ether worth $456.8 million. Five of them made transactions through the BitGo platform, while the rest used the OTC platform Galaxy Digital.

9 WHALE ADDRESSES JUST BOUGHT $450M OF ETH

9 massive addresses just bought a total of $456.8 MILLION USD of ETH. 5 of these addresses received from Bitgo while the remainder purchased their ETH with Galaxy Digital OTC.

Whales are buying $ETH.

Addresses:… pic.twitter.com/TceZQlng6w

— Arkham (@arkham) August 26, 2025

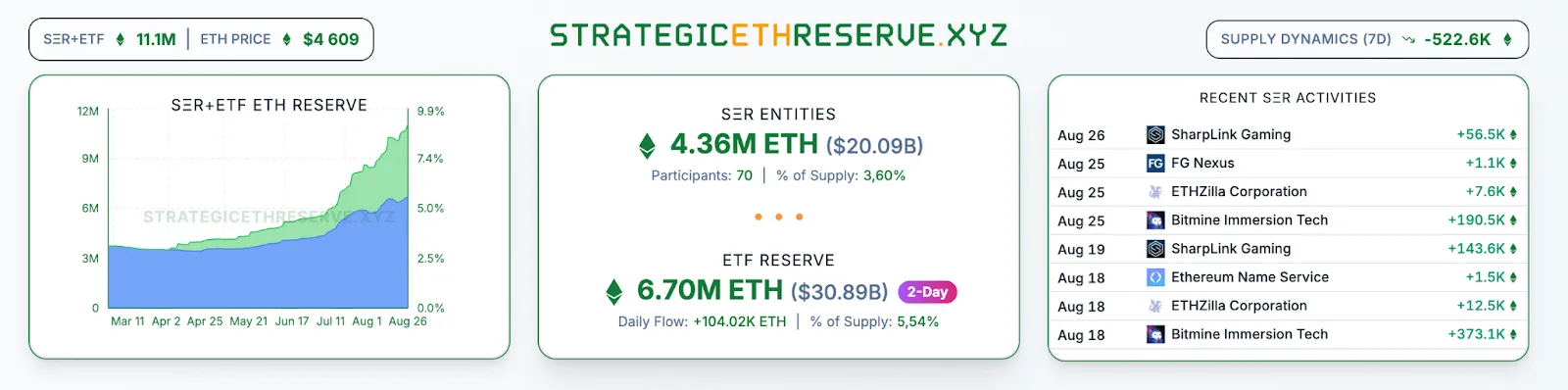

Demand for Ethereum continues to grow from the corporate sector as well. Last week, BitMine purchased cryptocurrency worth $2.2 billion, increasing its reserves to 1.7 million ETH valued at $7.9 billion.

Meanwhile, Ether-based spot ETFs attracted over $1 billion since August 21, offsetting previous outflows.

At the time of writing, more than 9% of the total Ethereum supply is under the management of exchange-traded funds and public companies.

In August, the head of digital asset research at Standard Chartered, Geoffrey Kendrick, described Ether and the companies holding it as undervalued.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!