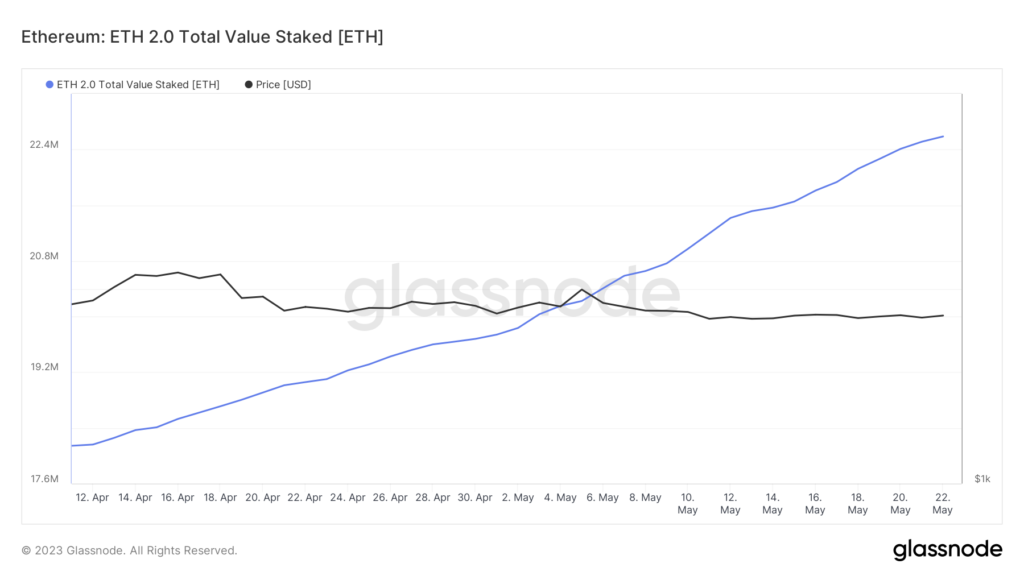

ETH staked amount rises by 4.4 million after Shapella activation

Since April 13, after the activation of the Shapella hard fork in the Ethereum network, the amount of ETH staked has risen by 4.4 million ETH.

In total, 22.5 million ETH are locked in staking — about 18% of the asset’s total supply.

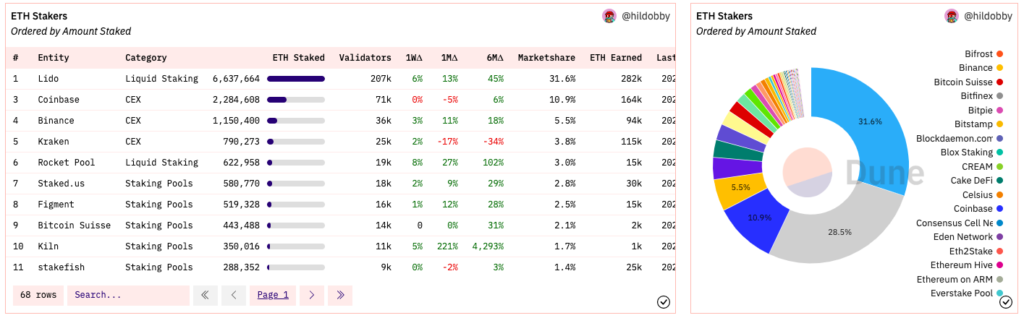

According to the dashboard Dune, net inflows to the deposit contract since the upgrade activation have reached 1.74 million ETH.

“The surge in demand for staking likely stems from major Ethereum holders. They prefer not to liquidate their assets, aiming to earn passive income. This trend is expected to persist, especially given that deflationary forces are likely to significantly push up ETH’s price,” said Bitfinex analysts in a conversation with CoinDesk.

Lido Finance accounts for 31.64% of staking-locked ETH, followed by Coinbase at 10.9%.

According to TokenUnlocks, as of writing, 812 of 655 158 validators are awaiting withdrawal of assets totalling 32 860 ETH. The platform indicates an expected annual staking yield of 8.66%.

On May 15, Lido opened Ethereum withdrawals from staking, deploying the second version of the protocol.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!