Ethereum Exchange Balances Plummet Amid Staking Frenzy

Ethereum exchange balances have been declining for six months amid staking interest.

The share of the second-largest cryptocurrency by market capitalization on trading platforms has been declining for six consecutive months, according to experts at Santiment.

🤑 Ethereum’s amount of non-empty wallets on the network has now ballooned to over 175.5M, a record among all cryptocurrencies. As staking continues to be of strong interest, especially while markets move sideways, exchange supply will continue to shrink as well. pic.twitter.com/sbDzmoRRS5

— Santiment (@santimentfeed) January 27, 2026

In July 2024, Ethereum exchange balances peaked at 12.31 million coins. By January 2026, this figure had fallen to 8.15 million ETH.

Experts anticipate a continued outflow of assets from trading platforms amid Ethereum’s weak price dynamics. The asset has been trading in a narrow range of $2900-3300 over the past month.

At the time of writing, the leading altcoin is priced at approximately $2940.

The key driver of liquidity reduction is the high interest in staking, analysts highlighted. A total of 36.5 million coins are locked in the network, accounting for 30% of the cryptocurrency’s total supply.

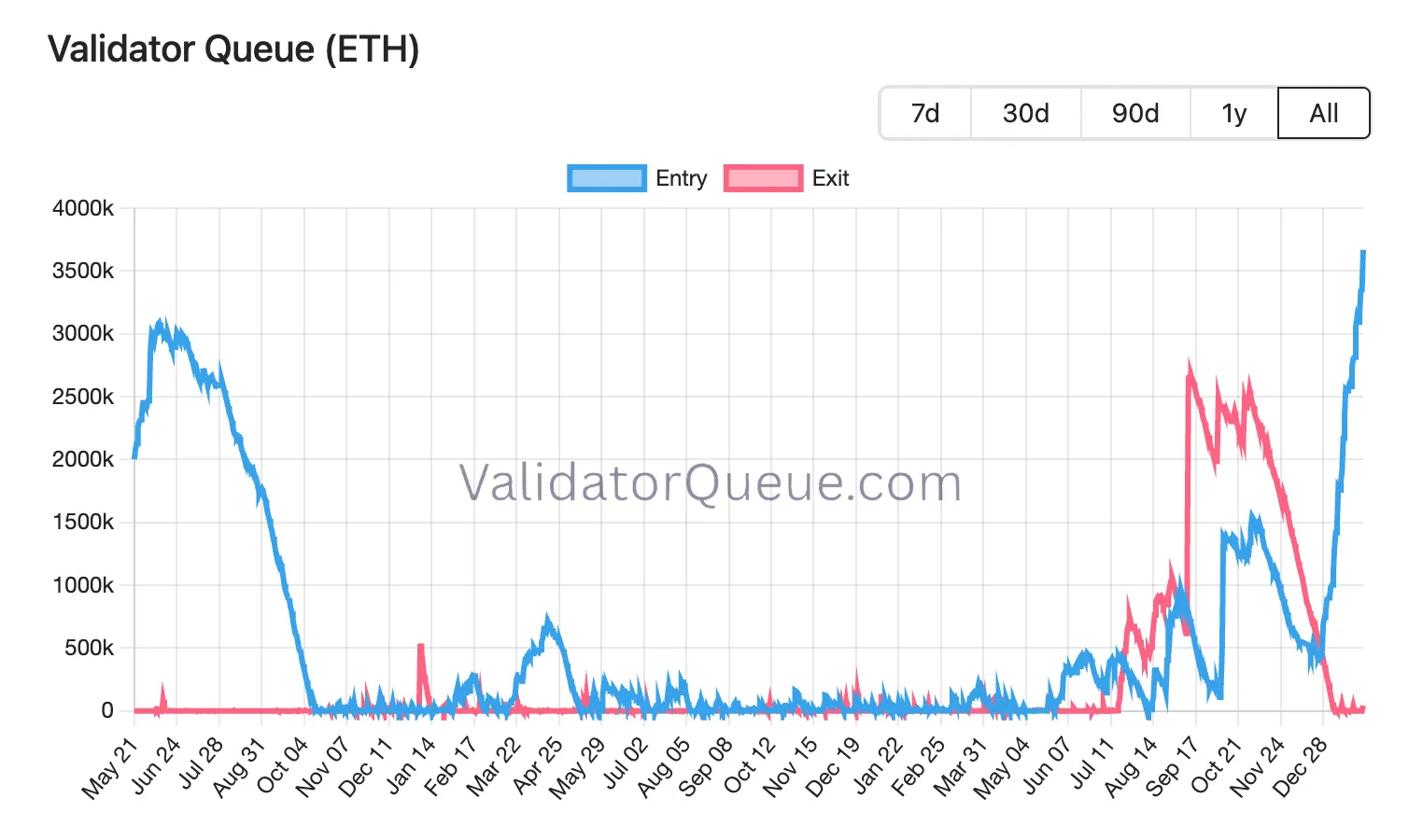

The validation queue has reached a record 3.7 million coins, with the waiting period extending to 64 days.

Ethereum Forecasts

Analysts view the current trend as a technical correction for retesting support levels before resuming growth.

An expert known as Annie noted that technical analysis using the Wyckoff method indicates a potential breakout of the cryptocurrency’s price above the $10,000 mark.

以太坊现在该洗的都洗完了,该吸的都吸够了

主力到位,结构完成,只差一个突破

行情一旦启动会垂直拉升,简称:拉飞了$ETH 目标价:$10,000

本文由 @Gate_zh 赞助 | 上 Gate App 抢黄金 pic.twitter.com/6jUonivAQy

— Annie 所长 (@web3annie) January 25, 2026

“The structure is complete, only the final breakout remains. Once the market starts, it will surge vertically. The target price for ETH is $10,000,” she wrote.

A specialist under the pseudonym Bitcoinsensus shares this optimism, calling Ethereum reaching $10,000 in the current cycle a “still possible scenario.”

Is a $10K $ETH on the table for this cycle?

Looking at previous price performance, we can see that #Ethereum has gone through massive upswings. 📈

Each cycle though, we’ve experienced diminishing returns.

If we apply the same logic, we could see $ETH reach somewhere between… pic.twitter.com/MppxSbNpGz

— Bitcoinsensus (@Bitcoinsensus) January 21, 2026

A researcher known as Crypto Caesar specified the condition for such growth: the asset needs to break the monthly resistance in the $4500-5000 zone.

Sooner or later (few years) $ETH — #Ethereum will break that red zone and we will reach 10K.

It’s very important to stay active in this space. When KOL’s are switching to other busines ideas etc. you know the bottom is close.

It’s a matter of time. On-chain season will come… pic.twitter.com/gO1vBIqVi7

— Crypto Caesar (@CryptoCaesarTA) January 26, 2026

Short-term forecasts are more restrained. After an unsuccessful test of the $3000 level, investor Ted Pillows pointed out the possibility of a drop to the $2800-2850 zone, which held up during last week’s testing.

A trader under the pseudonym Daan Crypto Trades called the $2800 mark “the most significant area for Ethereum in its history.”

$ETH The amount of times this $2.8K level has been tested on both sides this cycle is pretty insane.

Most impactful price area for Ethereum in history by far. pic.twitter.com/5RM7wUY2jQ

— Daan Crypto Trades (@DaanCrypto) January 29, 2026

“The number of tests of this $2800 level on both sides in the current cycle is truly impressive,” he wrote.

Following the Fusaka update, activity on the main Ethereum network surpassed the performance of L2 solutions.

Analysts at JPMorgan expressed doubts about the long-term sustainability of the blockchain’s metrics for the second-largest cryptocurrency by market capitalization.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!